“`html

Cisco’s Latest Earnings Report: Mixed Results With Future Potential

Cisco Systems CSCO announced its first-quarter fiscal 2025 non-GAAP earnings of 91 cents per share, surpassing the Zacks Consensus Estimate by 4.6%. However, this represents an 18% decline compared to the previous year.

CSCO has consistently exceeded the Zacks Consensus Estimate over the past four quarters, with an average earnings surprise of 4.14%.

Check out Zacks Earnings Calendar for the latest EPS estimates and surprises.

The company reported revenues of $13.8 billion, which also beat the Zacks Consensus Estimate by 0.57%, though it was down 5.6% year over year.

Following the earnings announcement, CSCO shares dropped more than 2.5% in pre-market trading on Thursday. Despite this decline, Cisco’s shares have gained 15.7% year to date, lagging behind the Zacks Computer and Technology sector, which has returned 29.3%.

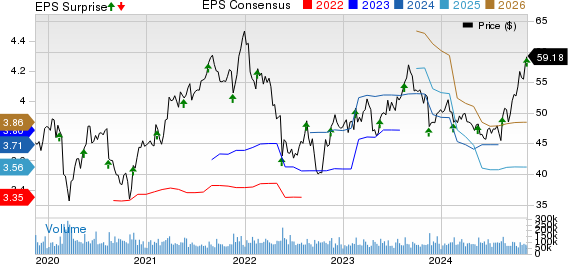

Cisco Systems, Inc. Price, Consensus, and EPS Surprise

Cisco Systems, Inc. price-consensus-eps-surprise-chart | Cisco Systems, Inc. Quote

Despite the current challenges, CSCO is poised for potential growth with the launch of enhancements to its data center infrastructure, including an NVIDIA NVDA-based AI server and AI PODs. These innovations, coupled with NVDA’s AI Enterprise cloud-native software platform managed through Cisco Intersight, aim to simplify the management of AI infrastructure.

Additionally, Cisco’s partnership with NVIDIA has yielded the Cosco Nexus HyperFabric AI cluster solution, designed to efficiently scale generative AI workloads.

Cisco’s diverse partner network, which includes major players like Meta Platforms META, Microsoft MSFT, Lenovo, and AT&T, may bolster its market position.

Year-to-Date Performance

Image Source: Zacks Investment Research

CSCO’s Revenue Decline Linked to Slow Networking Sales

Cisco continues to face challenges from sluggish networking sales. The demand from telecommunication and cable service providers has been lackluster, compounded by strong competition. Additionally, customers holding excess inventory has hindered revenue growth.

In the first quarter of fiscal 2025, networking revenues fell to $6.75 billion, reflecting a 23% decrease year over year.

The company has also expanded its collaboration offerings with new features such as the Webex AI Agent, AI Agent Studio, and Cisco AI Assistant for the Webex Contact Center, all aimed at enhancing customer satisfaction.

Collaboration revenues saw a decline of 3%, landing at $1.09 billion. The downturn is attributed to lower sales of the on-premises Webex Suite and collaboration devices, which were somewhat offset by growth in contact center and CPaaS services.

Observability revenues reached $258 million, up 36% from the previous year, largely driven by the performance of ThousandEyes and Splunk Observability.

Moreover, Cisco has witnessed strong growth in its security segment, including demand for its XDR, Secure Access, and Multicloud Defense solutions.

Security revenues doubled year over year to $2.02 billion, reflecting advancements in threat intelligence, detection, and response solutions such as Splunk and SASE.

Total product revenues for the first quarter of fiscal 2025 were $10.11 billion, accounting for 73.1% of overall revenues, though this was a 9.2% decline year over year.

Service revenues totaled $3.7 billion, contributing 26.9% to Cisco’s total revenues and seeing a 5.6% increase year over year.

The Annualized Recurring Revenues (ARR) for the quarter stood at $29.9 billion, an increase of 22% from the previous year, with product ARR growing by 42%.

By region, the Americas generated 59.6% of total revenues, while EMEA (Europe, Middle East, and Africa) and APJC (Asia Pacific Japan China) contributed 25.9% and 14.5%, respectively.

