Dell Technologies (DELL) shares have surged by 50.4% over the past year, outperforming the Zacks Computer – Micro Computers industry’s increase of 35.9% and the wider Zacks Computer & Technology sector’s rise of 35.7%.

The driving force behind this growth has been strong demand for AI servers, spurred by digital transformation and rising interest in generative AI (GenAI) applications.

The Dell AI Factory, which integrates Dell Technologies’ solutions and services tailored for AI workloads while working with partners like NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), and Hugging Face, has proven to be a transformative initiative.

Dell’s comprehensive solutions portfolio positions it well for future growth. The company estimates revenue growth of 3% to 4% and earnings growth of over 8%. Furthermore, Dell Technologies plans to return over 80% of adjusted free cash flow to shareholders, with a dividend growth rate projected to exceed 10% from 2024 to 2028.

Dell Outshines Competitors

Image Source: Zacks Investment Research

Since spinning off VMware, Dell Technologies has returned $5.5 billion to its shareholders.

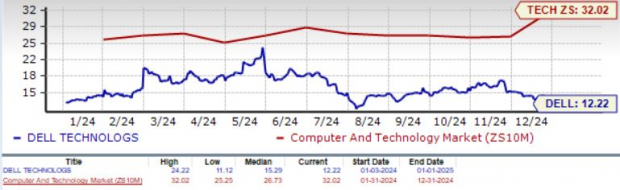

Currently, Dell Technologies shares are considered reasonably priced, as indicated by a Value Score of B.

The DELL stock trades at a forward 12-month P/E ratio of 12.22X, significantly less than the sector’s average of 32.02X.

P/E Ratio for DELL (Forward 12 Months)

Image Source: Zacks Investment Research

Strengthening Portfolio and Partnerships Boost DELL Stock

Dell’s advanced air and liquid-cooled AI servers, along with its optimized networking and storage capabilities, are propelling revenue growth.

Supported by NVIDIA, AMD, and Intel, Dell offers ten AI-optimized servers, including the XE9712, XE9685L, and XE7740. In the fiscal third quarter, the AI-optimized server pipeline grew 50% sequentially, reflecting demand across various customer segments.

During the third quarter of fiscal 2025, Dell reported $3.6 billion in orders, predominantly from Tier-2 cloud service providers (CSPs). The strong demand for the XE9680 product has significantly contributed to this success. Dell shipped $2.9 billion worth of AI servers in the same quarter, and the AI server backlog stood at $4.5 billion at the quarter’s close.

Expansion of the AI server pipeline is ongoing with Tier-2 CSPs and enterprise customers. Dell Technologies forecasts a robust revenue growth trajectory for the second half of fiscal 2025, driven by high demand for AI solutions.

DELL’s growing partnerships with companies like AMD, NVDA, META, MSFT, and Intel are also enhancing its market reach.

Additionally, a resurgence in demand for traditional servers, which has increased year over year for the fourth consecutive quarter, is benefiting Dell, leading to higher sales volumes and prices, especially in enterprise configurations.

A Positive Outlook for DELL

Dell’s target markets—including AI, PCs, peripherals, servers, and IT networking—are projected to reach $2.1 trillion by 2027. The Infrastructure Solutions Group (ISG) is anticipated to grow at a 7% compound annual growth rate (CAGR) from 2023 to 2027.

The AI hardware and services market is expected to grow to $124 billion by 2027, with a CAGR of over 18% during the same period. In preparation, Dell is enhancing its engineering capabilities to support initiatives related to AI.

With the anticipated release of new AI-powered PCs, Dell expects an uptick in revenues for fiscal 2026, positively impacting its Client Solutions Group (CSG).

Demand for AI servers will continue driving ISG’s performance, complemented by growth in traditional servers and storage solutions. PowerStore and PowerFlex witnessed double-digit growth in demand during the third fiscal quarter. Dell’s ongoing focus on the mid-range market is expected to drive long-term revenue growth and improved margins.

Changing Earnings Estimates for DELL

Currently, the Zacks Consensus Estimate for DELL’s fiscal 2025 earnings is $7.82 per share, reflecting a modest decline of 3 cents over the past two months, which is still expected to represent a 9.68% year-over-year growth.

For fiscal 2026, the consensus estimate for earnings is $9.57 per share—a slight decrease over the past month, but indicating a 22.4% year-over-year growth.

DELL has consistently beaten the Zacks Consensus Estimate in the previous four quarters, achieving an average surprise of 10.44%.

Dell Technologies Inc. Price vs. Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

What to Consider for DELL Investments

Dell’s solid portfolio and expanding partner network present compelling reasons for long-term investment. Current shareholders might see promising growth prospects in the foreseeable future.

However, a decline in the consumer PC market poses challenges for Dell investors. Additionally, cautious spending from enterprises on PCs and IT storage could hinder near-term performance.

Currently, DELL shares are trading below both the 50-day and 200-day moving averages, indicating a potential bearish trend.

Image Source: Zacks Investment Research

Currently, DELL holds a Zacks Rank #3 (Hold), suggesting it may be prudent to wait for a more opportune moment to enter the stock. Explore Zacks #1 Rank (Strong Buy) stocks for potential investment opportunities.

Recently Released: Zacks Top 10 Stocks for 2024

Don’t miss the chance to catch our top 10 stock selections for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has demonstrated remarkable performance. From its inception in 2012 through November 2024, the Zacks Top 10 Stocks achieved an astounding gain of +2,112.6%, vastly surpassing the S&P 500’s +475.6%. Sheraz has meticulously analyzed 4,400 companies and selected the ten best for long-term holding in 2025. Be among the first to discover these newly-released stocks with substantial potential.

See New Top 10 Stocks >>

Interested in the latest recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double at no cost.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For more on this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.