Tech Giants Brace for Regulatory Shifts as Trump Prepares for Term Two

As President Donald Trump gets ready to enter his second term, the tech sector is gearing up for substantial changes in regulations. Uncertainty looms; while some anticipate a deregulatory climate, others foresee intensified scrutiny of Big Tech. The selection of Andrew Ferguson as the chair of the Federal Trade Commission (FTC), who has pledged to end the alleged vendetta against competition and free speech, hints at a complicated regulatory landscape ahead.

Tech Companies Strengthen Ties with the Administration

Large tech firms are now actively working to build relationships with the new administration. By increasing financial contributions and engaging in outreach, they aim to influence policies on artificial intelligence (AI), energy regulation, and antitrust enforcement.

In light of a potentially stricter regulatory environment, leading companies like Alphabet GOOGL, Microsoft MSFT, Meta Platforms META, and Apple AAPL are strategizing how to navigate these challenges in 2025.

Alphabet’s Struggle with Antitrust Pressures

Alphabet – Despite being a Zacks Rank #3 (Hold) stock, Alphabet, Google’s parent company, has faced substantial regulatory hurdles under Trump. Recent actions by the United States Department of Justice include proposals to dismantle its search monopoly, considering the sale of Chrome and Android.

In response, Alphabet is proactively working with the administration, funding legal briefs opposing certain executive orders, and engaging in discussions around antitrust policies. Lobbying efforts are underway to maintain its core services, particularly its advertising business.

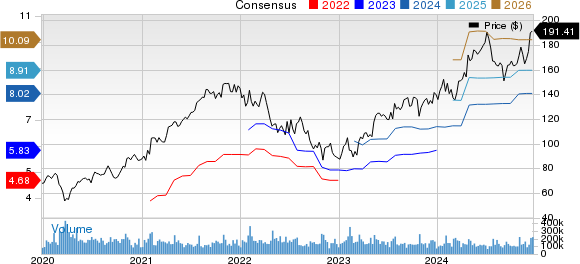

Over the past 30 days, the Zacks Consensus Estimate for Alphabet’s 2024 earnings has held steady at $8.02 per share. Meanwhile, GOOGL shares have risen 6.8% over the last six months.

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Microsoft’s Engagement Amid Scrutiny

Microsoft – Also carrying a Zacks Rank #3, Microsoft faces several regulatory challenges, particularly in antitrust and cybersecurity. The FTC has opened a thorough investigation into its business practices for potential anti-competitive behavior.

To navigate this landscape, Microsoft is lobbying the administration for AI policies that avoid costly regulations and facilitate data usage. Additionally, it is investing in nuclear energy to support the growing need for clean energy as it expands its AI data centers, demonstrating its commitment to sustainable practices.

The Zacks Consensus Estimate for Microsoft’s fiscal 2025 earnings has stabilized at $12.93 per share over the past month, though shares have decreased by 2.4% within the last six months.

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Meta Adjusts Strategies Amid Regulatory Challenges

Meta Platforms – With a Zacks Rank of #3, Meta confronts considerable regulatory issues linked to platform control and data privacy. Under the Trump administration, it has come under fire for its content moderation and market dominance practices.

In addressing these challenges, Meta is proactively adjusting its policies to prioritize free speech while tackling harmful content. It is also engaging with regulators to mitigate antitrust concerns related to its advertising strategies and potential monopoly.

The Zacks Consensus Estimate for Meta’s 2024 earnings remains unchanged at $22.68 per share, with shares increasing by 17.3% over the last six months.

Meta Platforms, Inc. Price and Consensus

Meta Platforms, Inc. price-consensus-chart | Meta Platforms, Inc. Quote

Apple’s Response to Legal Scrutiny

Apple – Another Zacks Rank #3 stock, Apple is facing scrutiny primarily concerning market influence, data privacy, and antitrust issues. Recently, a judge in New Jersey appointed several law firms to pursue a lawsuit alleging that Apple has monopolized the smartphone market, limiting consumer choices.

This lawsuit mirrors civil antitrust actions initiated by the U.S. Department of Justice against Apple, which accuse the company of violating the Sherman Act through monopolistic practices in the smartphone sector.

In light of these challenges, Apple is revising its App Store guidelines to increase flexibility and allow third-party app stores, aiming to project an image of fair competition. Engagements with regulators are ongoing to address these concerns, potentially leading to settlements that could avert harsher legal repercussions.

The Zacks Consensus Estimate for Apple’s fiscal 2025 earnings has remained intact at $7.43 per share, with shares increasing by 22.3% over the last six months.

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, five Zacks experts each have chosen their favorite to skyrocket +100% or more in the coming months. One standout recommendation is handpicked by Director of Research Sheraz Mian to have the most potential upside.

This company focuses on millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent dip makes this an ideal opportunity to invest. While not every pick is guaranteed to win, this particular one could significantly outperform past Zacks selections like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.