“`html

Holiday Season Sparks Investor Optimism as Stocks Surge

The holiday season is here, and with the recent stock market surge, investors are more hopeful than ever. The S&P 500 saw its best performance this year in November, rising nearly 6% and fueling optimism.

The big question now is whether this momentum can carry over into the holiday period. Many believe it can, and here are three key reasons why.

1. Seasonal Trends Indicate a Strong Finish

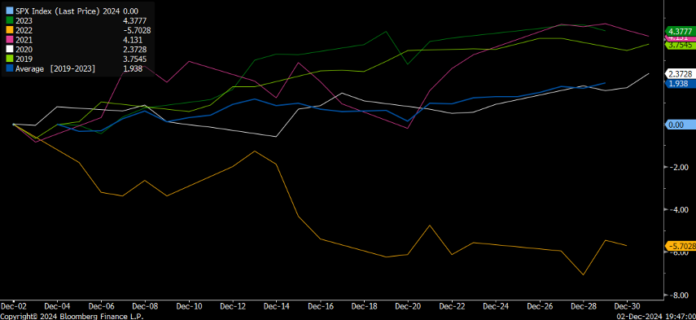

Historically, stocks often perform well during the holiday season. Data from 1950 shows that the stock market has increased about 80% of the time from Thanksgiving to New Year’s. In the last five years, December has typically seen market gains, with notable increases of around 4% in 2019, 2021, and 2023. Even in 2020, there was a slight increase of 2%. The exception came in 2022, marked by a challenging bear market.

Such seasonal trends provide a strong backdrop for continued gains.

2. Declining Inflation Is a Positive Sign

Another favorable factor is the recent decline in inflation. Concerns about rising inflation had weighed on the market. For example, the Truflation U.S. Inflation Index jumped from 1% in early September to nearly 3% by mid-November. Fortunately, this figure has now fallen to 2.7%, signaling a possible pause in inflationary pressures.

This easing should alleviate some market concerns and support stock growth.

3. Federal Reserve’s Stance Affects Market Sentiment

Lastly, the Federal Reserve is expected to adopt a friendly stance in their upcoming meeting. Scheduled for two weeks from now, the Fed is anticipated to cut interest rates by 25 basis points. However, the tone of Chair Jerome Powell during the follow-up press conference will play a crucial role. A dovish tone may bolster the stock market, while any hint of a pause in rate cuts could dampen enthusiasm.

Current indicators suggest that the Fed’s messaging may lean towards continued support, which could further enhance investor confidence.

In summary, historical trends, easing inflation, and supportive Federal Reserve policies could all contribute to a successful holiday season for investors.

“`

Market Insights: Holiday Spending Boosts Optimism for Investors

Recent fears about inflation have eased, leading the Federal Reserve to adopt a more dovish stance in its policies. Investors are hopeful that this trend will continue, encouraging positive market momentum.

Stock Market Predicts a Jolly Holiday Season

With dwindling inflation concerns, expectations are high for the Federal Reserve to maintain a supportive approach. This may pave the way for a festive atmosphere on Wall Street, similar to how Santa spreads joy during the holidays.

Holiday Shopping Trends Show Promising Growth

Exciting news for retailers, as the 2024 holiday shopping season is shaping up to be one of the strongest in years. Data from Mastercard (MA), Adobe Analytics, and Salesforce (CRM), reveals a solid start to the shopping season.

Black Friday and Cyber Monday sales rose by approximately 3-4% compared to last year, while online sales showed an impressive increase of 8-10%. This robust growth suggests that we might experience the best holiday shopping season since the pandemic began over four years ago.

Potential for a Holiday Market Rally

As we approach the end of 2024, investors can look forward to potentially favorable market conditions. With consumer spending on the rise, reduced inflation concerns, and the Federal Reserve appearing more approachable, the outlook is becoming increasingly positive.

The economic challenges brought on by the pandemic seem to be lessening, creating a more stable environment for investment. Nonetheless, investors should remain vigilant as market conditions can change unexpectedly. All eyes will be on the upcoming Federal Reserve meeting, where Jerome Powell’s comments could substantially influence market directions.

For now, it seems that a positive market run may be on the horizon.

Interested in uncovering which stocks could be the best picks for this holiday rally?

Discover more about our research services and top stock recommendations for potential year-end gains.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. Stay informed with Luke’s latest market insights by reading our Daily Notes! Check out new updates on your Innovation Investor or Early Stage Investor subscriber site.