Nvidia Reigns Supreme in AI Chip Market, But Broadcom Rises Fast Behind

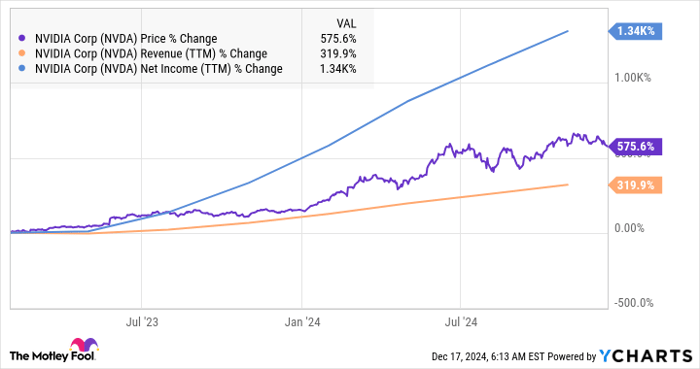

Nvidia (NASDAQ: NVDA) leads the data center graphics processing unit (GPU) sector, holding a significant 90% market share for chips used in artificial intelligence (AI) training and inference. This strong foothold has fueled impressive revenue and earnings growth for the company over the past few years, earning substantial returns for investors.

The company’s stock performance has been remarkable, though it has raised concerns about its valuation. Currently, Nvidia boasts a price-to-sales ratio of 29, far exceeding the U.S. technology sector’s average of 8.2, while its earnings multiple sits at 54. Yet, the pace of Nvidia’s growth justifies these high multiples, and the broad opportunity available in the AI market suggests that the company’s valuation could remain robust.

However, Nvidia is not alone in the AI semiconductor space. Another leading company, Broadcom (NASDAQ: AVGO), has been showing impressive growth and offers a comparatively lower price point. Recently released quarterly results revealed the stock’s potential and raised questions about its future performance.

Let’s explore Broadcom’s recent achievements and its prospects for 2025.

Broadcom’s Surge: Riding the Custom AI Chip Wave

Broadcom reported its fiscal 2024 fourth-quarter results (for the quarter ending Nov. 3) on Dec. 12. The company saw a striking 51% year-over-year revenue increase, reaching $14 billion. Non-GAAP earnings also rose by 28%, hitting $1.42 per share, slightly exceeding Wall Street’s forecast of $1.39.

When excluding revenue from its VMware acquisition, Broadcom’s organic growth stood at 9%. Looking ahead, the company anticipates $14.6 billion in revenue for the first quarter of fiscal 2025, marking a 22% growth compared to the previous year. Additionally, they expect adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to account for 66% of revenue, up from 60% from the previous fiscal year.

A key driver of Broadcom’s robust growth has been AI. The firm’s AI-related revenue totaled $12.2 billion for fiscal 2024, a significant jump from the $3.8 billion generated the previous year. Broadcom forecasts a 65% year-over-year increase in AI revenue for the current quarter, contributing to 26% of its overall sales.

The company’s management noted a large serviceable market for custom AI and networking chips, projected to reach between $60 billion and $90 billion by fiscal 2027. Even at the lower end of this range, Broadcom’s potential AI revenue could multiply significantly over the next few years.

Positive Analyst Projections Point to Future Growth

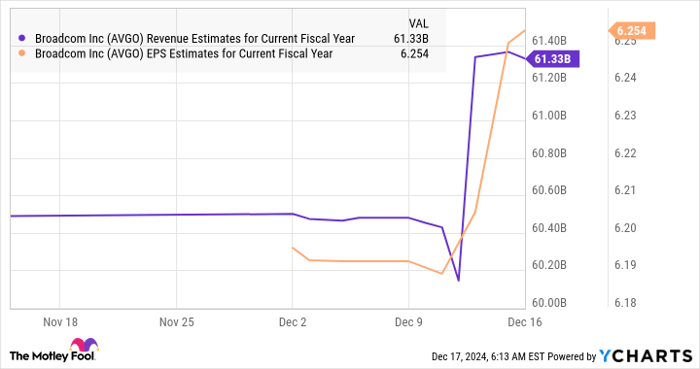

Following Broadcom’s latest earnings announcement, analysts have revised their growth projections upward.

AVGO Revenue Estimates for Current Fiscal Year data by YCharts

This fiscal year, which just started last month, revenue is expected to jump 19% from last year’s $51.5 billion, while earnings are projected to climb by 28% to $6.25 per share, up from 15% growth in the previous fiscal year.

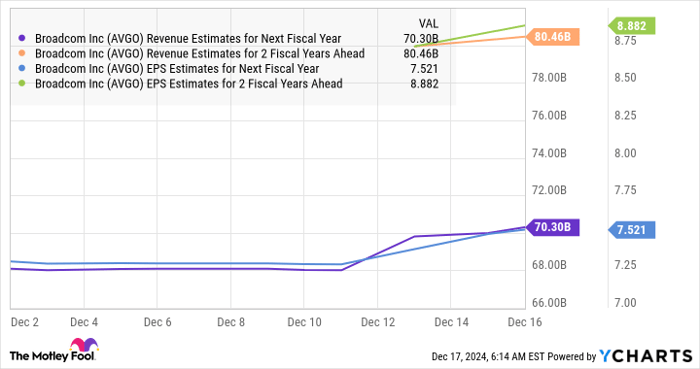

Broadcom could exceed growth expectations, fueled by its sizable market share and significant growth opportunities. As a result, the company’s stock is likely to maintain an upward trajectory through 2025 and beyond, with healthy double-digit growth projected for the upcoming years.

AVGO Revenue Estimates for Next Fiscal Year data by YCharts

Broadcom’s PEG ratio stands at 0.72, significantly lower than Nvidia’s 0.82. This makes Broadcom an attractive alternative for investors seeking growth in the AI sector while potentially enjoying a less expensive investment.

Is Now the Time to Invest $1,000 in Broadcom?

Before you decide to invest in Broadcom, think carefully:

The Motley Fool Stock Advisor team recently identified the 10 best stocks for investors to consider, and Broadcom did not make the list. These ten selections aim for substantial returns in the coming years.

Recall when Nvidia was added to the list on April 15, 2005… a $1,000 investment at that time would currently be worth an impressive $800,876*!

Stock Advisor provides investors with a straightforward approach to building wealth, featuring regular updates and two new stock picks each month. The service has outperformed the S&P 500 since 2002, achieving returns over four times greater than the index.

Explore the 10 stocks »

*Stock Advisor returns as of December 16, 2024

JPMorgan Chase is a partner of Motley Fool Money. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase and Nvidia, as well as recommending Broadcom. The Motley Fool operates under a standard disclosure policy.

The views expressed are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.