Tesla Soars Under Trump’s Influence: What Investors Need to Know

Optimism Greets Tesla as Trump Begins Second Term

American electric vehicle leader Tesla Inc TSLA is celebrating substantial gains over the past year, and the outlook could become even more positive as Donald Trump assumes the presidency again. Historically, stock sectors linked to Trump have seen favorable performance, with Tesla’s stock price reflecting this trend after the recent election.

On November 6, TSLA shares closed at $288.53, indicating a strong rally since the election. While Trump is known for advocating hydrocarbon energy—famously declaring that America will “drill, baby, drill” through his executive orders—he maintains a close relationship with Tesla’s CEO Elon Musk.

Such connections may create advantageous conditions for Tesla moving forward. Researcher Troy Teslike suggests Trump might keep the criteria for electric vehicle tax credits unchanged for a while, allowing buyers to purchase Teslas while benefiting from these credits.

Electrifying Trends in the Automotive Market

The rise of electric vehicles is not limited to Tesla. The 2023 International Energy Agency data shows that nearly 20% of all cars sold this year were electric, amounting to almost 14 million vehicles. A staggering 95% of these sales occurred in the Chinese, European, and U.S. markets.

A Sector-Based Investment Opportunity: The Direxion ETF

As global demand ramps up, investors might explore sector-focused exchange-traded funds (ETFs). One option is the Direxion Daily Electric and Autonomous Vehicles Bull 2X Shares EVAV. According to Direxion, this ETF aims to achieve double the performance of the Indxx US Electric and Autonomous Vehicles Index.

TSLA holds the largest share of the index at 11.26%, closely trailed by Cerence Inc CRNC, which specializes in software for vehicle AI assistants. Rivian Automotive RIVN, Tesla’s American competitor, also ranks among the top three, with EVAV incorporating exposure to several Chinese EV manufacturers.

One major appeal of investing in EVAV is the convenience it offers. This ETF provides access to numerous electric vehicle companies in one fund, while its 2X leverage opens the door to potentially substantial returns without requiring complex investment strategies like options trading.

Understanding the Risks of Leveraged ETFs

Potential investors should be aware of the risks associated with leveraged ETFs. Direxion emphasizes that EVAV is not designed to deliver double the benchmark return over extended periods. Holding EVAV for more than a single trading session may lead to value decay due to daily compounding effects.

Current Status of the EVAV ETF

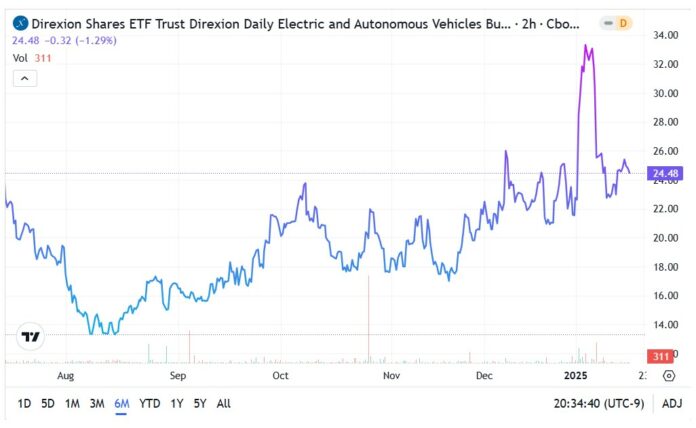

Although the EVAV ETF presents a trailing 52-week loss of over 11%, its performance since late summer last year indicates a steady upward trend.

- Technically, EVAV has been navigating through an established ascending trend channel, supported by the 50-day moving average.

- Despite bear market pressures in November, bullish momentum quickly returned, boosting confidence among investors.

- The next steps for EVAV include firmly establishing a baseline at $25 and making progress beyond the critical $30 mark.

Featured image by Paul Brennan on Pixabay.

Market News and Data brought to you by Benzinga APIs