CSCO Reports Increased Operating Expenses

Non-GAAP gross margin was recorded at 69.3%, a 2.6% decline from the previous year.

The product gross margin on a non-GAAP basis decreased by 590 basis points (bps) to 50.4%, while the service gross margin rose by 760 bps to 18.9%.

In the first quarter, total non-GAAP operating expenses reached $4.87 billion, reflecting a 9% rise from a year ago. This led to an increase in the percentage of revenues to 35.2%, up from 30.5% in the same quarter last year.

Research & Development (R&D) costs jumped 19.5% year over year to $2.29 billion, representing 16.5% of total revenues, an increase of 350 bps.

Sales & Marketing (S&M) expenses rose 9.8% to $2.75 billion, making up 19.9% of revenues, an increase of 280 bps.

General & Administrative (G&A) expenses were reported at $795 million, showing an 18.3% increase year over year and accounting for 5.7% of revenues, a rise of 120 bps.

As a result, CSCO’s non-GAAP operating income dropped 12.1% from the previous year to $4.72 billion.

CSCO’s Financial Position Overview

As of October 26, 2024, CSCO had cash and cash equivalents of $18.67 billion, up from $17.85 billion as of July 27, 2024.

Total debt on October 26, 2024, amounted to $31.99 billion, an increase from $30.96 billion on July 27, 2024.

Remaining performance obligations (RPO) stood at $40 billion at the close of the fiscal first quarter of 2025, marking a 15% increase, with 51% expected to be recognized as revenue in the next 12 months.

In fiscal Q1 2025, CSCO returned $3.6 billion to shareholders through dividends and share buybacks, repurchasing about 40 million shares for $2 billion. The share repurchase program has $3.2 billion left under its current authorization.

Cisco’s Q2 2025 Outlook

For the upcoming second quarter of fiscal 2025, Cisco forecasts non-GAAP earnings to fall between 89 cents and 91 cents per share.

Revenue expectations are set between $13.75 billion and $13.95 billion.

The projected non-GAAP gross margin for Q2 is anticipated to be between 68% and 69%.

“`

Cisco Forecasts Modest Growth Amidst Challenges

Operating margin is projected to range from 33.5% to 34.5%. Additionally, the non-GAAP effective tax rate is estimated to be around 19%.

The Zacks Consensus Estimate for Cisco Systems, Inc. (CSCO) forecasts second-quarter fiscal 2025 revenues at $13.66 billion, which reflects a year-over-year increase of 6.81%. The estimated earnings stand at 87 cents per share, remaining unchanged over the past two months.

Evaluating Cisco: Is It Time to Buy, Sell, or Hold?

Currently, Cisco’s near-term results may face challenges due to sluggish performance in the networking sector. However, optimistic projections are supported by the Nexus brand, which is likely to see an uptick in product orders. The demand for 400 gig and 800 gig switches using Silicon One technology remains robust.

Cisco benefits from an increasing product range, an expanding presence in cybersecurity, and strong partnerships, all of which are essential drivers that could stimulate growth for CSCO shares. However, a slowdown in the federal sector may pose challenges in the immediate future.

Value-wise, Cisco’s stock does not currently present a bargain, as indicated by a Value Score of C, suggesting a potentially inflated valuation.

Looking at its valuation, Cisco is trading at a forward 12-month Price/Sales ratio of 4.2, which exceeds the sub-industry average of 3.65.

Forward Price/Sales Ratio Analysis

Image Source: Zacks Investment Research

Cisco holds a Zacks Rank #3 (Hold), which suggests that investors may want to bide their time for a more advantageous buying opportunity. For those interested, you can check out the updated list of Zacks #1 Rank (Strong Buy) stocks here.

Seizing Opportunities as Infrastructure Investment Rises

With trillions of dollars allocated for federal infrastructure projects, America is set to undergo significant upgrades. This funding isn’t just for roads and bridges; it also aims at enhancing AI data centers, renewable energy sources, and more.

In this landscape, discover 5 surprising stocks that are positioned to benefit the most from the unfolding infrastructure spending wave.

Download your free guide on how to profit from the trillion-dollar infrastructure boom today.

For the latest recommendations from Zacks Investment Research, you can also access the report on 5 Stocks Set to Double. Click here to get this complimentary report.

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.