“`html

CrowdStrike Bounces Back: A Look at Its Market Resurgence

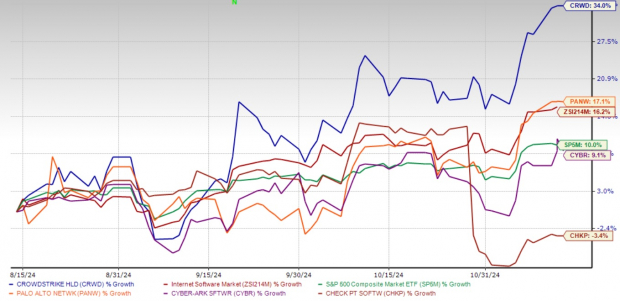

CrowdStrike Holdings, Inc. CRWD has made a remarkable recovery, with shares climbing 34% in the last three months. This rebound follows a notable drop in its stock price caused by a global IT outage on July 19, 2024.

CRWD has outshined the Zacks Internet – Software sector and even the S&P 500 index, which saw increases of 16.2% and 10%, respectively, during the same period. Moreover, its performance has surpassed other notable cybersecurity firms such as Palo Alto Networks PANW, CyberArk Software CYBR, and Check Point Software CHKP. In contrast, Palo Alto Networks shares gained 17.1%, CyberArk Software increased by 9.1%, while Check Point Software saw a decline of 3.4% in this timeframe.

Price Performance Over the Past Three Months

Image Source: Zacks Investment Research

Given this strong performance, investors are left pondering whether it is the right moment to buy or hold CRWD stock until there’s more stability. Here’s why opting to hold may be the most sensible choice.

Solid Financial Recovery Following the Outage

CrowdStrike’s fiscal Q2 2025 results highlight its ability to recover and maintain investor confidence. Despite the challenges posed by the July incident, the company reported substantial revenues of $963.9 million, marking a 31.7% increase year-over-year, and exceeding the Zacks Consensus Estimate by $5.3 million.

Furthermore, CrowdStrike recorded non-GAAP earnings per share (EPS) of $1.04, a 40.5% rise from the previous year, outpacing the consensus estimate by 6 cents. These results reflect the robustness of its business model despite facing significant challenges.

This impressive performance, accomplished even with delays in closing deals during the quarter, showcases the loyalty of CrowdStrike’s clientele and years of trust built with them. Annual recurring revenues (ARR) reached $3.86 billion, an increase of 32% year-over-year, indicating ongoing demand for its cybersecurity offerings.

Innovative Enhancements from CrowdStrike

CrowdStrike remains proactive in its response to the outage. The company introduced new automated recovery techniques and made enhancements to its Falcon platform, enhancing content visibility, quality assurance, and security through external reviews. These steps are vital for rebuilding customer trust, a key factor for maintaining its industry leadership.

Spanning over 28 modules, the Falcon platform ensures diverse growth opportunities, offering endpoint protection, identity security, and next-gen SIEM capabilities. CrowdStrike’s cloud security, identity protection, and LogScale SIEM segments collectively exceeded $1 billion in ARR in the second quarter, growing over 85% year-over-year. This diverse offering positions the company well against market fluctuations while adapting to changing client needs.

Market Position and Strong Customer Relationships

CrowdStrike’s strong market positioning is reflected in its ongoing partnerships and endorsements from customers. Even post-outage, the company secured significant deals, reinforcing its image as a trusted security provider. Among these were a nine-figure contract in cloud security and several eight-figure agreements, emphasizing a robust sales pipeline and growth potential.

The “Falcon Flex” subscription model, which facilitates easier module adoption, serves as a foundation for improved customer retention. This model enables businesses to expand their cybersecurity needs seamlessly, fostering long-term relationships and increased revenue.

Addressing Short-Term Challenges

Nevertheless, CrowdStrike faces short-term headwinds. The IT outage resulted in extended sales cycles and postponed some deals to later quarters. The company’s outlook indicates caution, anticipating subdued upsell activity and prolonged contract durations affecting net new ARR. Management projects that these challenges may ease within a year, indicating possible fluctuations but signaling a return to growth by fiscal 2026.

