Daiwa Capital Upgrades AppLovin: A Closer Look at Financial Insights

On November 8, 2024, Daiwa Capital upgraded their outlook for AppLovin (MUN:6RV) from Neutral to Outperform.

Sharp Price Forecast Reveals Potential Downside

As of December 21, 2023, the average one-year price target for AppLovin stands at 58.07 €/share. Predictions vary, with estimates ranging from a low of 21.21 € to a high of 96.60 €. This average price target suggests a striking decrease of 73.60% from the latest closing price of 220.00 € / share.

Revenue and Earnings Projections Show Decline

AppLovin’s projected annual revenue is set at 3,854MM, reflecting a decrease of 10.16%. The anticipated annual non-GAAP EPS is 1.65.

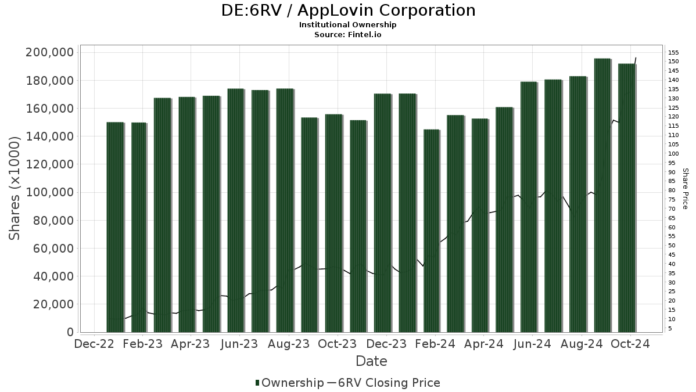

Increasing Institutional Interest in AppLovin

Currently, there are 1,204 funds or institutions reporting positions in AppLovin, an increase of 167 owners, or 16.10%, in the last quarter. The average portfolio weight for all funds dedicated to 6RV increased to 0.55%, up by 0.71%. Institutional ownership has grown by 9.38% over the last three months, with total shares owned climbing to 194,816K shares.

GQG Partners currently holds 13,289K shares, representing 4.47% of the company. This is a decrease from their previous holding of 22,646K shares, which shows a significant reduction of 70.41%. The firm has also cut its portfolio allocation in 6RV by 33.50% over the last quarter.

Conversely, Wcm Investment Management increased its holdings to 10,820K shares, now representing 3.64% ownership. This marks a rise from 9,791K shares, an increase of 9.51%. The firm ramped up its portfolio allocation in 6RV by 62.84% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 6,053K shares, which is 2.04% ownership. This reflects an increase from 4,227K shares, showing a 30.17% rise. Their portfolio allocation in 6RV grew by 67.41% over the last quarter.

Lone Pine Capital currently has 5,702K shares, representing 1.92% ownership, up from 5,320K shares, a 6.71% increase. Their allocation in 6RV has risen by 32.45% in the last quarter.

The Vanguard Small-Cap Index Fund Investor Shares (NAESX) owns 4,821K shares, or 1.62% of the company. This is up from 3,429K shares, which shows an increase of 28.88%. The firm raised its portfolio allocation in 6RV by 77.33% over the last quarter.

Fintel provides thorough research for individual investors, traders, financial advisors, and small hedge funds, offering insights on fundamentals, analyst reports, ownership data, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.