Eversource Energy Prepares for Earnings Report Amid Mixed Analyst Expectations

Springfield, Massachusetts-based Eversource Energy (ES), a leading public utility holding company, is involved in energy delivery across various segments. With a market cap of $22.9 billion, its operations include Electric Distribution, Electric Transmission, Natural Gas Distribution, and Water Distribution. The company is set to announce its Q3 earnings on Monday, Nov. 4.

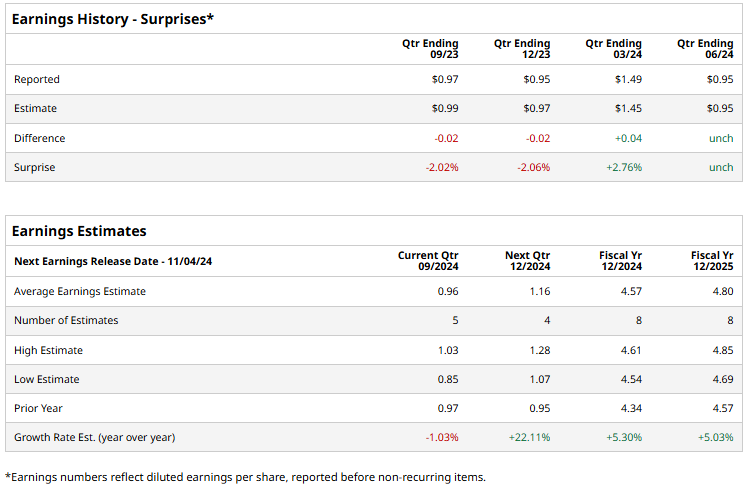

Analysts Predict a Slight Dip in Earnings

Before the earnings release, analysts are forecasting Eversource Energy to report a profit of $0.96 per share. This represents a 1% decrease from the $0.97 per share reported in the same quarter last year. Over the past four quarters, Eversource has either met or exceeded Wall Street’s adjusted EPS expectations twice, while falling short on two other occasions. In the last quarter, its adjusted EPS fell 5% year-over-year to $0.95, which was aligned with analyst projections.

Future Earnings Outlook Looks Positive

Looking ahead to fiscal 2024, analysts anticipate that Eversource Energy will achieve an adjusted EPS of $4.57, a growth of 5.3% from $4.34 in fiscal 2023. For fiscal 2025, the adjusted EPS is projected to rise again, reaching $4.80, marking a growth of 5% year-over-year.

Year-to-Date Performance Trails Behind Competitors

As of now, ES stock has increased by 5.3% year-to-date, falling significantly behind the S&P 500 Index, which has gained 22.5%, and the Utilities Select Sector SPDR Fund (XLU), which has seen returns of 28.7% over the same period.

Mixed Results in Recent Quarter

After releasing its Q2 earnings on July 31, shares of ES rose 1.8%. The company reported a significant jump in net income to shareholders, surging from $15.4 million in the previous year to $335.3 million. This spike, however, was influenced by a $401 million impairment cost related to Eversource’s Offshore Wind Investment incurred in the prior year, creating a notable base effect. Operating revenues fell 3.6% to $2.5 billion, missing Wall Street expectations.

Despite a 7.5% rise in operating income to $602.5 million—attributed to a 47.7% drop in amortization—Eversource’s adjusted EPS of $0.95 met analyst expectations, providing some reassurance to investors.

Analyst Sentiment on Eversource Stock

The overall sentiment on ES stock remains moderately optimistic, with a “Moderate Buy” rating from analysts. Out of 18 analysts, eight recommend a “Strong Buy,” while 10 suggest a “Hold.” The average price target stands at $72.43, indicating a potential upside of 11.4% from the current stock price.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.