Dropbox Reports Solid Q3 Earnings, Faces Competitive Challenges Ahead

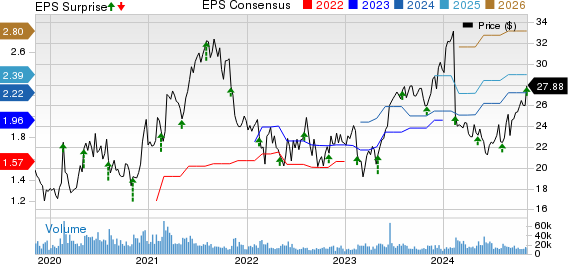

Dropbox (DBX) revealed its third-quarter 2024 results, posting non-GAAP earnings of 60 cents per share. This figure exceeded the Zacks Consensus Estimate by 15.38% and represented a 7.1% increase compared to the previous year.

Notably, DBX has beaten the Zacks Consensus Estimate in each of the last four quarters, achieving an average earnings surprise of 13.65%.

Check out the latest EPS estimates and surprises on the Zacks Earnings Calendar.

Quarterly revenues reached $638.8 million, a slight 0.9% rise from last year, and also surpassed the consensus forecast by 0.29%. Annual recurring revenues totaled $2.579 billion, reflecting a year-over-year increase of 2.1%.

Dropbox’s Financial Performance Overview

Dropbox, Inc. price-consensus-eps-surprise-chart | Dropbox, Inc. Quote

Future Outlook for DBX Shares After Q3

Following the Q3 results, Dropbox shares dipped slightly. Year-to-date, DBX stock has fallen by 5.4%, lagging behind the Zacks Computer & Technology sector, which has risen by 28.4%.

The stock has also not kept pace with the Zacks Internet Services industry or major competitors like Alphabet (GOOGL), which saw a 29.6% increase, and the industry overall, which rose by 24.3% in the same period.

Looking ahead, DBX provided a positive outlook for 2024, anticipating improvements in both gross and operating margins despite a narrower revenue base. The company faces strong competition in the File Sync and Share (FSS) market, compounded by challenging macroeconomic conditions.

In October, Dropbox launched Dropbox Dash, an AI-powered universal search tool for business users, which could attract more clients.

Growth in Paid User Base for Q3

By the end of Q3 2024, Dropbox reported 18.24 million paying users, an increase of nearly 19,000 since the previous quarter. The average revenue per paying user climbed to $139.05, up from $138.71 a year earlier.

Dropbox is a leader in the $12 billion content sharing and collaboration applications market, as estimated by IDC. The company has over 700 million registered users across its FSS plans and holds a greater market share than Apple (AAPL) and Box (BOX).

According to IDC’s May 2024 report, Dropbox holds a market share of 20.9%, with Alphabet’s Google following at 16.4%, Box at 8.8%, and Apple at 8.6%. Microsoft leads the pack with a 29.4% market share.

Expansion of Margins in Q3

During Q3, Dropbox achieved a non-GAAP gross margin of 84%, representing a year-over-year increase of 140 basis points.

For this quarter, research and development expenses stood at $155.4 million, a 1.8% increase from last year. Sales & marketing costs rose by 3.7% to $101 million, while general & administrative expenses climbed by 7.3% to $48.8 million.

The non-GAAP operating margin was recorded at 36.2%, up 30 basis points compared to the previous year.

Financial Position & Cash Flow Analysis

As of September 30, 2024, Dropbox’s cash, cash equivalents, and short-term investments totaled $890.8 million, down from $1.06 billion on June 30, 2024. The company’s available liquidity amounted to $1.36 billion at the end of September.

For Q3, free cash flow reached $270.1 million, an increase from $224.7 million in the preceding quarter.

In Q2 2024, Dropbox repurchased over 11 million shares for a total of $260 million, with about $868 million remaining under the current repurchase authorization.

Revised Margin Outlook for 2024

For Q3 2024, Dropbox forecasts revenues between $635 million and $638 million, anticipating a foreign exchange impact of less than $0.5 million.

The company expects a non-GAAP operating margin around 32%.

For the full year 2024, revenues are projected to fall between $2.542 billion and $2.545 billion, slightly adjusted from the previous guidance of $2.540 billion to $2.550 billion. At constant currency, revenues are expected to fall between $2.538 billion and $2.541 billion, down from prior guidance of $2.537 billion to $2.547 billion.

Dropbox aims for an improved gross margin of 84%, up from earlier guidance of 83% to 83.5%. They anticipate a non-GAAP operating margin around 36%, an increase from the previous guidance range of 33.5% to 34%.

However, the expectation for free cash flow has been lowered to between $860 million and $875 million, down from a prior range of $910 million to $950 million.

Zacks Rank Overview

Currently, Dropbox holds a Zacks Rank of #3 (Hold). To view the list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions in Federal funds have been allocated for the repair and enhancement of America’s infrastructure. This influx will not only improve roads and bridges but also finance AI data centers, renewable energy projects, and much more.

In this report, discover five surprising stocks poised to gain the most from the ongoing spending boom.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” completely free today.

Looking for the latest recommendations from Zacks Investment Research? Today, you can download “5 Stocks Set to Double.” Click to access this free report:

Apple Inc. (AAPL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

Dropbox, Inc. (DBX): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.