Analysts Predict Upside for Vanguard Russell 1000 Growth ETF Amid Stock Price Insights

In our latest analysis at ETF Channel, we have examined the stocks held within the Vanguard Russell 1000 Growth ETF (Symbol: VONG). By comparing the trading prices of these holdings with the average 12-month target prices from analysts, we determined that the ETF’s weighted average implied target price is $112.34 per unit.

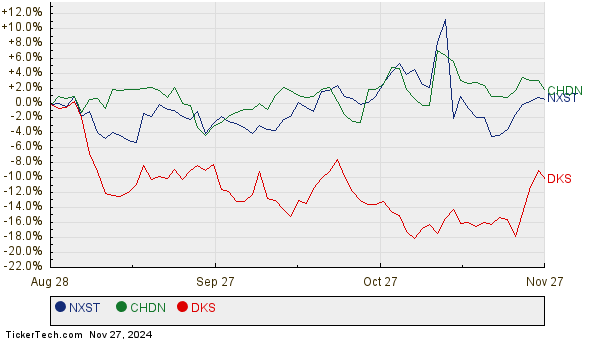

Currently, VONG is trading around $102.45 per unit. This indicates a potential upside of 9.65% based on analysts’ target prices for the underlying holdings. Notably, three stocks within VONG show significant upside compared to their analysts’ targets: Nexstar Media Group Inc (Symbol: NXST), Churchill Downs, Inc. (Symbol: CHDN), and Dick’s Sporting Goods, Inc. (Symbol: DKS). NXST is currently priced at $170.29 per share, yet analysts project a target of $200.38 per share, reflecting a potential increase of 17.67%. Similarly, CHDN, trading at $139.70, has a target of $162.30, indicating a 16.18% gain potential. Meanwhile, DKS trades at $212.22, with an average target of $245.80, signaling an upside of 15.82%. Below is a chart illustrating the price trends of NXST, CHDN, and DKS over the past twelve months:

Here’s a summary table showcasing the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Growth ETF | VONG | $102.45 | $112.34 | 9.65% |

| Nexstar Media Group Inc | NXST | $170.29 | $200.38 | 17.67% |

| Churchill Downs, Inc. | CHDN | $139.70 | $162.30 | 16.18% |

| Dick’s Sporting Goods, Inc | DKS | $212.22 | $245.80 | 15.82% |

Are analysts’ targets reasonable, or are they overly optimistic about these stock prices over the next year? Understanding whether analysts can justify their projections based on recent trends in companies and industries is essential. While high price targets may show confidence in the stock’s future, they could lead to downward adjustments if the targets become outdated. Investors should conduct thorough research to assess these predictions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• AAOI Historical Stock Prices

• FICO shares outstanding history

• NAV Price Target

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.