Buffett’s Investment Choices: Are Old-School Stocks Still in the Game?

On Friday, shares of Constellation Brands (STZ), known for its popular beverages like Corona and Modelo, rose over 6% in after-hours trading.

This jump followed reports that Warren Buffett had acquired a significant number of shares in the company during the fourth quarter, with more than 5.6 million shares added to his portfolio.

While Constellation Brands has established itself with recognized products, it notably lacks a focus on today’s trendiest investment sector – artificial intelligence (AI).

Some may wonder whether the Berkshire Hathaway filing also included investments in tech companies like Palantir.

Not this time.

The 13F filing did include increased stakes in other non-AI heavy firms, specifically Domino’s Pizza and Pool Corp., which stocks swimming pool supplies.

Buffett’s investment choices can be hard to dispute, given his impressive long-term returns (he also holds shares in prominent “AI” companies like Amazon). But is it time to rethink our investment strategies in the age of AI?

Indeed, we should diversify.

Global macro expert Eric Fry shed light on this in his latest issue of Investment Report, released last Friday:

AI investing can be categorized into three main groups: AI Creators, AI Appliers, and AI Survivors.

Investors should aim to include all three categories in their portfolios.

Interestingly, many investors are focusing primarily on just one or two categories.

The Allure of Technology

Retail investors are naturally drawn to AI and tech – and for good reason.

High-performing tech stocks likely hold the potential for substantial growth in the upcoming quarters and years.

However, excessive concentration in technology can lead to considerable risks.

As reported by Reuters following the recent DeepSeek-triggered downturn:

Retail investors invested one out of every three dollars into Nvidia shares right after the AI chipmaker faced a record market value loss in a single day.

Investors were also keen on companies like Tesla, Broadcom, and Apple.

Many investors snapped up tech-focused exchange-traded funds (ETFs) such as the Invesco QQQ Trust and leveraged ETFs that multiply returns from the Nasdaq 100 Index.

Unsurprisingly, headlines celebrating purchases of stocks like Pool Corp. by retail investors were nowhere to be found.

This fascination with AI is justified. Recently in the Digest feature, we highlighted Louis Navellier’s insights on AI’s Crossover Moment, where AI expands from digital realms into practical applications like self-driving vehicles, factory automation, and even creating detailed digital models of cities. If you missed Louis’ free presentation, click here to watch it for free.

His Crossover Moment stocks represent the visible AI enterprises that transition innovation from creators to practical application.

While these are essential to include, solely investing in these stocks may limit potential gains for some investors.

Recognizing the AI Survivors

Let’s return to what Eric highlighted:

“AI Survivors” are often overlooked by investors. This could lead to missed opportunities.

These companies are “future-proof,” producing tangible goods or services that are irreplaceable by AI.

Agricultural firms serve as a prime example – no amount of AI can replace the human desire for fresh produce like avocados and bananas.

Natural resources industries, such as copper, aluminum, and timber, are also likely to endure alongside the rise of AI technologies in the foreseeable future.

Diving deeper, today’s AI Survivor can potentially evolve into tomorrow’s AI Applier.

For instance, Eric includes mining giant Freeport-McMoRan (FCX) in his Investment Report portfolio. It has soared 219% since his initial recommendation.

While Freeport may appear to be an AI Survivor, it is actively integrating AI into its mining processes for enhanced efficiency, particularly in data management and operational refinement, aiming to boost copper production through insights gained from sensor data on mining equipment.

Eric also notes:

Survivors may not attract much attention, mainly because they belong to “old school” industries that seem less exciting at first glance.

Identifying an “Applier in Survivor’s clothing” could actually prove advantageous.

Opportunities Await for Visionary Investors

Investors have the chance to purchase shares of what could become “leading AI appliers” at prices reflecting outdated business models and technologies.

Eric elaborates,

As AI spreads throughout the economy, these Survivor industries may gain unexpected appeal.

This perspective changes how we view Buffett’s investments in Domino’s Pizza and Pool Corp.

In fact, upon close examination, Domino’s is already showcasing its potential as an “AI Applier.”

Some of its innovative AI applications include:

- Implementing a voice recognition system for phone orders

- Estimating wait times for orders, leading to quicker service and better customer satisfaction

- Streamlining inventory management, ingredient ordering, and employee scheduling

- Improving pizza preparation and quality control

- Enhancing customer personalization

Pool Corp. is following suit.

According to Modern Supplier:

Artificial Intelligence (AI) has become crucial to Pool Corp’s plan for optimizing sales and improving supply chain operations.

The company has embraced AI-driven forecasting tools that gauge demand patterns based on past data and market insights.

This forward-thinking strategy helps Pool Corp. balance inventory levels, thereby minimizing stock shortages and ensuring contractors receive necessary products promptly.

Perhaps Buffett is indeed a savvy technology investor.

Consider Both Traditional and Tech Stocks

While investors can continue to pursue well-known tech stocks, it’s essential to remain aware of the high valuations many currently command. The demand for AI exposure has driven prices of popular companies to significant heights.

Conversely, lesser-known firms transitioning from AI Survivors to Appliers might offer more substantial returns.

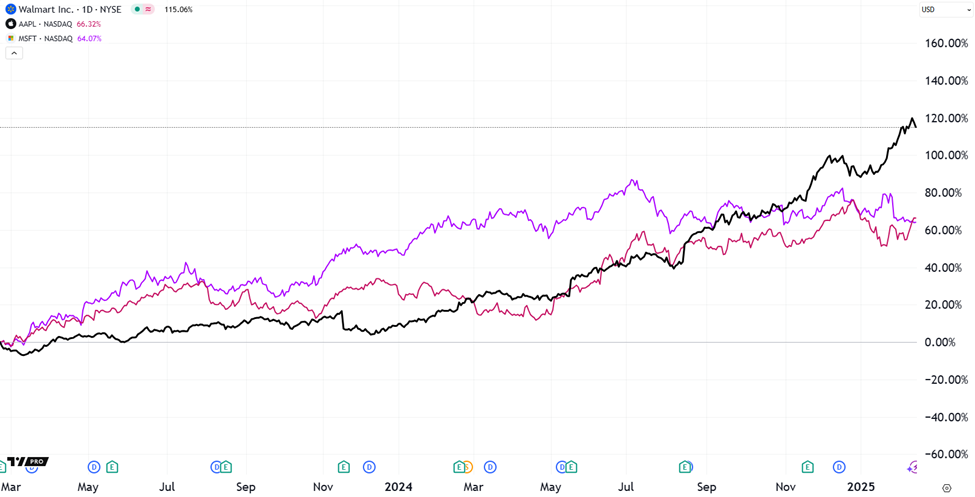

To illustrate this point, consider the past two years’ performance:

Which stock has outperformed the other: AI Survivor-turned-Applier Walmart or tech titans Microsoft and Apple?

Walmart leads by roughly two-to-one.

Walmart has gained 115%, while Microsoft and Apple each achieved about 65% returns.

Source: TradingView

(For full disclosure, I own these stocks.)

To wrap up Eric’s assertion:

Companies that can navigate AI integration will not just survive; they have the potential to flourish.

If you’d like to learn more about the Survivor and Applier stocks Eric recommends in his Investment Report, click here.

Furthermore, to watch Louis’ free presentation that explores seven of these Applier stocks (the Crossover Moment stocks), click here.

The bottom line: Don’t limit yourself to the obvious AI stocks; there are remarkable opportunities waiting to be discovered.

Have a great evening,

Jeff Remsburg