Equitable Holdings, Inc. EQH has announced that its board of directors approved an increase in quarterly dividends, consistent with its previously disclosed plan. The company will now pay out 24 cents per share, marking a 9% increase from the previous dividend.

The new dividend will be paid out on Jun 10, 2024 to stockholders of record as of Jun 3. Based on the increased rate, the annual dividend amounts to 96 cents per share. The dividend yield, calculated based on the new payout and the closing price on May 22, is 2.36%, which is higher than the industry average of 2.08%.

Moreover, EQH announced dividends on its preferred stock, including a $328.13 per share quarterly dividend on Series A 5.25% Non-Cumulative Perpetual Preferred Stock, a $618.75 semi-annual dividend on Series B 4.95% Non-Cumulative Perpetual Preferred Stock and a $268.75 per share quarterly dividend on Series C 4.30% Non-Cumulative Perpetual Preferred Stock.

Regarding its financial position, Equitable Holdings exited the first quarter with total investments, and cash and cash equivalents of almost $113 billion, while long-term debt was only $3.8 billion. The company is also improving its cash-generating ability. By 2027, it expects to generate around $2 billion in cash annually. In the first quarter of 2024, it came up with $31 million operating cash flow, improving from cash used in operations of $587 million.

This positive momentum is likely to support EQH’s capital-deployment initiatives. It has a 60-70% payout ratio target of non-GAAP operating earnings. In the March quarter of 2024, Equitable Holdings paid out $73 million of cash dividends and repurchased $253 million worth of shares.

The company’s Equitable business is expected to benefit from the increasing older population, driving demand for retirement products. In the first quarter, its individual retirement segment demonstrated growth, with net inflows of $1.6 billion.

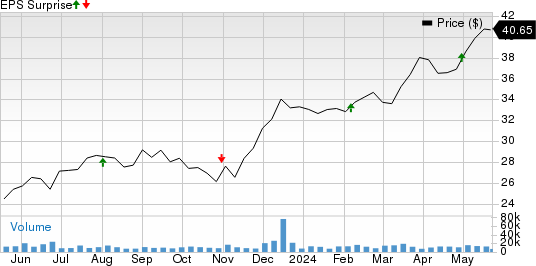

The Zacks Consensus Estimate for its 2024 bottom line is pegged at $6.08 per share, which suggests a 32.5% year-over-year increase. The same for 2025 implies a 17% jump from the year-ago level. In the last four quarters, EQH’s earnings beat estimates twice, met once and missed on the other occasion, with an average surprise of 2.5%.

Equitable Holdings, Inc. Price and EPS Surprise

Equitable Holdings, Inc. price-eps-surprise | Equitable Holdings, Inc. Quote

Zacks Rank & Key Picks

Equitable Holdings currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Finance space are Jackson Financial Inc. JXN, Euronet Worldwide, Inc. EEFT and CleanSpark, Inc. CLSK, each carrying a Zacks Rank #2 (Buy) now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Jackson Financial’s current-year earnings indicates 32.2% year-over-year growth. JXN beat earnings estimates twice in the past four quarters and missed on the other occasions. The consensus mark for current year revenues predicts a 115.1% jump from a year ago.

The Zacks Consensus Estimate for Euronet Worldwide’s 2024 earnings indicates 15.8% year-over-year growth. During the past month, EEFT has witnessed three upward estimate revisions against none in the opposite direction. It beat earnings estimates in each of the past four quarters, with an average surprise of 9.3%.

The Zacks Consensus Estimate for CleanSpark’s current-year earnings suggests a 140.3% year-over-year improvement. During the past month, CLSK has witnessed one upward estimate revision against none in the opposite direction. The consensus mark for current year revenues suggests a 183.6% surge from a year ago.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Equitable Holdings, Inc. (EQH) : Free Stock Analysis Report

Cleanspark, Inc. (CLSK) : Free Stock Analysis Report

Jackson Financial Inc. (JXN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.