Tesla’s Future under Trump: A Mixed Bag of Opportunities and Challenges

Tesla (NASDAQ:TSLA) faces a complicated future with opportunities and hurdles as Trump takes office. Elon Musk’s role in the new administration as the head of the ‘efficiency’ department may give Tesla some advantages.

However, Trump has shown skepticism towards electric vehicles, likely leading to the repeal of EV tax incentives and rebates. This could negatively affect Tesla and its competitors.

Despite these challenges, Deutsche Bank analyst Edison Yu sees potential benefits for Musk’s various ventures. He stated, “Beyond attributing the price action to tactical factors (e.g., retail exuberance, algos, short covering due to lack of near-term negative catalysts, etc.), we see potential large terminal value benefits to Tesla’s efforts in auto, robotaxi, and even humanoid robotics.”

How might the Trump administration impact Tesla? Positive policies could emerge, especially concerning robotaxis. Currently, regulations differ greatly by state, with minimal clear guidelines. Yu anticipates the new administration might “set standards at the national level to make approval of deployment faster/simple.”

If changes occur with the IRA or if new tariffs on imported components are implemented, Tesla might gain a competitive edge. The company already has the highest U.S. content of any major model sold domestically, and its scale and cost structure for battery electric vehicles (BEVs) outpace competitors. Both General Motors and Ford expect significant gains from the IRA, which are vital for their electric vehicle profitability.

In addition, there’s the potential for federal support in humanoid robotics. Yu emphasized the importance of developing a supply chain for large-scale, low-cost production, suggesting that policy support could mirror that provided to the semiconductor industry through grants or loans.

A key uncertainty revolves around China. Musk enjoys considerable popularity there, and Tesla is the only foreign automaker with a substantial presence in China’s EV market. Yu muses, “Could his influence facilitate some type of win-win reconciliation?”

Only time will reveal the results. Currently, Yu rates Tesla shares as a Buy. (To review Yu’s track record, click here)

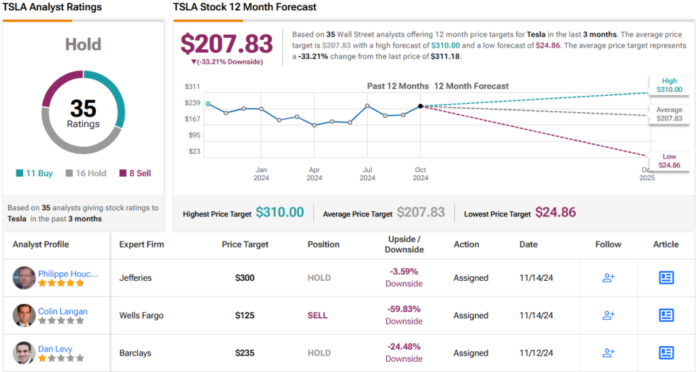

Out of 10 other analysts, several maintain a bullish stance on TSLA. However, 16 analysts suggest a Hold rating, with eight recommending a Sell. This results in a consensus Hold rating. Meanwhile, the average price target of $207.83 indicates a potential 12-month decline of 33%. (See Tesla stock forecast)

To find promising stock ideas trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that combines all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. This content is intended for informational purposes only. Conducting your own analysis before making any investment is crucial.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.