Understanding Social Security: The Cost of Early Retirement Claims

Are you considering retirement soon? If you’re thinking about stepping away from work this year, you’ve certainly earned that right. However, before you decide to start your Social Security retirement payments in 2025, it’s crucial to consider the financial implications of claiming benefits early versus waiting.

Choosing When to Claim: The Financial Impact

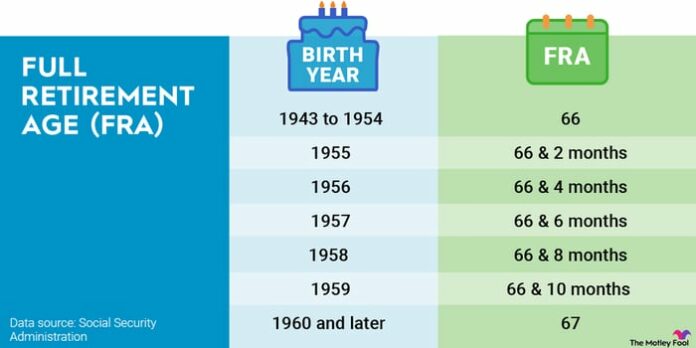

You may begin receiving Social Security benefits as early as age 62, but doing so comes with reduced payments. Those who wait until their full retirement age (FRA), which ranges from 66 to 67 based on your birth year, will enjoy larger monthly payments.

Image source: Motley Fool.

The difference in payments can be quite substantial. Claiming benefits four or five years early may permanently decrease your payments by around 25% to 30%, depending on your age. The penalty lessens as you approach your FRA; for instance, claiming benefits just 12 months before reaching FRA results in a reduction of only 6 2/3% of what your monthly payment would be at FRA.

As of now, the average Social Security check stands at just over $1,900. Consequently, these differences translate into a few hundred dollars per month, which is a significant amount for most individuals.

Moreover, waiting until after reaching your FRA increases your payments even further. If you delay your claim until the age of 70, you can receive monthly payments that are 15% to 25% higher than those at your FRA. The following table highlights the financial variations between claiming benefits early and waiting until later.

| Birth Year | Full Retirement Age |

Percentage of Full Benefit by Age at First Claim |

||||||

|---|---|---|---|---|---|---|---|---|

| 62 | 63 | 64 | 65 | 66 | 67 | 70 | ||

| 1943-54 | 66 | 75 | 80 | 86 2⁄3 | 93 1⁄3 | 100 | 108 | 132 |

| 1955 | 66, 2 mo. | 74 1⁄6 | 79 1⁄6 | 85 5⁄9 | 92 2⁄9 | 98 8⁄9 | 106 2⁄3 | 130 2⁄3 |

| 1956 | 66, 4 mo. | 73 1⁄3 | 78 1⁄3 | 84 4⁄9 | 91 1⁄9 | 97 7⁄9 | 105 1⁄3 | 129 1⁄3 |

| 1957 | 66, 6 mo. | 72 1⁄2 | 77 1⁄2 | 83 1⁄3 | 90 | 96 2⁄3 | 104 | 128 |

| 1958 | 66, 8 mo. | 71 2⁄3 | 76 2⁄3 | 82 2⁄9 | 88 8⁄9 | 95 5⁄9 | 102 2⁄3 | 126 2⁄3 |

| 1959 | 66, 10 mo. | 70 5⁄6 | 75 5⁄6 | 81 1⁄9 | 87 7⁄9 | 94 | ||

4⁄9

Data source: Social Security Administration.

Maximizing Your Social Security Benefits: Essential Steps Before Retirement

Key Steps to Take Now

It’s important to connect with the Social Security Administration—whether online, in person, or by phone—to examine all your benefit options. This assessment could reveal reasons to keep working for at least another year, or it might show that delaying retirement until age 70 isn’t beneficial.

Interestingly, waiting until after you turn 70 to file offers no additional benefit. In fact, there’s a real incentive to make your claim soon after reaching 70. The Social Security Administration only pays retroactive benefits for up to six months. If you wait longer, you risk missing out on money that isn’t retrievable.

More Financial Considerations

Evaluating your future Social Security payments isn’t the only task on your pre-retirement checklist. You’ll want to set up a convenient way to receive direct deposit payments, as paper checks are no longer issued. Additionally, ensure that the Social Security Administration has an accurate record of your income history; mistakes can occur, despite your consistent tax contributions.

Another crucial task involves preparing a plan for managing your finances post-retirement. Consider whether it’s wise to keep large sums in low-interest checking accounts or to invest in higher-yield money market funds that maintain liquidity. Evaluate your investment portfolio: if it’s too growth-oriented, now might be the right time to adjust it, as market conditions can change quickly. If you have workplace health coverage, consider whether you need to supplement it with additional Medicare coverage.

Planning your finances and understanding your situation is vital. The more informed you are, the better prepared you will be for retirement.

Uncovering Hidden Social Security Benefits

Many Americans find themselves behind in retirement savings. However, certain little-known “Social Security secrets” could significantly enhance your retirement income. One simple strategy, for example, could potentially add up to $22,924 more to your annual income! By learning how to maximize your Social Security benefits, you could approach retirement with greater confidence and security. Explore more about these strategies to secure your financial future.

Discover the “Social Security secrets” »

The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.