“`html

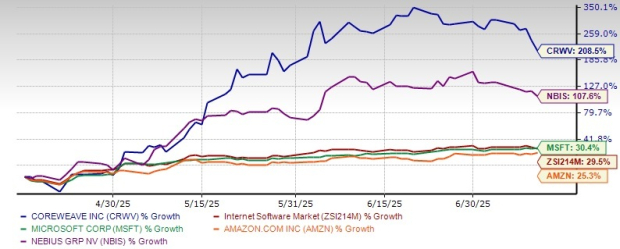

CoreWeave, Inc. (CRWV) has seen a 208.5% increase over the past three months, closing at $125.84, up from its initial price of $39 on March 28, 2025. The company, which specializes in GPU-based cloud solutions for AI workloads, also boasts a $259 billion revenue backlog. Despite recent growth, CRWV shares dropped 21% following the announcement of a $9 billion acquisition of Core Scientific on July 7.

CoreWeave anticipates capital expenditures between $20 billion and $23 billion for 2025 to support its aggressive data center expansion. However, high interest expenses of $264 million in Q1, attributed to new vendor payment terms, have raised concerns. Despite achieving a 420% revenue growth, the adjusted net loss surged to $150 million compared to $24 million in the prior year, with a customer concentration risk as 77% of total revenues in 2024 came from the top two clients.

With a current Zacks Rank of #4 (Sell), analysts suggest investors consider reducing their exposure, especially given the high valuation at a Price/Book ratio of 31.69X compared to the industry average of 6.54X, indicating that much future growth is already reflected in the stock price.

“`