Market Face-off: Eli Lilly vs. Novo Nordisk in the Obesity Drug Arena

As New Year’s resolutions often focus on weight loss, stocks for Eli Lilly LLY and Novo Nordisk NVO are drawing attention from investors.

Being major players in the growing market for injectable obesity treatments, investors are curious about which pharmaceutical company presents a better investment opportunity right now.

Introducing Zepbound and Wegovy

Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy are both once-weekly injectables aimed at long-term weight management. While Zepbound received approval in November 2023, Wegovy has been available since June 2021 and both have significantly boosted revenues for their respective companies.

Zepbound has yielded better results, as patients lost an average of 20.2% of their body weight in a Phase IIIb trial, outperforming Wegovy by 47%.

Comparing Growth and Outlook

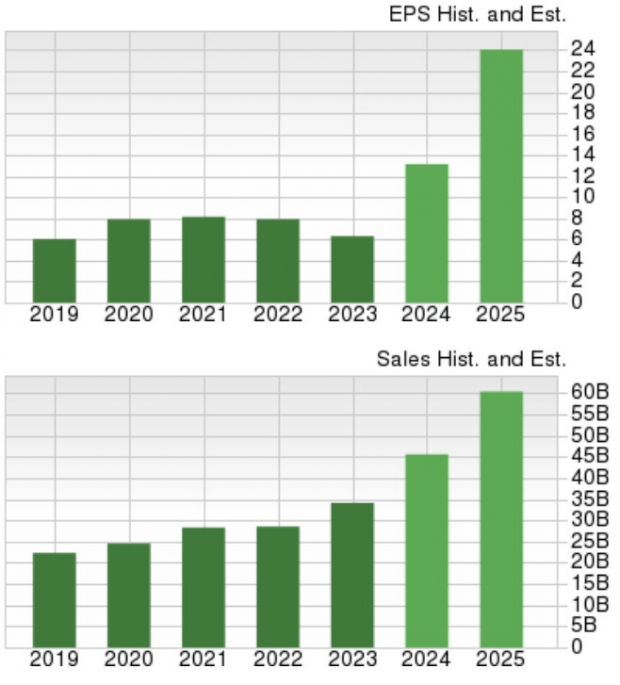

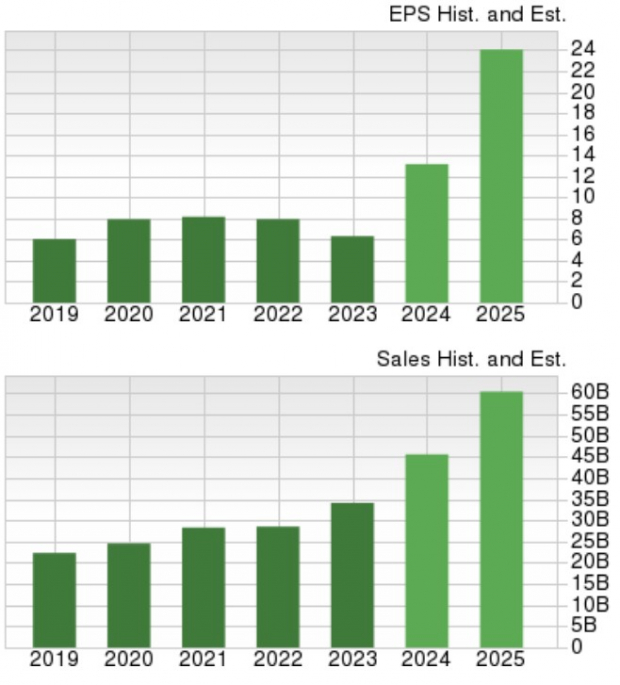

According to Zacks estimates, Eli Lilly’s total sales are projected to grow by 33% in fiscal 2024, reaching $45.44 billion compared to $34.12 billion in 2023. Additionally, FY25 sales are anticipated to increase another 33% to $60.36 billion.

Eli Lilly is expected to see its annual earnings jump by 108% in FY24 to $13.14 per share, up from $6.32 in 2023. Furthermore, FY25 EPS forecasts an increase of 83%, reaching approximately $24.04.

Image Source: Zacks Investment Research

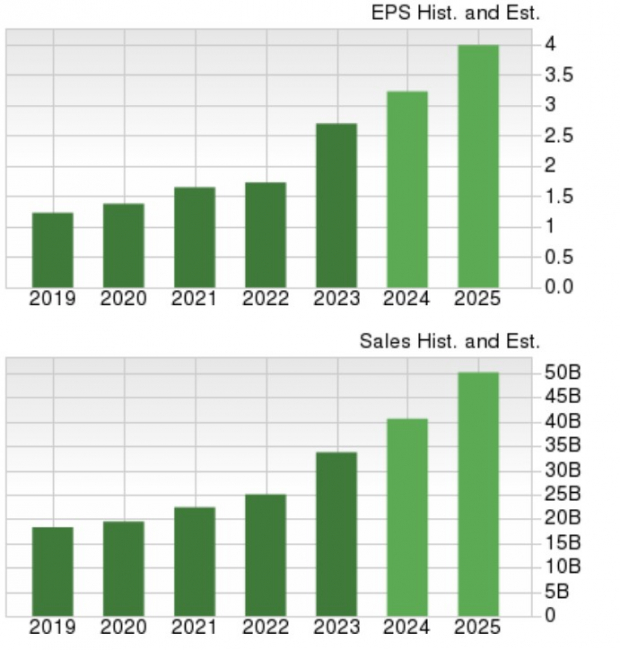

On the other hand, Novo Nordisk’s revenue is estimated to grow 18% in FY24 and an additional 23% in FY25, ultimately reaching $49.03 billion. EPS growth is also expected at 18% in FY24, with projections of a 22% rise to $3.89 per share in FY25.

Notably, EPS estimates for both FY24 and FY25 have declined for Novo Nordisk over the past 60 days.

Image Source: Zacks Investment Research

Examining Stock Performance

In the past year, Eli Lilly’s stock has increased by 25%, aligning closely with the S&P 500, while Novo Nordisk shares have dropped by 21%. The decline for Novo Nordisk has been connected to disappointing results from clinical trials for its weight-loss drug CagriSema, coupled with patent concerns.

Over three years, however, Novo Nordisk has risen by more than 60%, outperforming the broader market, although Eli Lilly has surged by an impressive 200% during the same period.

Image Source: Zacks Investment Research

Final Thoughts

Currently, Eli Lilly appears to lead in the weight loss drug market, rated with a Zacks Rank #3 (Hold). While there may be more favorable buying conditions in the future, its strong revenue and earnings growth make it appealing for long-term investors.

Conversely, Novo Nordisk’s stock is rated Zacks Rank #4 (Sell), reflecting a trend of lower earnings estimates that have clouded its previously strong outlook.

Research Chief Identifies Top Growth Pick

Among thousands of stocks, five Zacks experts have selected their favorites predicted to gain over 100% in the upcoming months. From these options, Director of Research Sheraz Mian has picked one with exceptional growth potential.

This selected company focuses on millennial and Gen Z markets, generating nearly $1 billion in revenue last quarter alone. Following a recent pullback in its stock price, now may be the ideal time to invest. While not all picks guarantee success, this stock could significantly outperform earlier Zacks recommendations like Nano-X Imaging, which soared by 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Runners-Up

Novo Nordisk A/S (NVO): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.