The Rise of Decentralization: A New Era in Finance

As awareness of control issues grows, decentralized technology presents exciting possibilities for financial independence.

Ever since Satoshi Nakamoto released the Bitcoin whitepaper in 2008, “decentralization” has emerged as a crucial idea within the cryptocurrency landscape shaped by blockchain technology.

This article delves into the essence of decentralization, its significance, and the range of benefits it can provide across different sectors, especially in finance.

Understanding Decentralization vs. Blockchain

The term “decentralization” is often equated to blockchain technology, particularly since cryptocurrencies gained popularity. This misunderstanding can lead people to think that these concepts are identical.

For individuals new to this field, reconciling the two concepts can be tricky. Decentralization is a fundamental idea within blockchain but they are distinct. Essentially, decentralization refers to distributing control and decision-making to various nodes in a network. In the context of blockchain, it implies shifting power from a single centralized body to a decentralized network, which could be either public or private.

Cryptocurrencies like Bitcoin benefit from this decentralized network of nodes, which operate within a public, permissionless system. This enables users to transfer assets without the oversight of centralized authorities. The Bitcoin network itself, using a consensus mechanism known as Proof of Work (PoW), acts as its own governing body to ensure security and operations, minimizing reliance on any singular entity.

Decentralization enhances the robustness and safety of the network by eliminating intermediaries, which can be particularly advantageous for decentralized platforms like cryptocurrency exchanges (DEXs). Users have full control of their funds during transactions, marking a significant leap towards financial autonomy that was previously inaccessible.

The Drawbacks of Centralization: Risks in Third-Party Custody

A primary goal of cryptocurrency is to address vulnerabilities tied to centralization, especially as seen in traditional Web2 systems and some Web3 models. These can be susceptible to technical glitches, cyberattacks, or manipulation despite claims of decentralization.

Some exchanges may mistakenly appear decentralized. While they utilize on-chain transactions, they keep user funds under centralized custody, which means that users still risk exposure to control by a single entity.

This arrangement could allow centralized authorities to limit user access or censor transactions, posing significant risks. Furthermore, negligence in managing funds might lead to exploitation by malicious actors.

Lack of transparency concerning fund custody raises skepticism among users who value true decentralization. The presence of intermediaries can also lead to heightened costs, slower transaction speeds, and various issues typically associated with centralized frameworks.

Benefits of Decentralization in Blockchain

Utilizing decentralized systems yields numerous advantages, particularly in custodial solutions and cryptocurrency trading. Since platforms like Uniswap debuted, significant advancements have granted users full control over trading decentralized assets, such as Bitcoin (BTC) and Ethereum (ETH).

By distributing control among multiple nodes, these systems become more resilient and difficult for attackers to disrupt. Secure blockchain networks, known for their high decentralization level, offer solid platforms for trading digital assets.

Moreover, when utilizing a public ledger accessible to everyone, trust among users is enhanced as transactions occur directly between parties. Automated Market Maker (AMM) models facilitate multi-asset liquidity pools, thereby reducing costs and improving efficiency.

Decentralized exchanges offer lower transaction fees, making them a more wallet-friendly option compared to centralized cryptocurrency exchanges.

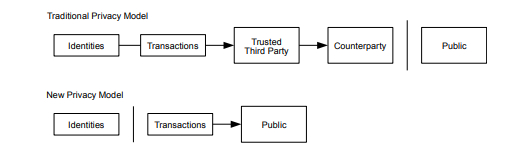

Moreover, by using decentralized platforms for trading, users reduce the risk of data breaches and can trade with a higher level of anonymity, as many DEXs do not require Know Your Customer (KYC) procedures.

Diverse Applications of Decentralization

Decentralization has found applications in various industries, presenting equitable and secure alternatives:

- Finance: A major area benefiting from decentralization is decentralized finance (DeFi). Platforms in this ecosystem enable on-chain lending, yield generation, and the execution of advanced financial instruments, such as leveraged futures, without depending on traditional banking systems.

- Supply Chain Management: This sector uses blockchain technology to track products from their origins to consumers, ensuring authenticity and reducing the chances of loss and fraud. Numerous examples of successful decentralized applications exist in traditional businesses worldwide.

- Decentralized Identity: This highlights a critical aspect of the new digital age, allowing users to manage their identities on-chain while focusing on privacy through methods like zero-knowledge proofs. This leads to more reliable, transparent online verification processes.

- Electronic Voting: Blockchain-based voting systems promise integrity and transparency in elections. Although still underutilized, several successful implementations have been observed in various elections globally.

The Advantages of DEX over CEX

Decentralized exchanges (DEXs) have become essential in the growing ecosystem of decentralized solutions, providing practical alternatives to centralized exchanges (CEXs).

By using DEXs, users can trade digital assets directly without intermediaries, take part in sophisticated investment options like perpetual swaps, and operate in a secure, non-custodial environment.

These exchanges leverage smart contracts and function on efficient blockchain networks, making them more resilient to technical failures, regulatory constraints, or attacks on centralized servers.

As a significant part of the decentralized finance (DeFi) sector, DEXs have experienced a surge in activity as individuals seek to manage their finances independently and explore the opportunities presented by blockchain technology. This growing interest is reflected in key performance metrics for the sector.

Since no central authority governs them, transactions on DEXs are less likely to face bans or limitations from governments or regulatory entities, a notable concern in past events involving platforms like Tornado Cash.

In addition to supporting user anonymity, DEXs provide access to anyone with an internet connection, eliminating geographic and time constraints.

In summary, decentralization in blockchain is crucial for ensuring fair, secure, and transparent transactions, giving users greater autonomy and assurance in their financial operations.

Spotlight on Zeus Exchange

Zeus Exchange exemplifies a decentralized platform that enables cryptocurrency trading through both spot and perpetual contracts. Unlike CEXs, it operates without intermediaries, allowing users to maintain complete control over their assets while mitigating risks related to hacks or arbitrary limitations.

The platform utilizes liquidity pools based on Automated Market Maker (AMM) technology, with enhancements for improved price stability and capital efficiency compared to traditional models. By incorporating a diverse array of assets, Zeus fosters liquidity and encourages smooth trading within a transparent framework.

With transactions recorded on blockchain networks, every trade is secure and resistant to censorship. The platform lessens reliance on major financial players, broadening access to advanced trading strategies, including perpetual swaps.

Currently, in the incentivized testnet phase, Zeus Exchange aims to position itself as a strong, reliable option for trading high-demand assets such as Bitcoin and Ethereum, particularly for executing high-leverage perpetual swaps.

Through cutting-edge tools and the backing of decentralized governance, platforms like Zeus Exchange empower users, heralding a new era of secure and autonomous trading.

Disclaimer: The platforms or assets mentioned here are examples used for illustrative purposes. This should not be construed as financial advice. Always conduct your own research, and you are solely responsible for your decisions.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.