Top Oversold Stocks in Communication Services: A Chance for Investors

Investors are looking into the communication services sector for potentially undervalued stocks as many companies are currently oversold.

The Relative Strength Index (RSI) is a key momentum indicator used by traders. It measures how a stock’s price performance on days with gains compares to those with losses. An RSI below 30 usually indicates that a stock is considered oversold, suggesting a potential buying opportunity. This information comes from Benzinga Pro.

Below is a list of notable stocks in the communication services sector that have recently shown RSI values near or below 30.

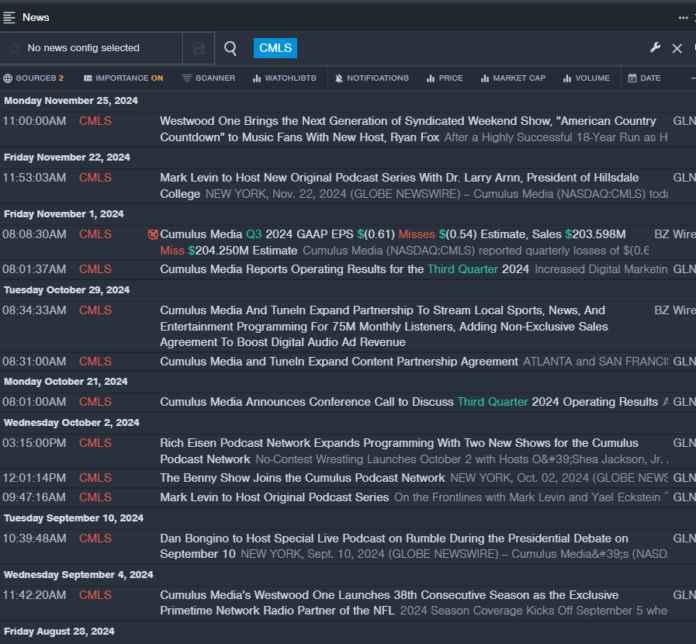

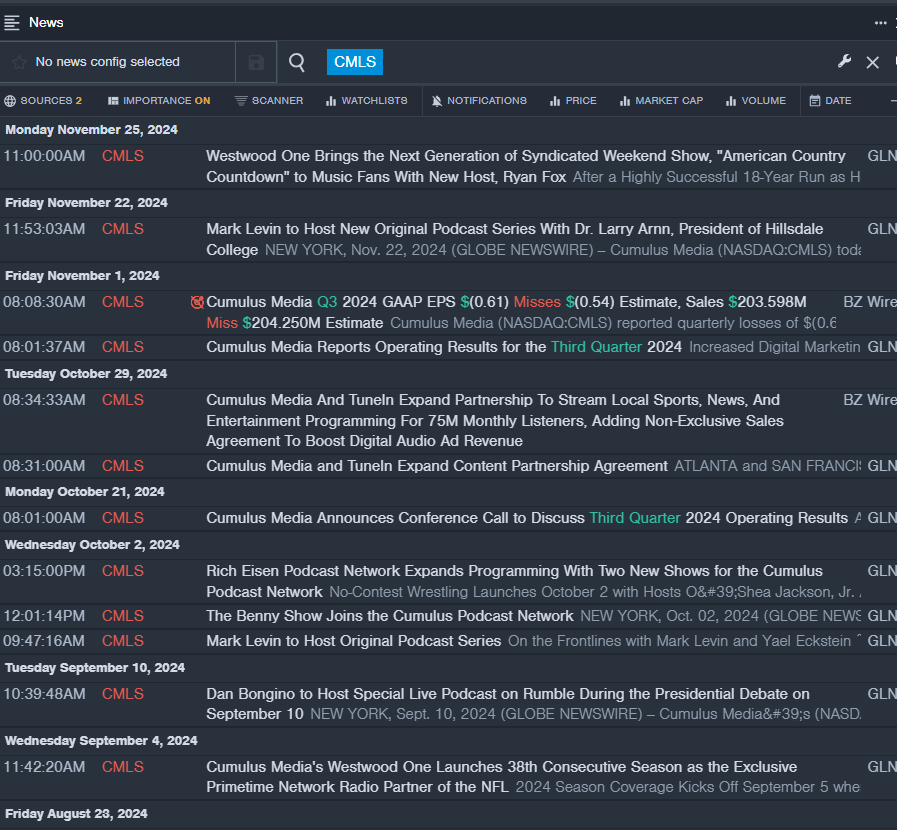

Cumulus Media Inc CMLS

- On November 1, Cumulus Media reported disappointing third-quarter results. CEO Mary G. Berner stated, “During the third quarter, we delivered revenue and EBITDA in-line with pacing commentary and analyst estimates. Given the market challenges, we focused on areas we can control. We continued investing to drive growth in our digital businesses, including a nearly 40% increase in digital marketing services revenue for the quarter.” The company’s stock has dropped approximately 42% over the last month, with a 52-week low of $0.70.

