Dillard’s Inc. Surpasses Earnings Expectations Amid Sales Challenges

Dillard’s Inc. (DDS) reported its fiscal third-quarter 2024 results, exceeding expectations for both earnings and revenue, despite a decrease in sales compared to last year. The company faced headwinds from a challenging retail environment but succeeded in maintaining a strong gross margin and lowering operating expenses through effective cost control measures.

Quarterly Earnings Overview

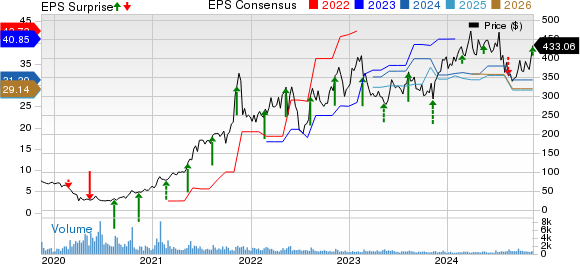

Earnings per share landed at $7.73, topping the Zacks Consensus Estimate of $6.47. Nevertheless, this marked a 16.9% decline from the adjusted earnings of $9.30 reported in the same quarter last year.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Net sales totaled $1.427 billion, down 3.3% year over year, yet slightly above the Zacks Consensus Estimate of $1.420 billion. Including service charges and other income, sales reached $1.451 billion, reflecting a 3.5% decline from the previous year.

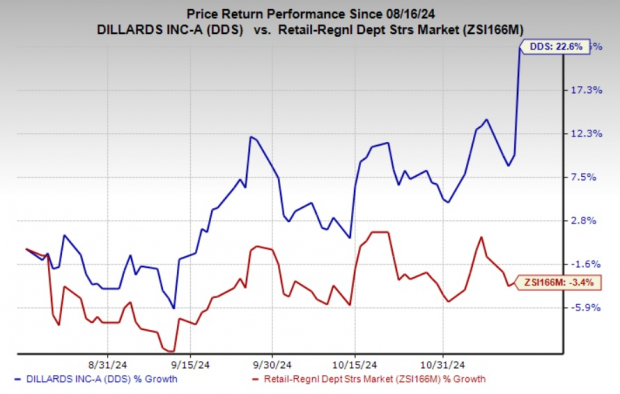

Following the report of these positive results, Dillard’s shares surged 11.5% on November 14, 2024. This rise highlights investors’ optimism regarding the reduced operational costs. Over the past three months, shares of Dillard’s have increased by 22.6%, contrasting with a 3.4% drop in the overall industry.

Dillard’s Performance Insights

A detailed examination of Dillard’s sales shows that total retail sales (excluding CDI Contractors, LLC) dropped 3.8% year over year to $1.356 billion, with comparable store sales down 4%. The challenging retail climate contributed to these declines, although the forecast anticipated a 2.4% decrease.

The cosmetics category saw robust performance, while men’s apparel and juniors’ and children’s clothing were the weakest sectors.

Image Source: Zacks Investment Research

Consolidated gross margin fell by 90 basis points to 42.6%. The retail gross margin decreased by 80 basis points to 44.5%, driven by declines in shoes, juniors’ and children’s clothing, home goods, and ladies’ apparel. However, improvements in ladies’ accessories and lingerie partially offset these losses.

Dillard’s selling, general, and administrative (SG&A) expenses increased by 80 basis points as a percentage of sales, reaching 29.4%. In dollar terms, SG&A expenses dropped by 0.7% year over year to $418.9 million, primarily due to stringent cost management practices that stabilized payroll expenses. However, the company faced higher insurance expenses during this quarter.

Analysts had projected a growth in SG&A costs, expecting a rise of 240 basis points in percentage terms and a 5.3% increase in dollar terms to $444.3 million.

Financial Position and Future Expectations

At the end of the third quarter, Dillard’s reported cash and cash equivalents of $980.4 million, long-term debt of $321.6 million, and total shareholders’ equity of $1.963 billion. The net cash from operational activities amounted to $349.4 million as of November 2, 2024. Furthermore, inventory levels rose by 3% year over year.

During this quarter, Dillard’s repurchased 294,000 shares for $107 million, averaging $364.43 per share. As of November 2, 2024, the company still had $287 million remaining under its share repurchase program initiated in May 2023.

Looking ahead, Dillard’s expects its capital expenditures for fiscal 2024 to be $110 million, slightly lower than the previously projected $120 million and a decline from $133 million spent in fiscal 2023.

For the current fiscal year, Dillard’s anticipates depreciation and amortization expenses to remain steady at $180 million, mirroring the figures from fiscal 2023. Additionally, the company projects net interest and debt expenses to reach $13 million, in contrast to an income of $5 million reported last year.

Notable Stock Recommendations

Investors might also consider stocks that have a strong ranking, such as Deckers Outdoor (DECK), Abercrombie & Fitch (ANF), and The Gap Inc. (GAP).

Deckers specializes in niche footwear and accessories for outdoor sports and lifestyle activities and currently holds a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate projects growth of 13.6% for sales and 12.6% for earnings per share this financial year compared to last year, with a trailing four-quarter earnings surprise averaging 41.1%.

Abercrombie operates as a premium casual apparel retailer and holds a Zacks Rank #2 (Buy). Its sales and earnings estimates indicate growth of 13.2% and 64.2%, respectively, year-over-year, with an average earnings surprise of 28% over the past four quarters.

Gap is a premier international retailer offering a range of clothing and accessories and also carries a Zacks Rank of 2. The consensus estimate for sales and earnings growth for Gap stands at 0.5% and 31.5% from the previous year, boasting an average earnings surprise of 142.8% over the trailing four quarters.

Solar Sector Insights

The solar industry is poised for a significant rebound as technological advancements shift focus from fossil fuels to renewable energy sources, particularly to accommodate the growing demand from AI developments.

With projected investments in clean energy reaching trillions of dollars, analysts anticipate solar power will represent 80% of the renewable energy growth over the next several years. This presents a unique opportunity for investors willing to identify the right stocks in this emerging sector.

“`html

Dillard’s Reports Strong Q3 Earnings: Stock Soars 11%

Increased Revenue Driven by Effective Cost Management

Dillard’s, Inc. (DDS) has released its financial results for the third quarter of 2023, showcasing a significant increase in earnings, primarily supported by strict expense control measures. This has led to an impressive 11% surge in the company’s stock price following the announcement.

During this quarter, Dillard’s reported $610 million in revenues, exceeding analysts’ forecasts. The company attributed the growth to efficient management strategies and a recovery in consumer spending patterns, which have positively impacted sales figures.

In light of Dillard’s positive performance, investors can access a free analysis report that delves deeper into the company’s financial health and future outlook.

Other companies in the retail sector, including Abercrombie & Fitch Company (ANF), Deckers Outdoor Corporation (DECK), and The Gap, Inc. (GAP), have also made headlines recently, as they navigate a challenging market landscape. For fresh insights on these companies, you can find Abercrombie & Fitch Company (ANF): Free Stock Analysis Report, Deckers Outdoor Corporation (DECK): Free Stock Analysis Report, and The Gap, Inc. (GAP): Free Stock Analysis Report available for download.

To read the full article detailing Dillard’s earnings results, please visit Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`