Evaluating Energy Transfer: A Strong Performer in Midstream Energy

Energy Transfer (NYSE: ET) has had an impressive start to 2024, with its stock price increasing by approximately 40%. The master limited partnership (MLP) also offers a competitive distribution, boasting a forward yield of 6.7%.

More than tripling in value since the end of 2020, investors now wonder whether to buy, sell, or hold the stock. Here’s an exploration of the arguments for each side.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

The Investment Proposition for Energy Transfer

Energy Transfer operates one of the largest integrated midstream systems in the U.S., handling transportation, storage, and processing of various energy products. This includes natural gas, liquefied natural gas (LNG), crude oil, and refined oil products. The company’s comprehensive system enables it to capitalize on increasing demand for these products and various marketing opportunities, yielding profits from seasonal price fluctuations and regional disparities.

For instance, natural gas tends to command higher prices at certain times or locations. Energy Transfer capitalizes on this by storing natural gas for peak winter demand or shipping it to higher-paying markets. Additionally, the company can upgrade hydrocarbons into more lucrative products.

The integrated structure of Energy Transfer positions it well for growth in LNG exports and for meeting the rising natural gas demand linked to the growth of artificial intelligence (AI) infrastructure. With strong footholds in Texas and the Permian Basin, it can access abundant, cost-effective natural gas.

Energy Transfer is set to invest between $2.5 billion and $3.5 billion annually to fuel its growth, aiming to enhance its already strong portfolio. During the most recent earnings call, the company reported strong interest from power generation and data center operators regarding natural gas projects, aligning with their growing energy consumption needs.

This month, Energy Transfer announced a $2.7 billion natural gas pipeline project aimed at supporting increased power generation and data center growth in Texas. The project is backed by a long-term, fee-based contract and is expected to be operational by late 2026.

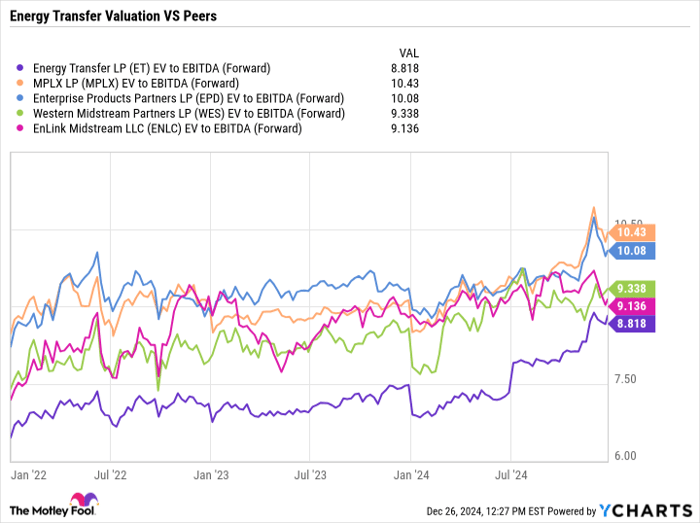

Despite these strengths, Energy Transfer trades at a forward enterprise value (EV)-to-EBITDA ratio of 8.8 times estimates, making it one of the most affordable MLP midstream stocks compared to peers. MLPs in general are trading below the historical multiple of 13.7 established between 2011 and 2016. Moreover, Energy Transfer expects to boost its attractive distribution by 3% to 5% annually moving forward.

Concerns About Energy Transfer

Historically, Energy Transfer hasn’t always maintained a conservative management approach. Back in 2020, the company was forced to cut its distribution nearly in half to strengthen its balance sheet amid a downturn in the energy market. Nevertheless, it swiftly reduced its leverage and restored its distribution level in early 2023, now nearly 6% higher than prior to the cut.

Additionally, the company has faced criticism regarding its shareholder treatment. Former CEO and significant shareholder Kelcy Warren was accused of prioritizing personal ambitions over stockholder value. An unsuccessful effort in 2016 to secure preferential treatment for himself in the distribution structure illustrated these concerns.

However, important changes have occurred. Warren is no longer CEO, and conflicts of interest were largely eliminated following the merger of the general partnership (GP) and limited partnership (LP) in 2018. Though Warren remains chairman, he now owns the same shares as other investors.

As with all companies in the energy sector, Energy Transfer must navigate fluctuations within the energy market and the ongoing shift to renewable sources. However, its model, which is predominantly volume-based with many fee-oriented contracts, helps mitigate risk. Furthermore, its diversified operations allow for balanced performance across different segments, allowing it to capitalize on increasing power needs driven by AI development.

Image source: Getty Images.

Conclusion on Energy Transfer

With its problematic past behind it and ownership of valuable assets in the midstream sector, Energy Transfer appears attractively priced compared to both its peers and its own historical valuations. Its advantageous position, particularly in Texas and in accessing affordable Permian natural gas, positions the company to be a leader in benefiting from emerging AI-related energy demands. Therefore, I consider the stock a buy as we approach 2025.

Is Investing $1,000 in Energy Transfer Right for You?

Before making a decision to invest in Energy Transfer, consider the following:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks for investors to buy now, and Energy Transfer is not included on that list. The chosen stocks could potentially yield substantial returns in the years ahead.

Consider how Nvidia was highlighted on this list on April 15, 2005… if you invested $1,000 at that time, you’d have $857,565!*

Stock Advisor offers investors a straightforward approach to achieving success, featuring guidance for portfolio building, regular updates from analysts, and new stock recommendations twice a month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024.

Geoffrey Seiler has positions in Energy Transfer, Enterprise Products Partners, and Western Midstream Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.