ETF Analysts See Significant Upside for USCA and Key Holdings

At ETF Channel, we analyzed the underlying assets of various ETFs in our coverage. By comparing the current trading price of each underlying holding with the average 12-month forward target price set by analysts, we calculated a weighted average implied target price for the ETFs. For the Xtrackers MSCI USA Climate Action Equity ETF (Symbol: USCA), the implied target price is $42.67 per unit.

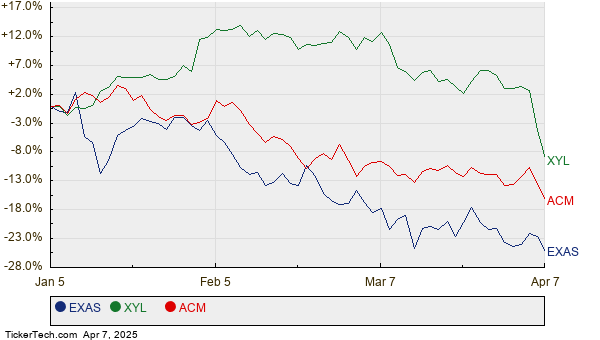

Currently, USCA trades at approximately $32.06 per unit, indicating a potential upside of 33.10% based on analysts’ target prices for its holdings. Among USCA’s key holdings, EXACT Sciences Corp. (Symbol: EXAS), Xylem Inc (Symbol: XYL), and AECOM (Symbol: ACM) stand out due to their significant upside potential. EXAS recently traded at $42.55 per share, but analysts set an average target price of $69.14, suggesting a remarkable upside of 62.48%. Similarly, XYL’s share price of $104.60 shows a potential increase of 41.70% towards the average target of $148.21. Lastly, ACM, currently priced at $89.25, has an analyst target of $123.80, representing a 38.71% upside.

Below is a twelve-month price history chart comparing the stock performance of EXAS, XYL, and ACM:

The summary table below features the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Xtrackers MSCI USA Climate Action Equity ETF | USCA | $32.06 | $42.67 | 33.10% |

| EXACT Sciences Corp. | EXAS | $42.55 | $69.14 | 62.48% |

| Xylem Inc | XYL | $104.60 | $148.21 | 41.70% |

| AECOM | ACM | $89.25 | $123.80 | 38.71% |

Are analysts justified in their target prices, or could they be overly optimistic about where these stocks will be trading in the next 12 months? Investors should evaluate whether analysts have a valid basis for their projections or if they are lagging behind recent trends in these companies and their industries. A substantial price target relative to a stock’s current trading price often reflects optimism for future performance; however, it could also precede potential target price reductions if those targets are outdated. Further research is essential for investors when considering these matters.

![]()

10 ETFs With Most Upside To Analyst Targets »

Also see:

• High-Yield Canadian Real Estate Stocks

• ONCO shares outstanding history

• RESI Historical Stock Prices

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.