Uncovering Opportunities: Oversold Stocks in the Materials Sector

The materials sector is experiencing a wave of overselling, making it an attractive time for investors to consider undervalued companies.

The Relative Strength Index (RSI) serves as an important momentum indicator. It compares how strong a stock’s price performance is on days it increases versus days it decreases. An RSI below 30 typically suggests that a stock may be oversold, hinting at potential recovery according to insights from Benzinga Pro.

Below is a current list of notable oversold stocks within this sector, with RSI values near or below the critical 30 mark.

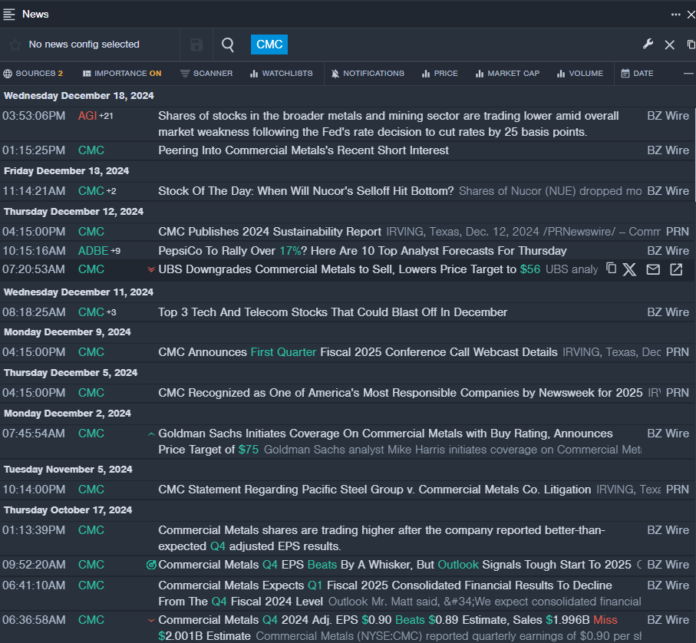

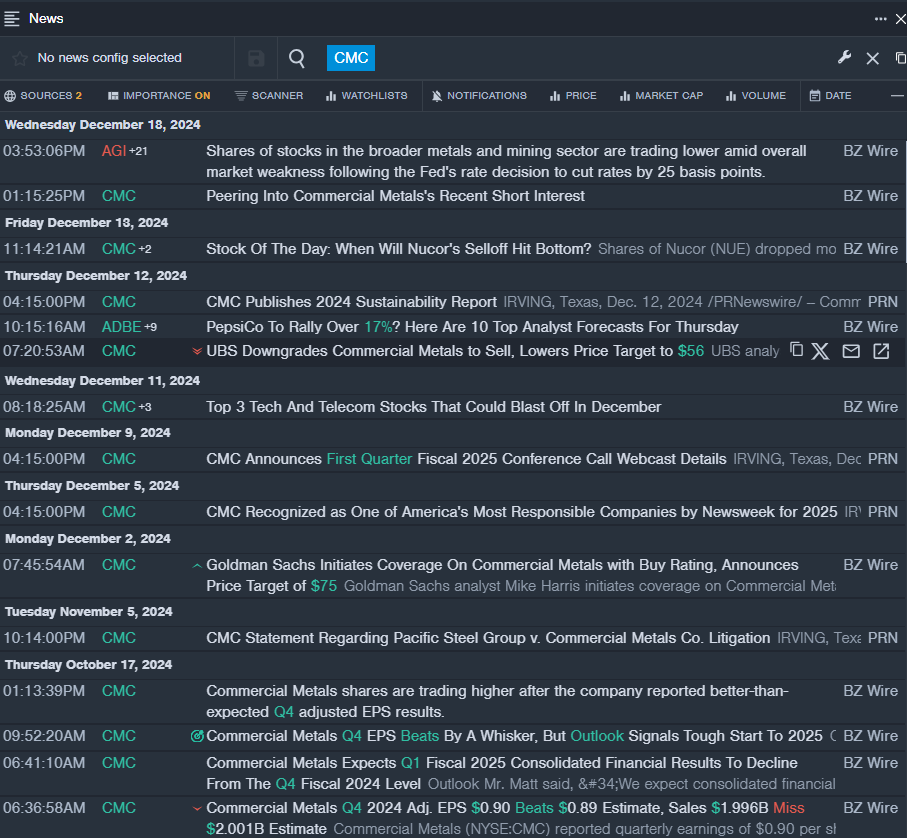

Commercial Metals Co CMC

- On December 12, UBS analyst Curt Woodworth downgraded Commercial Metals from Buy to Sell, adjusting the price target from $62 to $56. Over the past month, the stock has dropped around 19%, reaching a 52-week low of $47.42.

