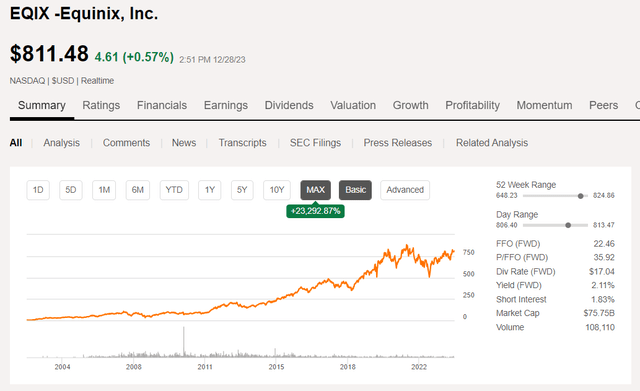

Equinix, Inc. (NASDAQ:EQIX) stands as the top data center provider globally, with 204 hubs spread across 5 continents. Its facilities are home to 1800 network service providers interconnected through cross connections. This company has displayed remarkable fundamental growth, with its stock surging by an astounding 23,292.87% over the past couple of decades.

While buying in 2003 would have been ideal, today’s investors are faced with the decision to purchase EQIX at around $811 per share. Let’s delve into the merits of making that investment.

Equinix’s Upside

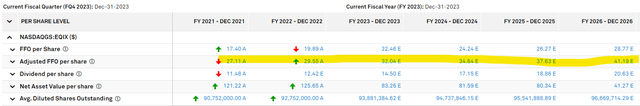

EQIX is currently trading at a relatively high multiple of 24X forward adjusted funds from operations, or AFFO. Yet, compared to its recent history, this figure is quite reasonable. Moreover, it appears inexpensive relative to the projected growth rate. EQIX is positioned to outpace its peers due to several key advantages:

- Strong property level operating margins.

- Exceptional cost of capital.

- Markedly higher profit margin at REIT level.

- Operational superiority stemming from:

- Cross connect ecosystems.

- Global presence facilitating a single source provider.

- Ease of setup.

- Customizability of setup.

- Speed of deployment.

We will explore these advantages in greater detail and then proceed with an analysis of valuation, adjustments to reported AFFO, and potential investment risks associated with EQIX.

Superior Property-level Operating Margins

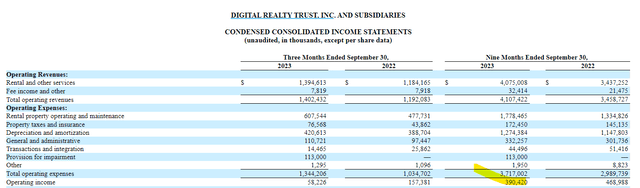

Digital Realty Trust, Inc. (DLR) is EQIX’s primary competitor with an annual revenue run rate of $5.476B. DLR’s latest 10-Q document reveals an operating margin of 9.5%.

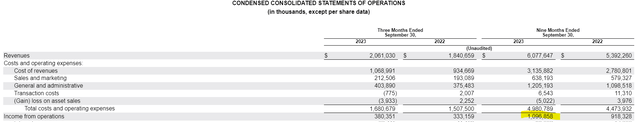

In contrast, despite having higher AFFO and revenues, EQIX, with an annualized revenue of $8.1B, boasts a significantly higher margin at 18%.

Remarkably, EQIX carries fewer assets on its balance sheet compared to DLR. Hence, the margin discrepancy does not stem from superior scale but reflects superior operational efficiency.

EQIX’s superior property level operating margin is further bolstered at the REIT level by its remarkable cost of capital.

Lowest Cost of Capital Available

As is known, a REIT’s cost of capital is composed of two components: Equity capital and debt capital.

At a forward AFFO multiple of 24X, EQIX’s cost of equity capital exceeds 4% (100 divided by 24).

While a low cost of equity capital benefits the REIT, it may not necessarily benefit shareholders due to its implication of a high earnings multiple (AFFO in this case).

