This article was coproduced with Wolf Report.

Just weeks back, we touted Enbridge Inc. with the article title, Enbridge: We’re Backing Up The Sleigh:

“…as long as it skirts around this $35/share level, the company is a superb investment here.”

When Enbridge Inc. (NYSE:ENB) experienced a dip and a long-dormant alert re-awakened, we swiftly took action.

Fast forward a month, and we are more than satisfied with our decision, as the shares purchased at less than $32/share have now surged above $36, underscoring the company’s robust outlook.

We invest in Enbridge in multiple ways – through common shares and debt/prefs, based on the allure and opportunities presented by each.

With Enbridge, we have pursued both routes, adding Canadian prefs when appealing and now also acquiring common shares.

We won’t divest from these shares unless the company’s NYSE ticker exceeds $50/share, aligning with market conditions, and in this article, we’ll reiterate why.

The Case for Enbridge in 2024 – a Top Long-Term Energy Play

The rationale for contemplating further investment in Enbridge rests on its compelling fundamentals.

With a market capitalization exceeding $70B and a BBB+ credit rating, despite climate and ESG risks, the company appears well-insulated against significant downside.

Enbridge’s core operations revolve around pipelines and energy transportation, encompassing commodities like crude oil, natural gas, and various other liquids, supplemented by a robust portfolio of renewable ventures.

It’s expected that a company of this nature will experience volatility due to energy pricing trends and sentiments toward its operations.

Our recent foray into Enbridge, whether via prefs or common shares, was driven by our exacting return requirements, aiming for the strong potential of outperforming the market even in adverse scenarios.

Achieving such an upside is rare indeed.

The contemporary Enbridge is an impressive entity.

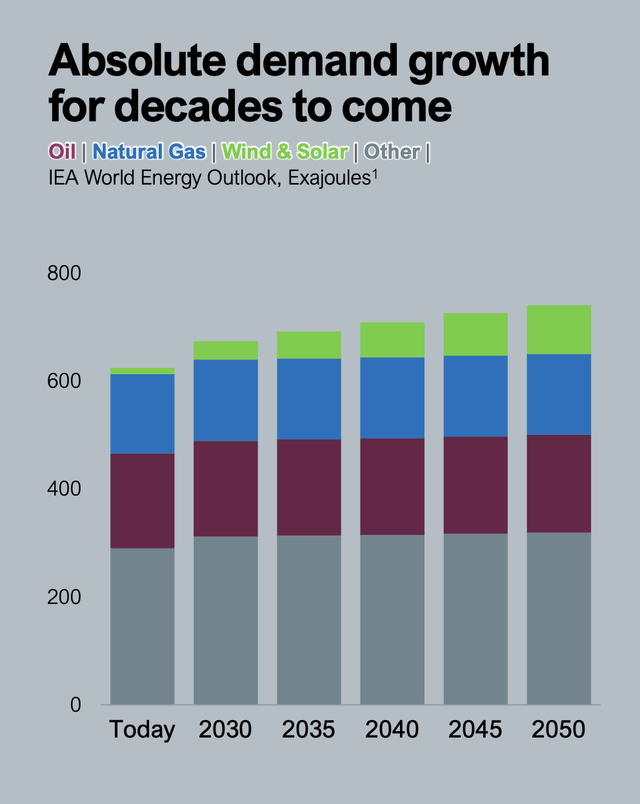

Broadly, the company’s standing is entrenched in the trajectory of escalating global energy demand, a well-documented and rational phenomenon.

At the right valuation, this premise is the principal driver behind our belief in the company’s potential for robust returns, undergirded by the undeniable fact that energy demand is poised for an unequivocal ascent.

It’s improbable to find dissenting viewpoints among analysts regarding this narrative.

The recent merger with Spectra has notably amplified Enbridge’s backlog and project assets, driving a material rebalance in its operations, culminating in a business mix comprising 49% liquids, 47% gas, and a burgeoning 4% renewable arm.

The integration has also unfurled geographical diversification, with a renewable target of 8-10% of the company’s operations on the horizon.

Enbridge furnishes a plethora of intrinsic rationales for its investment appeal, possessing the mantle of North America’s premier pipeline franchise and the largest natural gas utility, armed with the prospect of leveraging proceeds to fortify its expanding renewable and carbon capture portfolio, affording shareholders even loftier rewards.

A frequent pitfall for investors lies in ascribing an unduly high value to what the company offers or executes, relative to the broader market or its potential debt investments.

For those who purchased during the zenith in 2014-2015, the annualized returns, dividends notwithstanding, amount to less than 1.5%. Minus dividends, it nosedives to a negative 4% annually.

This historical precedent underscores a crucial lesson on valuation and the opportune junctures for investment.

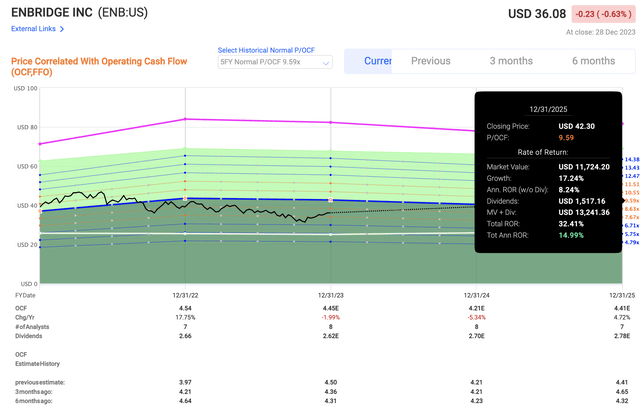

Historically, Enbridge has oscillated between 6-8x P/FFO at its troughs, with peaks of 9.5-11.5x P/FFO/OCF, affording an easily delineated and narrow trading range where a discerning, valuation-driven investor might discern the company’s appeal and its 7.6%+ yield as an astute investment.