- RSI Value: 27

- CMC Price Action: Shares of Commercial Metals increased by 1.5%, closing at $50.27 on Friday.

- Benzinga Pro’s real-time updates have provided recent news on CMC.

Cleveland-Cliffs Inc CLF

- On December 19, Citigroup analyst Alexander Hacking maintained a Neutral rating on Cleveland-Cliffs while lowering the price target from $12.5 to $11. The stock has fallen approximately 25% in the last month, with a 52-week low of $9.13.

- RSI Value: 28

- CLF Price Action: On Friday, shares of Cleveland-Cliffs rose 0.5% to close at $9.38.

- Benzinga Pro’s analytical tools played a role in identifying the current trends in CLF stock.

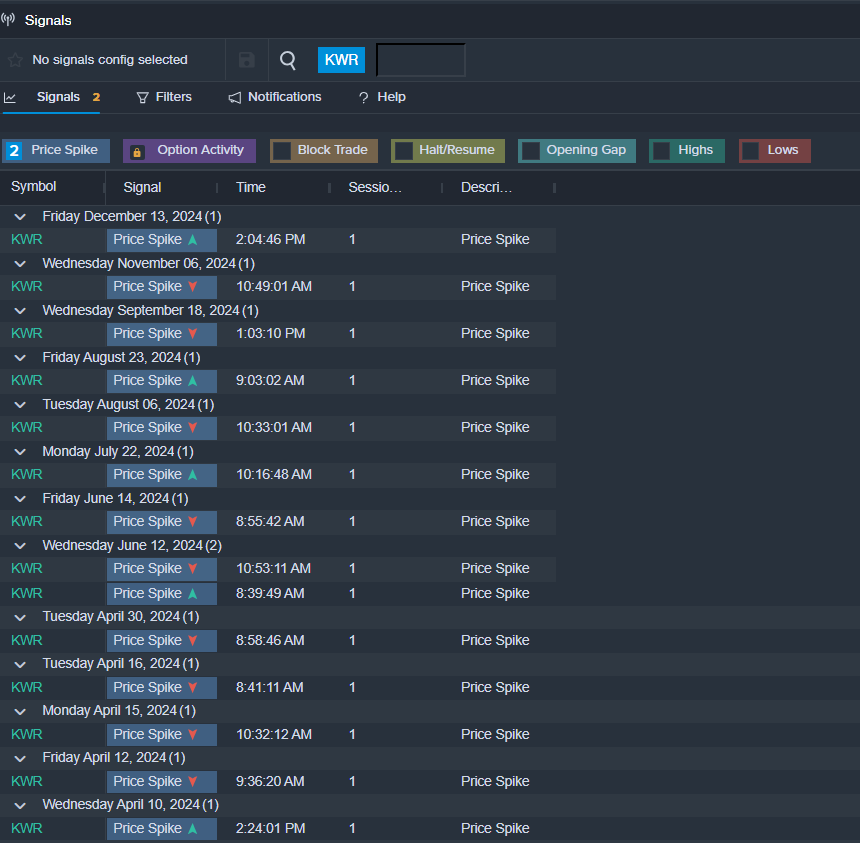

Quaker Chemical Corp KWR

- On November 18, Quaker Houghton announced the appointment of Joseph Berquist as CEO and President. Recently, the company’s stock has fallen around 15%, reaching a 52-week low of $137.65.

- RSI Value: 24

- KWR Price Action: On Friday, Quaker Chemical shares decreased by 1.7%, closing at $138.61.

- Benzinga Pro’s alert system indicated potential changes in KWR stock soon.

Read This Next:

Market News and Data brought to you by Benzinga APIs