Eli Lilly Faces Sharp Decline: Is This the Moment to Invest?

Stock Performance in Freefall

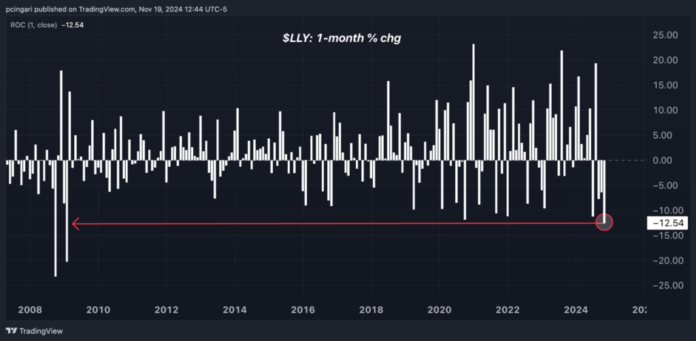

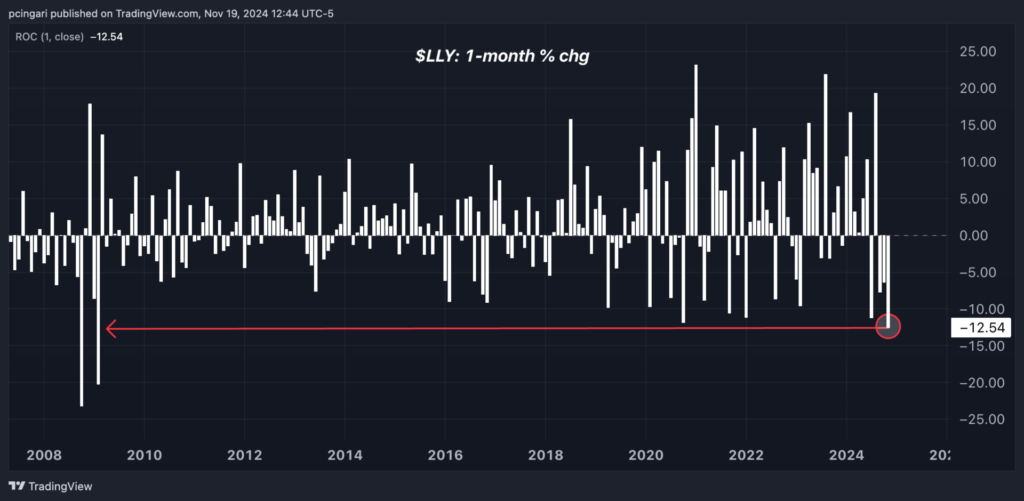

Eli Lilly & Co. LLY has experienced a significant drop of 12.5% so far in November, marking its steepest monthly fall since February 2009, when shares plummeted by 20.2%.

The pharmaceutical leader, ranked 11th in market capitalization on the S&P 500 and first among healthcare firms, is grappling with a lackluster earnings report for the third quarter and a cut in its revenue forecasts.

Investors have raised concerns about the immediate performance of Lilly’s key medications, Mounjaro and Zepbound, both of which failed to hit revenue targets, contributing to a wave of uncertainty in the market.

As the stock price falters, traders find themselves wrestling with a vital question: could this downturn provide a chance to “buy the dip” in a well-established and profitable company that has a strong foothold in healthcare?

Causation Behind the Decline

The decline was initiated by Eli Lilly’s third-quarter earnings report released on October 30. Although the company had previously benefitted from the success of its diabetes and obesity treatments, Mounjaro and Zepbound underperformed this quarter, missing revenue expectations by 14% and 26%, respectively.

Alec W. Stranahan, an analyst at Bank of America, noted, “The focus this quarter was again on Mounjaro and Zepbound, which missed revenue expectations by a wide margin.”

In light of these shortcomings, Eli Lilly revised its full-year revenue guidance downward. The new projected figures are between $45.4 billion and $46 billion, a reduction from the previous range of $45.4 billion to $46.6 billion.

Management attributed the weak results to temporary “inventory dynamics,” aiming to reassure investors that demand for its leading medications remains strong.

Additionally, the company mentioned its ongoing direct-to-consumer promotional campaigns, which began recently and are projected to help boost sales in the fourth quarter and beyond into 2025.

Looking Ahead: Analyst Perspectives

Despite the disappointing quarter, Bank of America remains optimistic about Eli Lilly’s future. Stranahan maintained a “Buy” rating on the stock with a price target of $1,100, suggesting a 55% increase from current prices.

Contrarily, Goldman Sachs has adopted a more cautious view, keeping a “Neutral” rating and setting a price target of $890, which indicates a potential 24% upside from the stock’s current valuation.

Chris Shibutani, M.D., referred to the third quarter as a “challenging update,” highlighting a $1 billion shortfall in tirzepatide revenues that raised eyebrows among analysts. Concerns linger regarding the company’s ability to meet its updated revenue guidance for the fourth quarter and 2025.

The analyst stressed the importance of successful execution across various operational fronts, stating, “These factors need to cooperate for LLY to deliver.”

Historical Context of Stock Returns

Historically, sharp sell-offs have been uncommon for Eli Lilly, occurring only four times in the past 15 years where the stock fell more than 10% in one month. Interestingly, the data suggests that the company has often bounced back robustly after such declines.

Here’s a look at how the stock performed following previous monthly losses:

| Month | LLY Monthly Loss (%) | LLY 1-Month Forward (%) | LLY 3-Month Forward (%) |

|---|---|---|---|

| October 2020 | -11.9% | +11.6% | +59.5% |

| September 2021 | -10.6% | +10.2% | +19.8% |

| January 2022 | -11.2% | +14.6% | +28.4% |

| July 2024 | -11.2% | +24.1% | +2.3% |

While past performance does not guarantee future outcomes, Eli Lilly’s stock typically shows resilience after major sell-offs, with rebounds varying from 10.2% to 24.1% one month later and a significant average gain over three months.

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs