The U.S. stock market closed on a high note today, riding the wave of the Federal Reserve’s decision to maintain interest rates at current levels.

As the closing bell rang, the Dow Jones Industrial Average surged by an impressive 350 points, reaching 39,467.76. Meanwhile, the tech-heavy NASDAQ climbed 1.08% to close at 16,341.42, and the S&P 500 also posted gains, rising by 0.78% to finish at 5,218.70.

Sector Highlights

Today, it was a tale of two sectors as consumer discretionary shares enjoyed a 1.3% boost, while health care stocks saw a dip of 0.4% in trading.

Headline Story

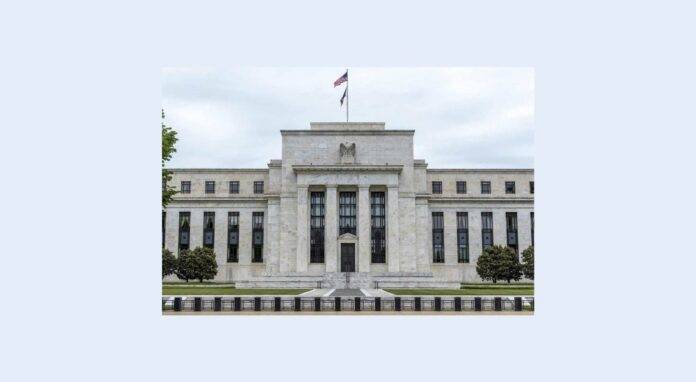

In a move that surprised few, the Federal Reserve announced its decision to maintain interest rates unchanged at today’s March meeting, holding steady between 5.25% and 5.5%. The central bank’s decision highlighted its commitment to managing the cost of money as we venture further into the year.

Winners and Losers in Equities

ETAO International Co., Ltd. ETAO shares stole the spotlight, skyrocketing by an astonishing 87% to $0.2670 following an announcement of a reverse stock split.

Meanwhile, XTL Biopharmaceuticals Ltd. XTLB surged 90% to $1.96 after unveiling plans to acquire The Social Proxy. Additionally, TruGolf Holdings, Inc. TRUG saw a 48% spike in share price to $1.70 following the announcement of a new AI technology licensing deal with mlSpatial.

On the Decline

Lifecore Biomedical, Inc. LFCR experienced a 32% drop to $4.9050 after concluding a strategic evaluation, announcing management changes. Shares of Aquestive Therapeutics, Inc. AQST fell by 16% to $4.47 after the company priced their public offering lower. Signet Jewelers Limited SIG was also down, falling by 10% to $92.17 following disappointing sales figures and a weak guidance for the coming year.

Commodities Movement

In commodities trading today, oil dipped by 2% to $81.84, contrasting with gold’s 1.3% rise to $2,187.90. Furthermore, silver jumped by 2.6% to $25.80, and copper posted a modest 0.4% increase, closing at $4.0890.

Insights from Global Markets

European markets displayed mixed results, with the STOXX 600 in the eurozone dipping slightly by 0.05%. In contrast, the FTSE 100 in London slipped by 0.01%, while Spain’s IBEX 35 Index rose by 0.48%. The DAX in Germany increased by 0.15%, but France’s CAC 40 fell 0.48%, and Italy’s FTSE MIB Index edged up by 0.09%.

Italy reported a 1.2% decline in industrial production in January after a surge in December. In Germany, producer prices fell by 4.1% year-over-year in February. On the other hand, UK’s producer prices saw a slight 0.4% increase, while the inflation rate eased to 3.4% year-over-year in February.

Asian Markets Overview

In Asia, markets closed higher today, with Hong Kong’s Hang Seng Index rising by 0.08%, China’s Shanghai Composite Index up by 0.55%, and India’s S&P BSE Sensex gaining 0.1%. The People’s Bank of China opted to maintain their benchmark lending rates at current levels.

Economic Insights

Recent reports indicated a 1.6% decline in U.S. mortgage applications for the week ending March 15. Additionally, the U.S. saw a 1.952 million barrel reduction in crude oil inventories for the week concluded on March 15, surpassing the market’s preliminary expectations.

The Fed’s decision to maintain interest rates at today’s March meeting resonates with their commitment to stability and prudent economic management.