Embraer’s Q3 Earnings Soar Beyond Expectations, Driven by Diverse Revenue Streams

Embraer S.A. (ERJ) reported its third-quarter 2024 adjusted earnings at $1.20 per American Depository Share (ADS), significantly exceeding the Zacks Consensus Estimate of 28 cents by an impressive 328.6%. This represents a remarkable 566.7% increase from last year’s third quarter, which recorded earnings of 18 cents.

Check the Zacks Earnings Calendar for timely updates on market trends.

For the quarter, GAAP earnings reached 97 cents per ADS, a jump from 33 cents per ADS in the same period last year.

Reviewing Embraer’s Revenue Performance

Embraer’s total revenues for the quarter were $1.69 billion, up 31.9% year over year. The increase was primarily fueled by growth in its Executive Aviation, Defense and Security, Commercial Aviation, and Services & Support segments. The revenue figure also surpassed the Zacks Consensus Estimate by 4.1%.

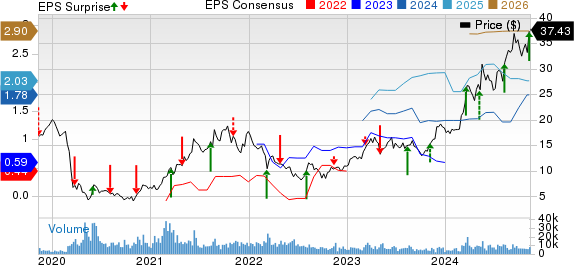

Embraer’s Stock Performance: Price, Consensus, and EPS Surprise

Embraer-Empresa Brasileira de Aeronautica price-consensus-eps-surprise-chart | Embraer-Empresa Brasileira de Aeronautica Quote

Order and Delivery Details for ERJ

During the quarter, Embraer delivered 59 jets, consisting of 16 commercial and 41 executive jets (22 light and 19 midsize). This stands in contrast to the previous year, when 15 commercial and 28 executive jets (19 light and 9 midsize) were delivered.

The company reported a backlog of $22.7 billion at the end of the quarter, remaining steady compared to the prior year.

Segment Breakdown

Executive Aviation: Revenues reached $561.5 million, a 65% increase from the previous year, primarily due to higher aircraft deliveries and an improved product mix.

Defense & Security: This segment earned $219.6 million, also up 65% year-over-year, supported by increased orders for the Super Tucano and C-390 jets.

Commercial Aviation: Revenues grew to $473.3 million, up 11% from a year earlier, driven by increased aircraft deliveries.

Services & Support: This segment generated $425.5 million in revenue, reflecting a 16% rise year-over-year due to heightened fleet utilization as well as ramped-up Maintenance, Repairs, and Operations services.

Others: This segment includes Agriculture Aviation and the cyber division, Tempest. It reported revenues of $12.5 million, a decline of 40% year-over-year, largely due to reduced volumes and unfavorable foreign exchange rates.

Operational Insights for ERJ

Embraer’s operating income rose to $285.2 million, compared to $84.4 million in the same quarter last year.

The company posted an adjusted EBITDA of $356.6 million, representing a solid 138.8% increase from the previous year’s figure.

Current Financial Overview for ERJ

As of September 30, 2024, Embraer’s cash and cash equivalents stood at $0.83 billion, down from $1.63 billion at the end of 2023.

The adjusted free cash flow (excluding Eve) was $241.1 million, up from $44 million in the same quarter last year.

Cash outflow from operating activities for the recent quarter was $176 million, slightly better than the $186.2 million recorded a year earlier.

Updated Guidance for 2024

Embraer has adjusted its guidance for 2024, now projecting deliveries of 70-73 commercial jets, a reduction from the previous forecast of 72-80. However, the expected range for Executive Aviation deliveries remains at 125-135 jets.

For revenue, Embraer anticipates generating between $6.0 and $6.4 billion, with the Zacks Consensus Estimate at $6.28 billion, sitting above the midpoint of the company’s range.

Additionally, adjusted EBIT margin is now expected to be between 9% and 10%, an increase from the prior estimate of 6.5% to 7.5%. Adjusted free cash flow is projected to exceed $300 million, compared to the earlier guidance of $220 million or more.

Embraer’s Zacks Ranking

Currently, Embraer holds a Zacks Rank #3 (Hold). For additional insights, see the comprehensive list of Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings in Defense Sector

General Dynamics Corporation (GD) reported a third-quarter EPS of $3.35, which fell short of the Zacks Consensus Estimate of $3.54 by 5.4%, but marked an increase from $3.04 in the year-ago quarter. Revenues totaled $11.67 billion, slightly missing the consensus of $11.72 billion while improving by 10.4% year-over-year.

RTX Corporation (RTX) posted adjusted EPS of $1.45 for Q3 2024, surpassing the Zacks Consensus Estimate of $1.33 by 9%, and improving 16% from last year’s $1.25. Sales reached $20.09 billion, exceeding expectations of $19.91 billion by 0.9% and showing a remarkable 49.2% increase from $13.46 billion in Q3 2023.

Lockheed Martin Corporation (LMT) reported adjusted earnings of $6.84 per share, beating the Zacks Consensus Estimate of $6.47 by 5.7% and showing a modest rise from $6.77 a year earlier. Net sales reached $17.10 billion, falling short of the consensus of $17.28 billion by 1% but slightly increasing from the previous year’s $16.88 billion.

Free Report: Discover 5 Clean Energy Stocks Poised for Growth

Energy plays a crucial role in our economy as a multitrillion-dollar sector that has supported some of the largest companies worldwide. Cutting-edge technology is now enabling clean energy sources to challenge traditional fossil fuels. Investments are rapidly flowing into clean energy projects, ranging from solar to hydrogen fuel cells.

Emerging frontrunners in this sector could represent excellent opportunities for your investment portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks for free today.

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.