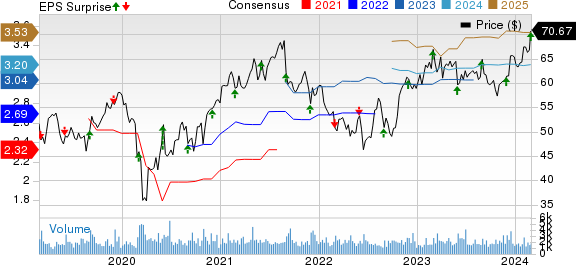

Fuel up the engines, investors! Donaldson Company, Inc. (DCI) has revved up its performance in the second quarter of fiscal 2024, ended January 31, 2024, with adjusted earnings of 81 cents per share. This figure not only left the Zacks Consensus Estimate of 73 cents trailing behind in the rearview mirror but also marked a spirited 15.9% surge from the previous year.

Acceleration in Revenue Results

In this joyride of financial success, Donaldson (DCI) didn’t just hit the gas—it zoomed past expectations. Total revenues clocked in at an impressive $876.7 million, beating the Zacks Consensus Estimate of $861 million with a 5.8% surge (5.3% at constant currency rates). Behind the wheel of this growth were volume upticks and the advantages of strategic pricing maneuvers.

Across regions, the United States/Canada terrain saw a vigorous 8.8% climb in net sales. Meanwhile, in Europe, the Middle East, and Africa, the road proved bumpier with a 3% decline. The Latin America and Asia Pacific arenas, however, showcased robust increases of 9% and 9.1%, respectively.

Switching lanes, Donaldson introduced three distinct reporting segments starting in the second quarter of fiscal 2023: Mobile Solutions, Industrial Solutions, and Life Sciences.

Let’s quickly peek under the hood of each segment:

The Mobile Solutions segment, comprising 62.7% of net sales, accelerated to $550.3 million, a 5.3% year-over-year surge. Aftermarket sales particularly shone with an 11.3% improvement, even as Off-Road and On-Road businesses softened by 13.4% and 3%, respectively.

For the Industrial Solutions segment, accounting for 30.1% of revenues, the odometer read $263.4 million—a 6.9% uptick over the previous year. Sales growth was evenly distributed with a 6% increase in Industrial Filtration Solutions and a more robust 12.4% jump in Aerospace and Defense.

In the Life Sciences sector (7.2% of revenues), the journey brought in $63 million, marking a 6% annual expansion.

Donaldson’s Pioneering Price, Consensus, and EPS Revelations

As the road unfolded, Donaldson steered its way through the fiscal second quarter with finesse. Costs of sales surged by 4.4% year over year to $568.1 million. However, gross profit hit the gas, surging by 8.5% to $308.6 million. This ascendancy translated into a 90-basis-point increase in gross margin to 35.2%, fueled by pricing benefits, deflation in freight costs, and favorable material prices.

Operating expenses, going head-to-head with challenges, revved up by 6.4% year over year to $178.9 million. Despite this, the operating profit for the quarter climbed by 11.5% to $129.7 million, resulting in an operating margin of 14.8%, boasting an 80-basis-point gain year over year.

Not steering clear of taxes, Donaldson managed an effective tax rate of 23.5%, down from 24.1% in the same quarter of the previous year.

Roadmap of the Balance Sheet and Cash Flows

As sunset approached on the second quarter of fiscal 2024, Donaldson counted its cash and cash equivalents, summing up to $193.8 million, compared to $187.1 million the quarter before. Long-term debt took a detour, plummeting to $352 million from $496.6 million in the previous quarter.

In the initial six-month stretch of fiscal 2024, the company revved up net cash from operating activities to $225 million, a 2% increase year over year. Capital expenditure (net) displayed signs of acceleration, slowing to $44.5 million from $57.6 million in the prior-year period. Free cash flow hit the pedal, zooming up by 10.8% to $180.5 million. Over the same period, Donaldson zipped through a repayment of long-term debt, totaling $88.7 million.

Pulling over briefly, Donaldson spent $86.6 million on repurchasing treasury stocks and allocated $60.3 million for dividends during the first half of fiscal 2024.

2024 Vision: High-Speed Outlook

Peering ahead into the foggy distance of fiscal 2024, Donaldson unveils details of its navigation plans. Adjusted earnings per share are projected to clock in between $3.24 and $3.32, an upgrade from the previous range of $3.14 to $3.30. Sales are anticipated to blaze a trail with a 3-7% increase from fiscal 2023 levels. Positive pricing ventures are estimated to paddle in a 2% boost, while the currents of foreign exchange are expected to gently nudge sales up by 1%.

Scrutinizing segmentally, Mobile Solutions is expected to drift up by 1-5% from fiscal 2023 sales figures, while Industrial Solutions plans to motor ahead with a 3-7% sales surge. Ventures in the Life Sciences section anticipate a heart-thumping increase of around 20%.

By the side of the road, interest expenses are poised to park at approximately $23 million, accompanied by other income cruising at $10-$12 million. Expectations point to an effective tax rate cozying up between 24-25%.

Cruising through, capital expenditure for the fiscal year expects to cover a stretch from $95 to $110 million. The free cash flow conversion is anticipated to gear up to 95-105%. Lastly, buckle up for share buybacks, projected to account for 2% of the outstanding shares.

Roadmap with Zacks Rank & Other Top Picks

Embracing its well-deserved Zacks Rank #2 (Buy), Donaldson leads the pack confidently. Joining in the ride are other star performers in the Industrial Products sector:

– Atmus Filtration Technologies Inc. (ATMU) sustains a Zacks Rank #2, boasting a trailing four-quarter average earnings surprise of 20.3%. Over the last 60 days, the Zacks Consensus Estimate for its 2024 earnings has accelerated by 2%.

– Tetra Tech, Inc. (TTEK) comfortably holds a Zacks Rank of 2, showcasing a trailing four-quarter average earnings surprise of 14.4%. The past 60 days reveal a 2.9% rise in the Zacks Consensus Estimate for its 2024 earnings.

– Brady Corporation (BRC) secure with a Zacks Rank of 2 and flaunting a trailing four-quarter average earnings surprise of 6.3%. The Zacks Consensus Estimate for Brady’s 2024 earnings remains steady, sending a strong signal.

Feel the adrenaline? Dive into the future and Download Free ChatGPT Stock Report Right Now or check out the latest recommendations from Zacks Investment Research for 7 Best Stocks for the Next 30 Days by clicking here!

To read this article on Zacks.com click here.

As you navigate the exciting twists and turns, remember: the views and opinions expressed herein are those of the author alone and not necessarily reflective of Nasdaq, Inc.