“`html

Stock Splits: A Pathway for Retail Investors in 2024

High-quality companies are known for offering substantial value to their shareholders over the long haul. This often results in stock prices that reach hundreds or even thousands of dollars, making it tough for smaller investors to get a foothold.

Stay Ahead of the Market! Receive Breakfast News in your inbox every trading day. Sign Up For Free »

One way for companies to address this issue is through stock splits, which increase the total number of shares while lowering the share price. For instance, a 10-for-1 stock split means a company’s share count increases tenfold, as does the share price decrease by the same factor.

This action does not alter the actual value of the company; the new share price reflects the same overall market capitalization. It simply allows smaller investors to invest more easily.

Image source: Getty Images.

Major Stock Splits in 2024

The S&P 500 (SNPINDEX: ^GSPC) is currently in a strong bull market with no slowdown in sight. Numerous high-profile companies experienced significant stock price increases in 2024 and took action through stock splits:

- Nvidia executed a 10-for-1 split on June 10, lowering its stock price from $1,200 to approximately $120.

- Chipotle completed a 50-for-1 split on June 26, reducing its price-per-share from $3,283 to just $66.

- Broadcom performed a 10-for-1 split on July 12, which cut its stock price from $1,700 to $170.

- Palo Alto Networks (NASDAQ: PANW) executed a 2-for-1 split on December 13, bringing its stock price down from $400 to $200.

As 2025 approaches, it might be an opportune moment for investors to seek new opportunities. The stocks mentioned above demonstrated excellent value creation in 2024 and carry strong momentum heading into the new calendar year.

An interesting option is Palo Alto Networks, a leader in the cybersecurity realm. With the increasing prevalence of cyber threats, the demand for its software is anticipated to rise throughout 2025. Furthermore, the company is integrating artificial intelligence (AI) across its product line, enhancing value for both customers and shareholders alike.

Thus, investing in Palo Alto stock could be a noteworthy goal for your New Year’s resolutions.

Innovating Cybersecurity with AI

Palo Alto has developed three main cybersecurity platforms: cloud security, network security, and security operations. Each platform incorporates a variety of individual products, and the company is focused on integrating AI into them to help clients identify threats more swiftly and precisely.

Typically, large organizations deploy security operation centers filled with analysts to tackle cyber incidents. However, Palo Alto argues that many of these centers depend too heavily on human processes that struggle with the high frequency of attacks. To combat this, it introduced Cortex XSIAM, an AI-driven security operations center platform featuring over 400 algorithms designed to enhance automation.

Customers using XSIAM report impressive results, with an oil and gas company experiencing a 75% reduction in cybersecurity incidents needing human intervention, and a healthcare provider increasing automated issue resolution from 10% to 90%.

Nevertheless, organizations face novel risks when incorporating AI into operations. Many utilize third-party AI models, such as those offered by OpenAI and Anthropic, to develop software, inadvertently creating new vulnerabilities. Palo Alto is addressing these challenges with its Secure AI by Design product line, which could be a considerable growth driver as AI adoption continues to expand.

Accelerating Revenue Growth at Palo Alto

The cybersecurity sector was once highly fragmented, with providers specializing in individual products, forcing customers to mix and match their security tools. Palo Alto has transformed this landscape by serving as a comprehensive provider through its three platforms.

The lifetime value of customers engaging with all three of Palo Alto’s platforms is reportedly 40 times greater than those using just one, reinforcing the effectiveness of this strategy. The company recently emphasized its “platformization” initiative by offering fee-free trial periods to entice clients from competitors. While this approach temporarily slowed revenue growth, it’s beginning to yield positive results.

In its fiscal 2025 first quarter ending October 31, Palo Alto reported total revenues of $2.1 billion, marking a 14% year-over-year increase and reflecting an acceleration from the 12% growth observed in fiscal 2024 Q4.

Additionally, the company reported $4.5 billion in annual recurring revenue (ARR) from its next-generation security (NGS) products at the end of Q1, representing a 40% increase from the previous year. Palo Alto defines NGS products as those stemming from its significant investments in innovation, including AI solutions within the Cortex platform like XSIAM.

