Amazon vs. Sirius XM: A Tale of Two Investment Paths

Satellite radio leader Sirius XM Holdings (NASDAQ: SIRI) was once a golden ticket for investors, particularly during the dot-com boom. Back then, its stock price climbed high, leaving many hopeful for continued success.

However, the market took a turn when the dot-com bubble burst, resulting in a significant drop for Sirius XM’s share price. For many investors, it ceased to be a wealth-building opportunity. Today, the company offers a high dividend yield and sparks of hope for recovery, especially with Warren Buffett’s recent endorsement of the stock in 2024. While the stock still has some attraction, its reliance on a traditional satellite radio service raises questions. With the prevalence of high-speed internet, wouldn’t it make more sense to focus on online streaming?

Though I admire Buffett’s strategy with Sirius XM and wish success for his followers, I prefer to observe the company’s recovery efforts from a distance.

There are other companies from the dot-com era that continue to thrive, most notably Amazon.com (NASDAQ: AMZN). Unlike many of its peers, Amazon didn’t just manage to survive; it actively shaped two new industries: e-commerce and cloud computing. Let’s explore how this dynamic company has adapted and prospered.

Amazon’s Innovative Business Model Transforms Industries

With a market capitalization of $2.1 trillion, Amazon stands tall among the so-called “Magnificent Seven” of the business world.

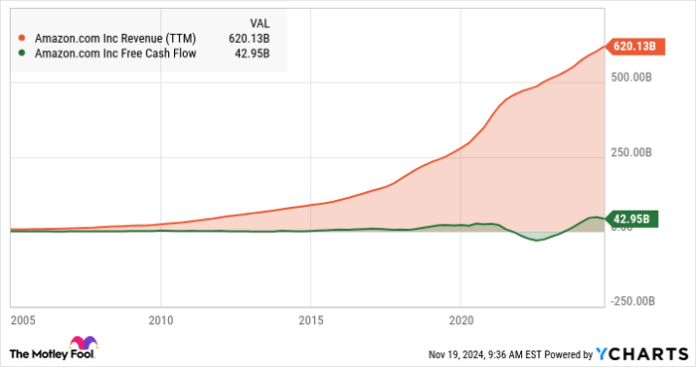

In the third quarter, Amazon’s global e-commerce network generated $131 billion in net sales, a significant increase from $120 billion the previous year. Additionally, the Amazon Web Services (AWS) platform reported an impressive operating profit of $10.4 billion. After a brief dip, Amazon’s free cash flows have returned to a robust $43 billion annually.

AMZN Revenue (TTM) data by YCharts

This isn’t a turnaround for Amazon; the company continues to lead and innovate across various sectors. It has established a global computing service that rivals Alphabet’s Google and has revolutionized shipping services, making competitors like FedEx (NYSE: FDX) seem outdated with its same-day delivery options.

Amazon’s Growth and Strong Valuation as Investment Highlights

Amazon is pursuing greater international e-commerce engagement while positioning itself in the ongoing artificial intelligence (AI) revolution. Despite its massive size, the company retains an aggressive, growth-oriented approach. It currently trades at 3.4 times sales and 43 times earnings, reflecting a reasonable valuation for such a successful firm.

For those seeking an investment in AI and a representative in the “Magnificent Seven,” Amazon stands out. It excels in both online retail and cloud services and boasts an award-winning Prime Video service aimed at significant growth. No other company closely parallels Amazon’s unique capabilities across multiple sectors.

Amazon: A Dependable Investment Across Market Cycles

Historically, Amazon has rewarded its early investors and maintains strong long-term growth potential. For investors drawn to Sirius XM due to Buffett’s $2.8 billion stake, Amazon is also appealing, with a $2.0 billion investment from him as well.

Overall, Amazon presents a compelling mix of growth and value, making it hard to ignore. This company is multifaceted, making it a wise investment choice, even by trillion-dollar standards.

Don’t Miss Your Opportunity for Lucrative Investments

Have you ever felt you missed the chance to invest in great stocks? Here’s how you can rectify that.

On rare occasions, our team of expert analysts issues a “Double Down” stock recommendation for companies poised to excel. If you’re feeling anxious about missing your opportunity to invest, now may be the ideal time; waiting could mean losing out. Here are some compelling examples:

- Nvidia: Investing $1,000 when we recommended it in 2009 would have resulted in $378,269 today!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $43,369!*

- Netflix: If you bought in for $1,000 when we recommended it in 2004, you’d have $476,653!*

Currently, we are releasing “Double Down” alerts for three outstanding companies, and the chance to invest may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. Anders Bylund has positions in Alphabet and Amazon. The Motley Fool has investments in and recommends Alphabet, Amazon, and FedEx. The Motley Fool adheres to a strict disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.