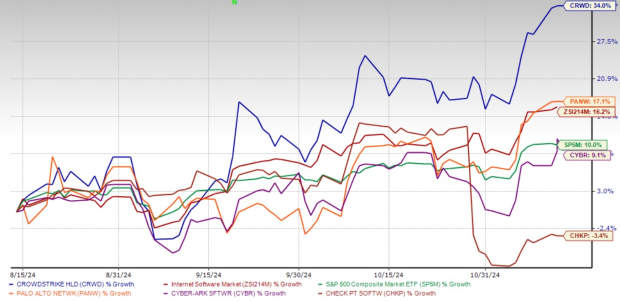

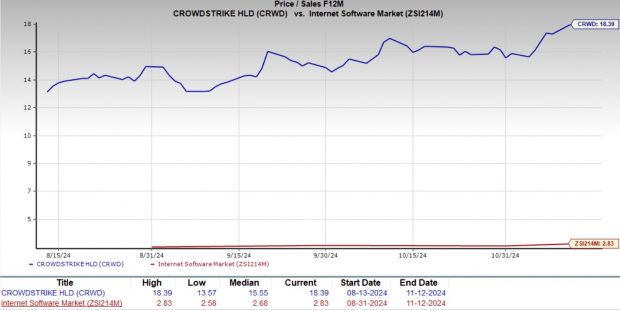

Analysts have recently adopted a more cautious stance regarding CrowdStrike’s short-term potential, with the Zacks Consensus Estimate for fiscal 2025 and 2026 showing revisions downward.

Image Source: Zacks Investment Research

Court-related risks associated with the July incident and competitive pressure from rival cybersecurity firms may pose additional concerns. However, with solid financial reserves of $4.04 billion in cash and cash equivalents, CrowdStrike is well-positioned to navigate these challenges.

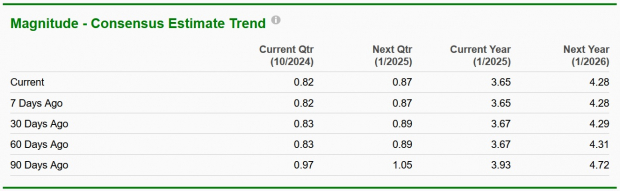

Valuation Concerns for CrowdStrike

Currently, there are rising concerns over CrowdStrike’s valuation. The stock trades at high multiples compared to its earnings and revenues. CRWD currently sits at 82.85X forward 12-month earnings, significantly higher than the industry average of 34.95X. Additionally, it trades at 18.39X forward 12-month sales, compared to the industry’s 2.83X. Such elevated valuations suggest that much of the anticipated future growth is already reflected in the stock price, making it susceptible to negative developments or earnings disappointments.

Image Source: Zacks Investment Research

Final Thoughts: Maintain Hold on CRWD Stock

While CrowdStrike’s recent stock performance is noteworthy and its long-term growth potential appears promising, holding onto the stock may be advisable for the time being. The company’s Q2 fiscal 2025 results, innovative strategies, and robust customer relationships demonstrate its resilience. Given the short-term operational issues and potential delays in sales cycles, adopting a hold strategy allows investors to aim for long-term gains while navigating any immediate market instability.

CrowdStrike’s strengths solidify its status as a leader in cybersecurity, making the stock a worthwhile hold as it approaches the latter half of fiscal 2025 and beyond. Currently, CRWD stock holds a Zacks Rank #3 (Hold).

“`

Top 7 Stocks You Should Watch This Month

Experts Select the Best Picks for Quick Gains

Recently released: Analysts have identified 7 exceptional stocks from a pool of 220 Zacks Rank #1 Strong Buy recommendations. These selections are labeled as “Most Likely for Early Price Pops.”

Since 1988, this comprehensive list has outperformed the market, achieving an average annual gain of +23.7%, more than twice the market performance. It’s wise to keep a close eye on these carefully chosen stocks.

Discover the selections now >>

Check Point Software Technologies Ltd. (CHKP): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

Read the article on Zacks.com for more insights.

Explore more at Zacks Investment Research

The views and opinions expressed herein reflect the author’s and do not necessarily represent those of Nasdaq, Inc.