Eli Lilly Poised for Growth: Key Trial Results on the Horizon

Eli Lilly (NYSE: LLY) may seem like a high-priced stock right now, trading at nearly 90 times its trailing earnings. With a market capitalization of $720 billion, it holds the title of the most valuable healthcare stock globally.

Recent fluctuations in its stock price might suggest a peak, but a significant upcoming catalyst could propel the company to new heights by 2025. Investors should monitor this closely, as it may lift stock values to record levels.

Important Trial Data Expected in April

Eli Lilly is recognized for its contributions to diabetes management and weight loss solutions. Its product, Tirzepatide, generates billions in revenue. While its existing injectable medications, Mounjaro and Zepbound, are already approved, investors are eager to see if the company can introduce an oral GLP-1 weight loss pill soon.

By April 2025, Eli Lilly plans to release data from a late-stage trial on orforglipron, a promising oral GLP-1 medication. In previous phase 2 trials, obese and overweight adults using this once-daily pill lost as much as 14.7% of their body weight in just 36 weeks. Awaiting phase 3 trial results could lead to potential FDA approval if outcomes remain positive and side effects are minimal.

Investors typically buy stocks ahead of official approvals, so strong trial results could result in a substantial rise in Eli Lilly’s share price.

Impressive Sales and Profits

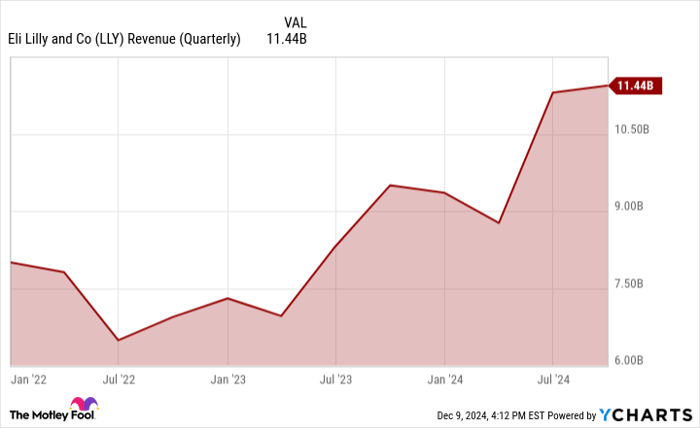

Eli Lilly boasts a robust product lineup, with Mounjaro and Zepbound at the forefront, which has significantly boosted sales in recent quarters. Encouragingly, these products are still in their early growth phases.

LLY Revenue (Quarterly) data by YCharts

There’s potential for these drugs to gain additional approval for various indications, expanding their market reach. For instance, Zepbound may soon be cleared as a treatment for sleep apnea, showcasing its effectiveness in trials.

As research develops, these medications could secure approvals for more uses, further increasing revenue potential. Mounjaro and Zepbound accounted for nearly $4.4 billion in sales for the quarter ending September 30, representing 38% of the company’s total earnings.

If Eli Lilly can add another weight loss drug to its arsenal, it could alleviate concerns over its current high valuation. The highly lucrative obesity drug market is projected by some analysts to reach $200 billion by 2031.

Future Growth Potential for Eli Lilly Stock

While Eli Lilly shares have decreased recently, long-term investors may find it a worthy addition to their portfolios. Although its current valuation might appear steep, it could prove reasonable when viewed from a long-term perspective. The stock has a forward price-to-earnings ratio of 37, based on analysts’ forecasts for next year’s earnings. Should Eli Lilly lead the substantial anti-obesity market, it may be considered a bargain in the coming years.

The stock stands in a prime position to become the first healthcare company to reach a market valuation of $1 trillion. With strong performance expected next year and great potential for future growth, Eli Lilly may be an excellent buy well into the next decade.

Should You Invest $1,000 in Eli Lilly Now?

Before investing in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors currently, and Eli Lilly was not among them. These ten selected stocks could yield substantial returns in the years ahead.

Reflect on the past; for example, when Nvidia made this list on April 15, 2005, if you had invested $1,000 at that time, it would be worth $853,765* today!

Stock Advisor offers investors a clear plan for success, including portfolio-building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500 returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.