However, the real advantage to shareholders is derived from the REIT’s access to cheap debt capital, an area where EQIX is unparalleled. Over the past 12 years, I have not encountered a REIT with such a large amount of debt at such low rates.

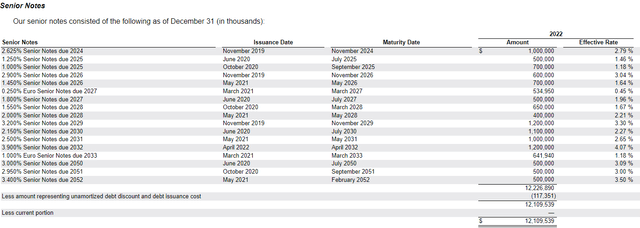

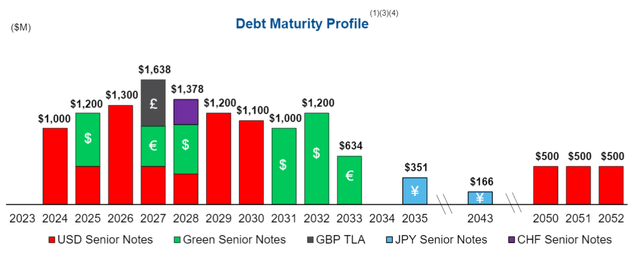

EQIX’s senior notes reflect:

- The weighted average cost is a mere 2.25%.

- The maturity schedule is well-laddered, extending out to 2052.

Of note, among the senior notes is $534 million of debt due in 2027, bearing an interest rate as low as 0.25%!

How does EQIX manage to secure such low-cost debt? There are three primary reasons:

- Low overall leverage at 20% debt to capital, supporting a BBB stable outlook credit rating.

- EQIX’s global presence facilitates Euro-denominated notes which tend to be cheaper.

- EQIX possesses a commendable environmental standing in terms of energy sourcing.

Regardless of one’s inclination towards environmental policies, EQIX’s ecological initiatives have tangible financial benefits. On December 20th, 2023, EQIX announced the allocation of $4.9B of Green Bonds. The proceeds from Green Bonds are remarkably affordable but must be dedicated solely to approved projects. EQIX fulfills these requirements, which enables it to access this extremely cheap debt. Green notes constitute a significant portion of EQIX’s capital structure.

Cheap debt translates into higher AFFO margins. EQIX’s AFFO annualized run rate of $3.06B against $8.1B of revenue results in an impressive AFFO margin of approximately 38%. In comparison, DLR’s AFFO annualized run rate of $1.75B against $5.476B in revenues yields an AFFO margin of about 32%. It’s worth noting that the reason for higher AFFO margins compared to operating margins is largely due to depreciation and amortization. We’ll delve deeper into the complexities of AFFO accounting later in this article.

Equinix’s superior operations and low cost of capital are propelling it to outperform the competition with higher margins.

Evidence of EQIX Operational Superiority

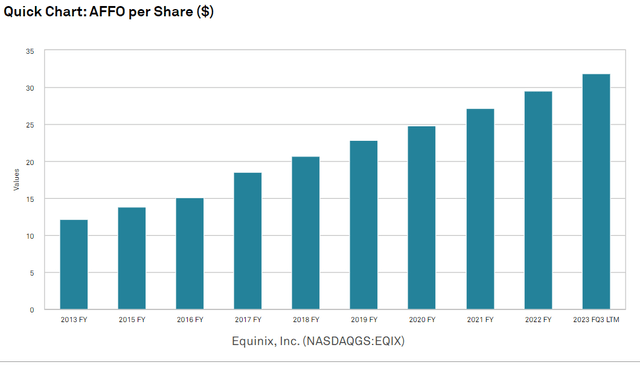

Beyond the margin data, EQIX’s track record reflects its operational strength, with AFFO per share consistently growing.

Wall Street analysts widely anticipate ongoing AFFO growth extending through at least 2026. This consensus provides compelling evidence of EQIX’s operational resilience.