Notably, over half of the customers contributing to NGS revenue are “platformed,” highlighting the potential success of the platformization strategy.

Why Consider Palo Alto Stock in 2025

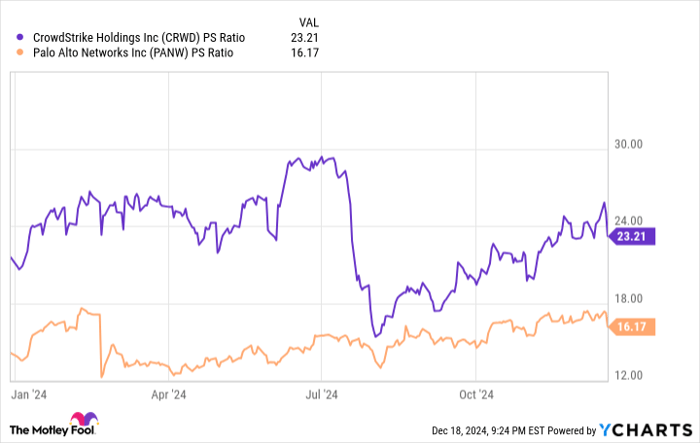

Palo Alto’s stock price rose by 30% in 2024, approaching a record high. Yet, it maintains a price-to-sales (P/S) ratio of 16.1, which is lower than its principal competitor, CrowdStrike (NASDAQ: CRWD).

CRWD PS Ratio data by YCharts

Although CrowdStrike may justifiably hold a higher premium with its 29% revenue growth in the last quarter compared to Palo Alto’s 14%, Palo Alto serves a larger market. Its NGS ARR of $4.5 billion exceeds CrowdStrike’s total ARR of $4 billion. Additionally, with NGS revenue growing by 40%, Palo Alto’s P/S ratio could warrant an upgrade.

Palo Alto currently boasts 1,100 platformization customers, with ambitions to expand to 3,500 by fiscal 2030, projecting an NGS ARR of $15 billion. This growth could lead to a forward P/S ratio of 8.2, implying that the stock price would need to nearly double in the next five years just to keep pace with its present P/S ratio of 16.1.

Clearly, demand for innovative solutions like Secure…

“`

AI Adoption: Rising Opportunities in Cybersecurity and Investing

According to a recent study by McKinsey and Company, a significant shift is occurring in business operations. Currently, 72% of organizations have integrated AI into at least one aspect of their operations. However, a mere 8% are utilizing this technology across five or more functions. This illustrates that AI adoption is still in its infancy. As firms expand AI use, the demand for advanced cybersecurity tools to safeguard sensitive information is set to grow.

The Future Looks Bright for Palo Alto Networks

Palo Alto Networks is gearing up to introduce new products aimed at meeting the demands of the AI era throughout 2025. Given the company’s valuation in comparison to its major competitor, investing in its stock could be a smart move for the upcoming year. A recent stock split has also made it more accessible to smaller investors.

Is Now the Time to Invest $1,000 in Palo Alto Networks?

Before making a move on Palo Alto Networks stock, it’s essential to weigh the options. The Motley Fool Stock Advisor analysts have identified what they consider the 10 best stocks for investment right now—Palo Alto Networks is not among them. The selected stocks have strong potential for high returns in the near future.

Reflecting on past recommendations can be insightful; for example, when Nvidia was highlighted on April 15, 2005, an investment of $1,000 would have grown to a remarkable $790,028 today!*

The Stock Advisor service gives investors a practical guide to developing a successful portfolio, complete with regular analyst updates and two new stock suggestions monthly. Since 2002, this service has more than quadrupled the returns of the S&P 500.*

Explore the 10 stock picks here »

*Stock Advisor returns as of December 16, 2024

Anthony Di Pizio does not hold positions in any of the stocks discussed. The Motley Fool has investments in and recommends Chipotle Mexican Grill, CrowdStrike, and Nvidia, while also endorsing Broadcom and Palo Alto Networks. The Motley Fool has a disclosure policy.

The opinions expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.