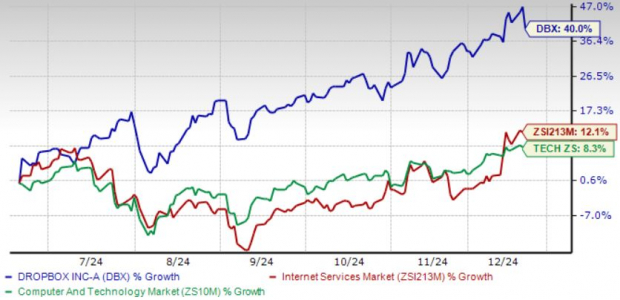

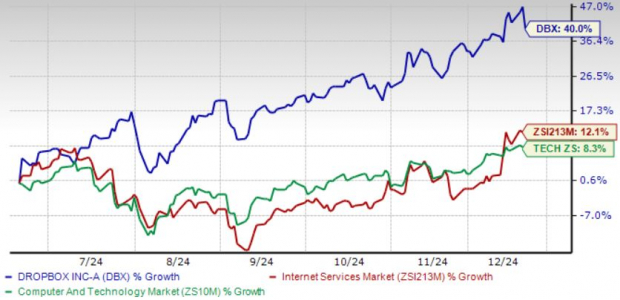

Dropbox’s DBX shares have increased by 40% over the past six months, significantly better than the broader Zacks Computer & Technology sector, which saw an 8.3% return, and the Zacks Internet Services’ 12.1% increase.

Dropbox’s focus on enhancing its AI-driven product lineup has played a crucial role in expanding its user base. The company’s approach, which centers around using AI to consolidate cloud content into a single platform, is paying off.

DBX reported 18.24 million paying users at the end of the third quarter of 2024, reflecting a sequential gain of approximately 19,000 users. This total includes around 23,000 new paying users acquired through the purchase of Reclaim.

Performance Overview

Image Source: Zacks Investment Research

Dropbox’s collaboration tools have been instrumental in attracting business users.

Strength in Innovation and Partnerships

DBX stands out in the $12 billion content sharing and collaboration market, as reported by IDC. It serves over 700 million registered users with its File Sync and Share offerings, surpassing competitors like Apple (AAPL) and Box (BOX).

According to IDC’s May 2024 analysis, Dropbox holds a 20.9% market share, trailing only Microsoft MSFT, which dominates with 29.4%. Google follows with 16.4%, while Box and Apple hold 8.8% and 8.6% market shares, respectively.

Dropbox benefits from a strong portfolio of innovative products and collaborations with major firms including Google, Slack, Adobe, Atlassian, Zoom, Microsoft, Salesforce, and NVIDIA.

Noteworthy among its offerings is Dropbox Dash, which facilitates users in retrieving information quickly from multiple sources like Microsoft Outlook and Google Workspace. Enhanced functionality in Dash allows for keyword and semantic searches, yielding more relevant results.

The introduction of Dropbox Dash for business users in October is expected to attract more clients.

The platform has also added new security and organizational features, along with real-time co-authoring integrations with Microsoft 365, expanding its appeal.

Dropbox has recently improved its DocSend and Replay services, enabling advanced sharing options and seamless integration with industry-standard tools.

A collaboration with NVIDIA further augments Dropbox’s AI capabilities, enhancing search precision and simplifying workflow, thus solidifying its competitive edge.

Positive Outlook for Dropbox

DBX has issued optimistic projections for 2024, anticipating improvements in both gross and operating margins despite a tighter revenue forecast.

Expected revenues are set between $2.542 billion and $2.545 billion, slightly adjusting from prior guidance of $2.540-$2.550 billion. On a constant currency basis, anticipated revenue ranges from $2.538 billion to $2.541 billion.

The company predicts a gross margin of 84%, an increase from the previous guidance of 83-83.5%. Notably, extending the lifespan of its servers from four to five years is expected to enhance gross profit by $30 million.

A non-GAAP operating margin of approximately 36% is projected, up from the earlier estimate of 33.5-34%. This improvement is attributed to cost-saving measures from workforce reductions.

The Zacks Consensus Estimate for 2024 revenues is $2.54 billion, reflecting a year-over-year growth of 1.66%. Meanwhile, the earnings consensus stands at $2.39 per share, marking a 7.7% increase over the past two months and representing a 20.71% rise compared to 2023.

Dropbox Price and Consensus

Dropbox, Inc. price-consensus-chart | Dropbox, Inc. Quote

Looking ahead, the gross margin is anticipated to be between 83-83.5% for the year, while the non-GAAP operating margin is expected between 32.5-33%.

For 2024, Dropbox forecasts free cash flow between $860 million and $875 million, driven by strong liquidity that supports shareholder initiatives. Currently, the company has $519 million left under its share repurchase program.

For 2025, DBX expects a non-GAAP operating margin increase of about 150 basis points, alongside flat revenue growth in constant currency and free cash flow projected to exceed $950 million.

Why Investors Should Consider Dropbox

Despite its premium valuation, Dropbox is regarded as a smart investment, supported by a Value Score of C.

Its forward 12-month Price/Earnings ratio of 11.22X eclipses the sector average of 27.74X.

Price/Earnings (F12M)

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The recent strength of DBX shares, which are trading above both the 50-day and 200-day moving averages, signals a bullish outlook.

Overall, Dropbox’s innovative approach and robust partnerships justify its strong market position and premium rating.

Currently, Dropbox holds a Zacks Rank of #1 (Strong Buy) and a Growth Score of B, indicating a promising investment opportunity according to Zacks’ proprietary evaluation criteria.

Zacks Naming Top 10 Stocks for 2025

Curious about Zacks’ top picks for 2025? The firm’s track record indicates that these selections could perform exceptionally well.

Since 2012, when Sheraz Mian took charge of the portfolio, the Zacks Top 10 Stocks have returned +2,112.6%, vastly outpacing the S&P 500’s +475.6%. Sheraz is currently reviewing 4,400 companies to pinpoint the top 10 stocks to buy and hold in the upcoming year. Don’t miss the chance to access these selections on January 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Box, Inc. (BOX) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.