Alphabet and Amazon Gear Up for Key Q4 Earnings Reports

As we navigate through the earnings season for Q4 2024, many companies are releasing their quarterly results.

This week’s schedule is particularly packed, featuring major players like Alphabet GOOGL and Amazon AMZN. Both companies have captured headlines recently due to the buzz around DeepSeek, raising questions about their recent capital expenditures.

Let’s explore what analysts expect from these earnings announcements and identify some crucial metrics to monitor.

Key Focus on Alphabet’s Advertising Revenue

Alphabet’s earnings projections have remained stable in recent months. The current Zacks Consensus EPS estimate stands at $2.12, indicating a robust 30% growth year-over-year. Meanwhile, projected sales are expected to reach $81.4 billion, which reflects a 12% increase.

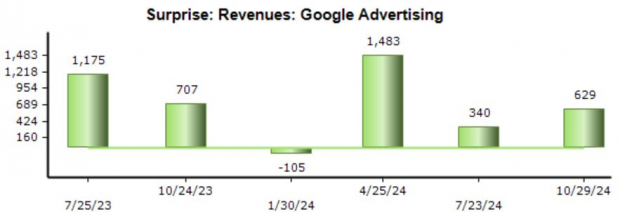

Alphabet’s advertising results, which contribute significantly to its total revenue, will be scrutinized. The Zacks Consensus estimate for advertising sales is $71.6 billion—a nearly 10% rise from the previous year.

Historically, Alphabet has often surpassed expectations in this area, with only one miss in the last six quarters. The recent boost in advertising performance is likely attributed to AI enhancements that have improved the relevance of search results.

Image Source: Zacks Investment Research

Additionally, the positive advertising results reported by competitors like Meta Platforms provide a glimpse into what might be expected. Both Alphabet and Meta have integrated AI technologies to enhance user engagement.

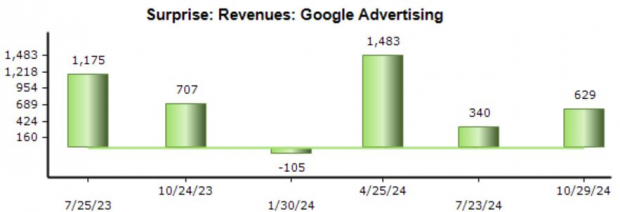

Another critical part of Alphabet’s earnings to watch is the Cloud segment, which has shown growth over the past six quarters. The current estimate suggests Cloud sales will hit $12.1 billion, reflecting a significant 32% increase from last year’s figures.

Image Source: Zacks Investment Research

Sundar Pichai, CEO of Alphabet, expressed optimism after the last earnings release, stating, ‘In Search, our new AI features are expanding what people can search for and how they search for it. In Cloud, our AI solutions are helping drive deeper product adoption, attract new customers, and secure larger deals. YouTube’s total advertising and subscription revenues surpassed $50 billion over the past four quarters for the first time.’

While the momentum in advertising and cloud services is promising, analysts will also be keeping an eye on CapEx discussions. However, concerns may have eased following strong quarterly releases from Meta and Microsoft.

Amazon’s AWS Remains a Focal Point

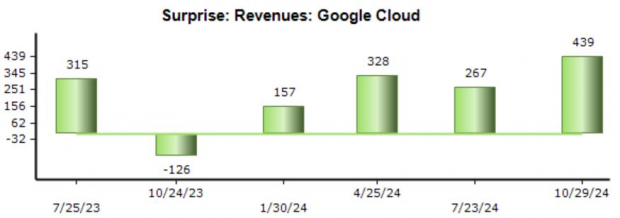

For Amazon, analysts express a modest sense of optimism regarding its upcoming earnings release. Both EPS and sales expectations have risen slightly in recent months, with analysts anticipating a remarkable 50% year-over-year increase in EPS and a 10% growth in sales.

Image Source: Zacks Investment Research

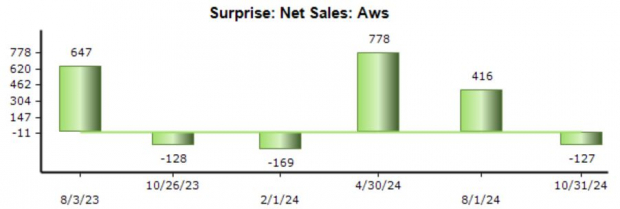

Much like Alphabet, Amazon’s cloud results, particularly from Amazon Web Services (AWS), will be a crucial highlight. AWS dominates the cloud computing sector globally, providing essential services like computing power, storage, databases, and AI tools.

Last quarter, AWS underperformed against expectations, ending a streak of consecutive beats. The current sales estimate for AWS is $28.8 billion, which signifies a 19% year-over-year increase, almost matching the previous quarter’s growth rate.

Growth in Cloud revenue is expected to be bolstered by the increased adoption of AI-related services, with Amazon continuously updating its product offerings.

Image Source: Zacks Investment Research

Conclusion

This week, Alphabet GOOGL and Amazon AMZN are the highlights of the earnings reports, almost concluding the Q4 cycle for the Mag 7 companies. Following their announcements, NVIDIA remains the last major player in this group, set to release its results at the end of February.

The anticipation surrounding these earnings seems mildly positive, aided by solid results from peers such as Meta and Microsoft, which have eased concerns regarding AI infrastructure investments.

For Alphabet, advertising results will be pivotal as investors hope for continued progress in user engagement. For Amazon, AWS will remain central to its earnings, with expectations that the adoption of innovative tools will propel growth. Guidance from both companies will be critical, influencing their market performance post-earnings.

Unlock Zacks’ Recommendations for Just $1

It’s true.

Some years ago, we surprised our members by offering them access to our top picks for just $1. There’s no obligation to spend more.

Thousands have seized this opportunity, while others were hesitant, thinking it was too good to be true. Our goal is simple: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others that posted 228 positions yielding double- and triple-digit gains in 2023.

Check Stocks Now >>

Looking for the latest recommendations from Zacks Investment Research? Today, you can download the report on 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.