More on this valuation will follow, as the recent recovery does not imply that the opportunity in this stock has elapsed.

In actuality, the current juncture presents a compelling opportunity to enter Enbridge’s orbit before valuations become exorbitant.

The company’s overarching potential lies in substantial growth not only within its legacy networks and business lines but also via consequential renewable and other projects in Europe.

Enbridge anticipates substantial expansion from its renewable portfolio in 2024, actively procuring additional assets, exemplified by seven operational landfill-to-RNG facilities across North America, buttressing the company’s environmentally conscious profile and generating immediately accretive DCF.

This should undoubtedly strike a harmonious chord with investors. After all, the

Aligning Enbridge Shares with Realistic Valuations for Profits

Headwinds and downside risk are limited to increased cost levels and mainline tolls, but as we noted in the previous article, the company remains confident in its guidance.

The main problem we see the market and analysts generally having with Enbridge is that they estimate the company at a level that is too high.

Enbridge is a great company, but due to the many alternative investments available in energy, and in Enbridge’s energy in the form of debt investments, we believe that you need to invest at the right valuation here in order to make a rate of return that pleases, while also maintaining a realistic stance to the potential downward risk.

Enbridge does not go below a certain level, but if you, as some suggest, buy the company well over $39 for the native ticker, then you might see some poor returns.

Let’s clarify some of the risks that we believe are pushing the company down.

Challenges and Opportunities for Enbridge

The company’s size and very legacy-heavy mix of business lines make it a natural target for environmental interest groups and political pushes.

We’re seeing this in the current challenges to the 3 and 5 line, as well as the stake in the Dakota Access Pipeline.

None of these projects are, as we see them, inherently bad, nor is the company in any fundamental risks from these pushes, but they represent both the potential for underperformance if you buy too high and the potential for outperformance if you can buy cheap.

Additionally, and to the same points, the company’s infrastructure still carries a fairly large portion of the oil sand mix from Canada. This is one of the least ESG-friendly sources of crude and is another chip on many ESG investor’s shoulders.

Some analysts argue that the company has yet to prove its renewable business line. We believe that the company is currently doing this, and while there is a risk to these investments, we view them as more limited than other colleagues.

We also have upsides worth considering that are not spoken of enough.

With the cancellation of the Keystone XL project, the company is in a prime position to capture new project expansions due to increased demand from players who were counting on Keystone.

The dividend that we’re seeing for Enbridge is also secure and can conceivably grow at least 3% p.a for at least the next few years. This fights off inflation, and makes the 7.6%+ yield “solid.” That means it’s a very solid play for income investors also.

However, let’s clarify the problem with the valuation.

Realistic Valuation for Enbridge Shares

As we said, the issue with Enbridge is that most analysts vastly overestimate the company’s target share price.

So let’s make this very clear.

Enbridge above $37/share for the NYSE ticker is not something we would buy under any current circumstances.

We made it clear that under $35/share, the company has a great upside.

Under $38/share, the company still has a very strong upside here, and you can still get your 15% under relatively conservative estimates and assumptions.

Below $32/share is where you want to buy, but we don’t foresee us going back to that all that soon.

The reason that you want to get in below $37/share, is that this is the point where the 15% annualized upside to a conservative mid-point 10-year P/FFO of 10x disappears.

Once you go above $37, you’re locking in the potential for a sub-standard market return.

The lower you buy here, the lower you need Enbridge to perform.

At current cost basis, we only need Enbridge to manage a 7.5-8x P/FFO for the next few years to lock in my 15%+ annualized RoR. Guess how likely we consider this to be?

That doesn’t mean that today’s buy-in is bad.

As we’re writing this, the market shows the company trading at around $36, which means the upside to 9.6x P/FFO is like this.

We always invest in the native, and due to FX and some shifted estimates, the Canadian ticker has a slightly better upside above 15%.

Very few analysts have the company at a “fair value” target of $37/share.

We’re definitely in the minority here.

Looking at the native ticker and translating CAD to USD, most analysts give the company somewhere along a $39-$42/share target, with some going as high as $45/share.

If the first number in the NYSE share price becomes a “4,” you can bet that we’re going to be looking at what we can get from alternative investments to Enbridge.

But at $36/share, we’re telling you that it might be your last chance to annualize 15% in this company for the foreseeable future if it keeps climbing – and selling is something we won’t do until we hit that $40/share or close to it.

So, as usual, this is about valuation.

Thesis for Investors in 2023

- Enbridge is a class-leading investment in the energy sector, with a solid overall upside at the right price. The right price, as we see it, is below $35/share to really ensure that upside here, and not going higher than $37/share. And as we’re writing this article, the company is trading at this, or below this level.

- We believe Enbridge represents one of the safest income investments in the entire NA energy sector, based on how the company has been developing its portfolio for the past decade. However, given the slew of investment options including prefs, you want to be sure to pick the “right” avenue to enter this investment.

- At under or around $36/share, we believe the company represents a great value and an upside over 15% per year conservatively. Due to this, we say “BUY” here, but it’s teetering on the edge of not being investable.

Remember, we’re all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, we harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, we buy more as time allows.

- We reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are our criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Enbridge isn’t cheap, but it’s buyable here.

Taxes: Enbridge issues 1099 tax forms, and because it’s a Canadian business, foreign tax is withheld on their dividend payments (unless held by a U.S. investor in a retirement account). Consult your tax professional.