I believe the operational strength stems from various factors, including:

- Cross connection ecosystems.

- Global presence enabling a single source provider.

- Ease of setup.

- Customizability of setup.

- Speed of deployment.

When enterprises, Internet service providers, or other data center customers have critical data needs, they often require an immediate solution. Speed and accuracy of deployment hold significant weight. Equinix is designed to offer Infrastructure as a Service (IaaS), allowing customers to select location, capacity, and cross-connect partners seamlessly via its website. With premium data centers located across major global data hubs, Equinix serves as a one-stop solution, catering to all data center needs in a single location, regardless of geographical location.

These setup conveniences likely contribute to EQIX’s rapid data center leasing and retention. However, the crux of EQIX’s success lies in its cross connection ecosystem. To comprehend the immeasurable value of this, let’s first dissect the competitive landscape’s impact on new supply.

Network Externalities Countering New Supply

The physical data center is rather generic, with numerous companies constructing their own facilities. SDX Central projects a significant 50% surge in operational hyperscale data centers between 2022 and 2026.

Notably, hyperscale cloud giants such as Microsoft Corporation (MSFT) and Alphabet Inc. (GOOG) (GOOGL) are increasingly building their own data centers. The physical structure lacks differentiation in this competitive landscape.

Data centers…

The Battle of Data Center REITs: EQIX vs. DLR

Amidst the corridors of commerce, the data center real estate investment trust (REIT) sector is akin to a bustling marketplace, with Equinix, Inc. and Digital Realty Trust, Inc. as its undisputed giants. The former is a titan renowned for its cross-connection-centric data centers, while the latter navigates the terrain of commodity infrastructure where raw power reigns supreme.

Equinix’s Unique Offering

Equinix’s data center model revolves around cross connections, enabling tenants direct, near-zero latency interconnections with major companies. This focus enhances the value proposition well beyond the mere equipment leasing, hence cementing its position as a major player resilient to new market entrants.

Embracing the network effect, Equinix creates a positive externality, making its data centers more appealing as the number of existing tenants soars. This, in turn, fortifies tenant loyalty and permits Equinix to command premium rent while reaping the rewards of cross-connection revenues.

Valuation: The Tug of War

Equinix trades at 24.06X forward estimate adjusted funds from operations (AFFO), while Digital Realty hovers at 21.5X forward AFFO. The 3.5-turn premium on AFFO aligns with Equinix’s superior quality, making it the evident choice within the data center REIT sphere.

However, closer scrutiny of Equinix’s accounting reveals a fair bit higher true earnings multiple of 28X, surpassing the industry standard of around 15X for REITs, indicative of its relatively expensive position from a valuation standpoint.

Historical Context and Market Pause

Equinix has encountered a 4% decline in market performance over the past 2 years, juxtaposed with significant AFFO growth. This hiccup in its market price presents a potentially favorable entry point for discerning investors.

Assessing Growth Potential

Consensus estimates hint at a steady 8% to 15% growth trajectory for Equinix, with a long growth runway that goes beyond the implied multiple. Such potential bodes well for investors eyeing a robust total return in the current market climate.

Thesis Risks Unveiled

Fluctuating Geopolitical Landscape

Equinix’s global presence might be adversely impacted by geopolitical tensions, particularly in the digital space. Any encroaching barriers on global interconnection could stifle its operations, rendering this a pivotal risk for shareholders to monitor.

ETF-Induced Market Headwinds

A potential Nasdaq pullback might have repercussions on Equinix, given its inclusion in various ETFs linked to the tech-heavy index. Such a scenario could spur an industry-wide selloff, painting a nuanced risk picture for prospective investors.

The Final Verdict

Equinix, Inc. emerges as the prime choice in the data center REIT realm, despite its seemingly elevated multiple. Its long-term growth narrative, buoyed by unique market positioning and growth potential, underscores its status as a worthwhile conduit for astute shareholders.