DoorDash’s Stock Soars 53.4%: Strong Orders and Strategic Partnerships Fuel Growth

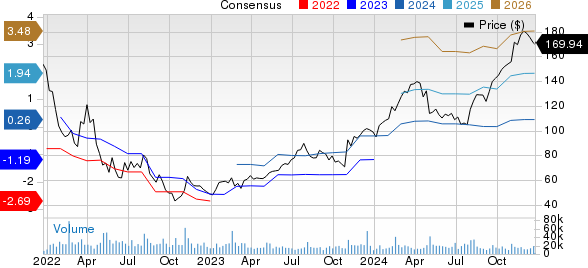

DoorDash’s DASH stock has jumped 53.4% in the last six months, far outperforming the Zacks Internet – Services industry, which rose by 7.7%, and the Zacks Computer & Technology sector, which saw an increase of 7.9%.

This rapid growth places DoorDash ahead of major rivals like Amazon AMZN and Alphabet GOOGL, which increased by 21% and 8.5%, respectively, during the same period. DoorDash’s impressive stock performance is attributed to substantial growth in total orders and Marketplace Gross Order Value (GOV), improved logistics efficiency, and a boost in advertising revenue.

Expanding Clientele Fuels Order Growth

DoorDash reported an 18% year-over-year increase in order volume for the third quarter of 2024, totaling 643 million orders. Moreover, Marketplace GOV surged by 19%, reaching $20 billion.

The company owes some of its success to an expanding clientele, which includes partnerships with Walmart Canada, Wegmans Food Markets, Lyft LYFT, Warner Bros. Discovery’s streaming service, Max, and JPMorgan Chase & Co.’s Chase bank. These collaborations have broadened DoorDash’s reach and diversified its service offerings.

Recently, DoorDash Canada and Walmart Canada launched a nationwide collaboration, providing Canadians with on-demand grocery and essentials from over 300 Walmart Supercenters. Additionally, a partnership with Lyft offers DashPass members monthly benefits on rides, while eligible Lyft riders can enjoy a free trial of DashPass.

Strengthening its grocery delivery capabilities, DoorDash expanded its partnership with Wegmans Food Markets, allowing grocery delivery from all Maryland locations and soon from stores across several states, including Virginia and New Jersey.

Positive Fourth Quarter Guidance

DoorDash’s robust increase in total orders and Marketplace GOV is set to drive revenue growth. The company anticipates Marketplace GOV between $20.6 billion and $21 billion for the fourth quarter of 2024.

The Zacks Consensus Estimate for fourth-quarter 2024 revenues is $2.83 billion, reflecting a 22.93% year-over-year increase. Additionally, the Zacks Consensus Estimate for fourth-quarter earnings stands at 33 cents per share, indicating a substantial year-over-year growth of 184.62%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Should Investors Consider DASH Stock?

Despite its growth prospects, DoorDash stock is currently rated as expensive, with a Value Score of F indicating a stretched valuation. The Price/Book ratio for DASH stands at 9.33, higher than the Zacks Internet – Services industry average of 6.33.

Nonetheless, DoorDash’s strong portfolio and expanding partnerships continue to enhance growth potential. Currently, DASH stock is rated Zacks Rank #2 (Buy) and holds a Growth Score of A, representing a potentially strong investment opportunity, according to Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Potential High-Growth Stocks to Watch

Here are five stocks recommended by Zacks as having the potential to double in value in 2024. Not all picks may succeed, but previous recommendations have seen impressive gains, with increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks remain under the radar of Wall Street, offering a lucrative opportunity for early investors. Explore these five potential home runs now.>>

For the latest recommendations from Zacks Investment Research, download the report on 5 Stocks Set to Double.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Lyft, Inc. (LYFT): Free Stock Analysis Report

DoorDash, Inc. (DASH): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.