Hedge Funds Show Interest in Tesla Stocks: A Closer Analysis

In reviewing the latest 13F filings for the period ending December 31, 2024, we found that Tesla Inc (Symbol: TSLA) was held by 13 hedge funds. When multiple hedge funds converge on the same stock, it often warrants further examination.

However, it’s essential to understand that 13F filings only disclose long positions, leaving short positions concealed. For example, a fund might maintain a long position while simultaneously betting against the stock by shorting it. Consequently, a fund appearing bullish based solely on its long position might actually have a mixed sentiment when short positions are considered.

Despite this limitation, analyzing groups of 13F filings can yield valuable insights, especially when comparing different reporting periods. Below, we present the changes in TSLA holdings among the most recent 13F filers:

| Fund | New Position? | Change In Share Count | Change In Market Value ($ in 1000’s) |

|---|---|---|---|

| BluePath Capital Management LLC | Existing | +1,031 | +$3,030 |

| HCR Wealth Advisors | Existing | –93 | +$2,004 |

| Sterling Investment Advisors LLC ADV | NEW | +599 | +$242 |

| RMR Wealth Builders | Existing | +6,439 | +$3,871 |

| Essex Savings Bank | Existing | +172 | +$515 |

| Connective Portfolio Management LLC | NEW | +6,000 | +$2,423 |

| Keeler & Nadler Financial Planning & Wealth Management | NEW | +718 | +$290 |

| St. Louis Financial Planners Asset Management LLC | Existing | +132 | +$2,683 |

| Breakwater Investment Management | Existing | UNCH | $UNCH |

| Nabity Jensen Investment Management Inc | NEW | +594 | +$240 |

| Sagace Wealth Management LLC | Existing | UNCH | +$209 |

| ERn Financial LLC | Existing | +505 | +$2,142 |

| Surience Private Wealth LLC | NEW | +9,861 | +$3,982 |

| Aggregate Change: | +25,958 | +$21,631 | |

During this reporting period, five funds increased their TSLA positions from September 30, 2024, while one fund decreased its holdings, and five established new positions.

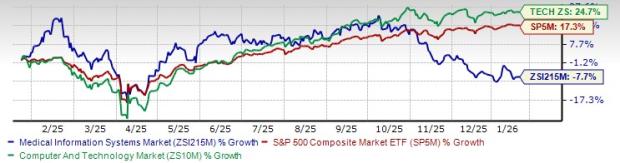

A broader look reveals that the total share count held by all funds sharing interest in TSLA declined significantly. When comparing the 13F filings from December 31, 2024, to those from September 30, 2024, funds reduced their holdings by a noticeable 10,259,365 shares, dropping from 15,182,892 to 4,923,527 shares, reflecting a decrease of about 67.57%. Among hedge funds reporting on December 31, 2024, the top three holders of TSLA were:

This analysis of 13F filings reveals insights into hedge fund strategies and their positions in Tesla. While individual filings might not provide the full picture due to the long-only reporting requirement, examining the aggregates across multiple funds can yield important signals about market sentiment.

![]() 10 S&P 500 Components Hedge Funds Are Buying »

10 S&P 500 Components Hedge Funds Are Buying »

Also see:

Stocks with Recent Secondaries That Hedge Funds Are Buying

Institutional Holders of HMHC

HOOD YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.