Understanding S&P 500 Returns: Should You Consider an Equal Weight Strategy?

Over the long term, the benchmark S&P 500 index has generated average annualized returns of about 10%. Recently, it has more than doubled that figure, achieving a total two-year return of about 53%, marking its best two-year performance in the 21st century. This remarkable growth largely stems from the artificial intelligence (AI) boom, propelling several companies into the highest reaches of market capitalization.

Concerns About Concentration in the S&P 500

While the impressive returns of a few dominant companies captivate investors, it’s important to note that eight stocks now represent nearly one-third of the total value of the S&P 500. This concentration raises concerns about diversification for investors using S&P 500 funds. If that sounds familiar, consider the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSPT) as an alternative.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Rebalancing for a Balanced Portfolio

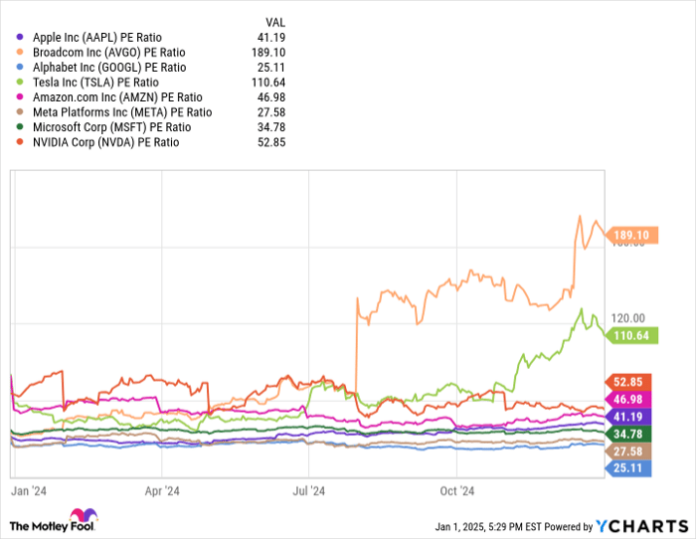

The S&P 500 consists of roughly 500 companies spread across various market sectors. Each stock is weighted according to its market capitalization, offering a better reflection of market value. Recently, however, the success of tech and AI stocks has skewed this balance, resulting in the S&P’s focus on a few high-flying stocks nicknamed the “Fateful Eight,” including Broadcom (NASDAQ: AVGO). As of January 1, these eight stocks made up approximately 36% of the index’s value.

This concentration means increased risk for investors during potential market downturns, particularly given that many of these stocks are trading at high valuations.

AAPL PE Ratio data by YCharts.

If you’re looking for broader market exposure while minimizing the influence of the Fateful Eight, you could consider the Invesco S&P 500 Equal Weight ETF. This ETF rebalances its portfolio quarterly to ensure that all stocks in the S&P 500 are equally weighted. This strategy reduces concentration risk and increases investment in smaller large-cap companies that have underperformed in comparison. However, it’s worth noting that the equal-weight ETF has lagged behind the standard S&P 500 over the past two years.

RSP data by YCharts.

Balancing Risks with Investment Choices

Your investment choices will depend on your risk tolerance and financial goals. Opting for the equal-weighted S&P 500 ETF means you may miss out on some of the significant gains from the top-performing stocks, but it could limit your losses when those influential stocks pull back. Concerns about downside risk remain significant as we look to 2025.

While there is a chance for broader gains within the S&P 500, it is uncertain. Elevated Treasury yields and potential inflation catalysts may disrupt market stability. The prominence of the Fateful Eight could lead to broader market sell-offs if declines occur among these stocks. Some analysts believe these leaders may act defensively during tough market conditions due to their strong balance sheets, market shares, and technological advancements.

If you are a long-term investor, with ten years or more until retirement and no immediate plans to withdraw funds, it’s best to prepare for potential market volatility. However, if you plan to take some profits, invest new funds in less volatile options, or need a shorter-term strategy, considering the Invesco S&P 500 Equal Weight ETF may be worthwhile.

Seize the Opportunity Before It’s Too Late

Have you ever felt like you missed the chance to invest in top-performing stocks? If so, keep reading.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they believe are set to perform well. If you think you’ve already missed out, now may be the best chance to invest before it’s too late. The numbers are compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $358,640!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,181!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $478,206!*

Currently, we are alerting investors to three promising “Double Down” stocks, and similar opportunities may not come often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.