- RSI Value: 25.88

- CMLS Price Action: Shares of Cumulus Media declined 3.3%, closing at $0.70 on Monday.

- Benzinga Pro’s real-time newsfeed provided updates on CMLS.

Beasley Broadcast Group Inc BBGI

- Beasley Broadcast Group announced a quarterly loss of $2.33 per share on November 5. CEO Caroline Beasley noted, “Beasley delivered third-quarter net revenue of $58.2 million and reported a 0.5% increase in same-station revenue, largely due to strong political advertising and an 11.7% rise in digital revenue.” The company’s stock fell about 31% in the last month, reaching a 52-week low of $7.66.

- RSI Value: 23.76

- BBGI Price Action: Shares of Beasley Broadcast jumped 11.7%, closing at $9.25 on Monday.

- Benzinga Pro’s charting tool highlighted trends in BBGI stock.

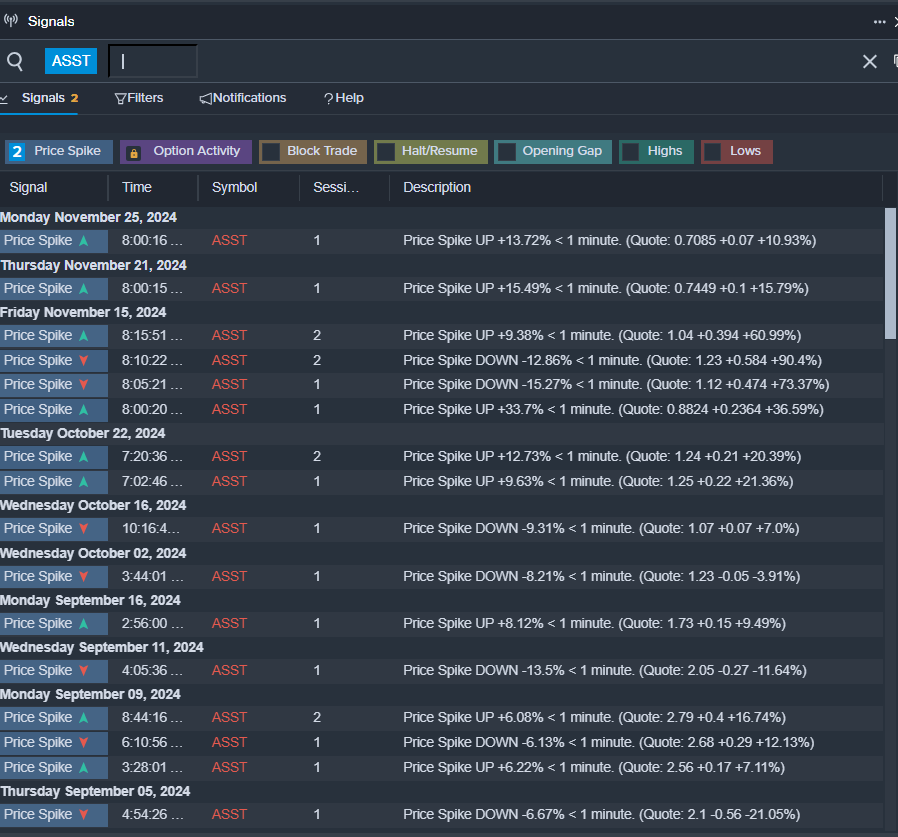

Asset Entities Inc ASST

- On November 15, Asset Entities reported third-quarter revenues of $202,921, a significant increase compared to $60,135 from the previous year. “We are thrilled to see the strong year-over-year growth in revenue, thanks to our strategic acquisitions and partnerships,” said CEO Arshia Sarkhani. “We remain optimistic as we execute more growth initiatives and partnerships.” The stock has dropped about 37% in the past month, now at a 52-week low of $0.51.

- RSI Value: 24.21

- ASST Price Action: Shares of Asset Entities fell 9.9%, closing at $0.58 on Monday.

- Benzinga Pro’s signals feature highlighted a potential breakout for ASST shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs