Ericsson ERIC has embarked on a strategic alliance with T-Mobile TMUS to cater to the surging demands of the remote work culture. Market forecasts reveal a projected 22% of the American workforce, translating to 32.6 million employees, transitioning to remote work by 2025. As part of this collaboration, T-Mobile will implement connectivity solutions equipped with Secure Access Service Edge (SASE) capabilities for Ericsson employees utilizing 5G laptops.

The Rise of Remote Work Culture

Based in Bellevue, WA, T-Mobile is a prominent national wireless service provider specializing in mobile voice, messaging, and data services across postpaid, prepaid, and wholesale segments. The company’s extensive deployment of 5G and 4G LTE networks is instrumental in supporting its core “Un-carrier Value Proposition” strategy, aimed at boosting customer satisfaction through affordable rates and straightforward terms.

Enhanced Security and Connectivity

Through the incorporation of 5G laptops within its Enterprise Virtual Cellular Network (EVCN) pilot program in the United States, Ericsson seeks to address the security apprehensions of enterprise IT teams and employees. This initiative is anticipated to counter fraudulent activities effectively and fortify cybersecurity measures for corporate employees operating remotely. T-Mobile’s cutting-edge SASE solution, complemented by T-SIMsecure under the Security Slice offering, is poised to provide a competitive advantage to Ericsson’s EVCN solution.

Fostering Productivity in a Hybrid Workplace

The integration of these tech giants is poised to catalyze employee contentment and productivity within a hybrid work environment. Leveraging eSIM profile activation, 5G laptops can seamlessly connect to the TMUS network, ensuring a smooth workflow while safeguarding against cybersecurity threats. With this groundbreaking agreement, Ericsson is set to influence the future landscape of digitization and flexible work arrangements significantly.

Future Prospects and Market Positioning

The multifaceted collaboration with the acclaimed 5G network provider in the U.S. is expected to position Ericsson at the forefront of the wireless equipment market. Recognizing the pivotal role of 5G standardization in advancing industry digitalization and broadband connectivity, the company is likely to pursue similar ventures to enhance its operational foothold, bolster technological prowess, and ensure reliability. Presently, Ericsson boasts 158 operational 5G networks in 67 countries worldwide.

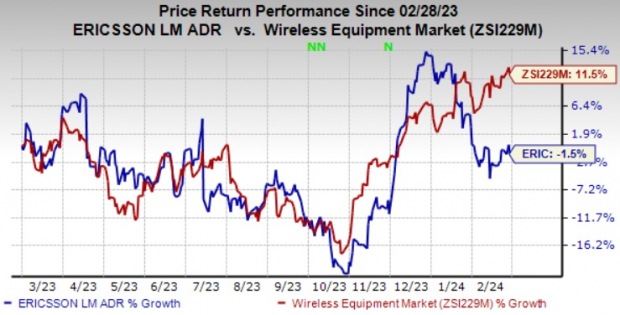

The stock has witnessed a 1.5% decline over the past year compared to the industry’s overall growth rate of 11.5%.

Image Source: Zacks Investment Research

Insights on Other Key Performers

Presently, Ericsson holds a Zacks Rank #3 (Hold).

NVIDIA Corporation NVDA, currently holding a Zacks Rank #1 (Strong Buy), has consistently delivered a trailing four-quarter average earnings surprise of 20.18%. In the most recent quarter, it surpassed earnings estimates by 13.41%. NVIDIA, a global leader in visual computing technologies and GPU invention, has evolved its focus from PC graphics to AI-driven solutions for high-performance computing, gaming, and virtual reality platforms.

InterDigital, Inc. IDCC, with a Zacks Rank #2 (Buy), has boasted an impressive trailing four-quarter average earnings surprise of 170.50%. In the previous quarter, it exceeded earnings expectations by 16.53%. Renowned for pioneering advanced mobile technologies in wireless communications, InterDigital specializes in designing solutions for digital cellular, wireless 3G, 4G, and IEEE 802-related products and networks.

For investors seeking top opportunities, Zacks Senior Stock Strategist Kevin Cook has unveiled 5 carefully selected stocks poised for exponential growth in the Artificial Intelligence realm. By 2030, AI’s economic impact is projected to reach $15.7 trillion, equivalent to the scale of the internet and iPhone.

Today, you can seize the chance to invest in the future wave by accessing a ChatGPT Stock Report that champions automation’s ability to enhance decision-making processes, rectify errors, challenge assumptions, and elevate operational efficiency.

To explore the latest recommendations from Zacks Investment Research, download the “7 Best Stocks for the Next 30 Days” report today.

The viewpoints expressed herein reflect those of the author and not necessarily those of Nasdaq, Inc.