Essex Property Trust: A Strong Performer in Real Estate Investment

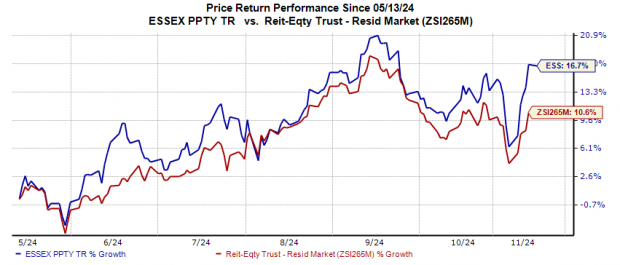

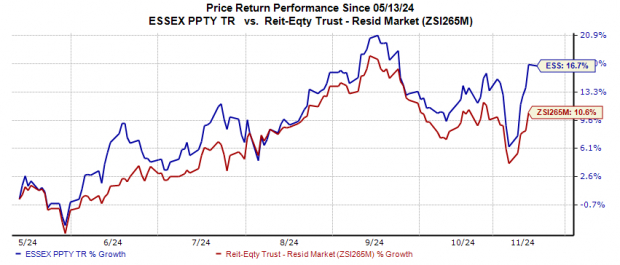

Shares of Essex Property Trust (ESS) have surged 16.7% in the past six months, exceeding the industry average increase of 10.6%.

This residential REIT is positioned well for growth, thanks to its solid property portfolio in the West Coast market, supported by strong demand drivers and a healthy balance sheet.

Recent Financial Highlights

Last October, ESS reported its third-quarter 2024 core funds from operations (FFO) per share at $3.91, surpassing the Zacks Consensus Estimate of $3.88. This figure represents a 3.4% improvement compared to the same quarter last year.

The positive results stemmed from healthy growth in same-property revenues and net operating income (NOI). Moreover, ESS has updated its full-year 2024 guidance to a more optimistic outlook.

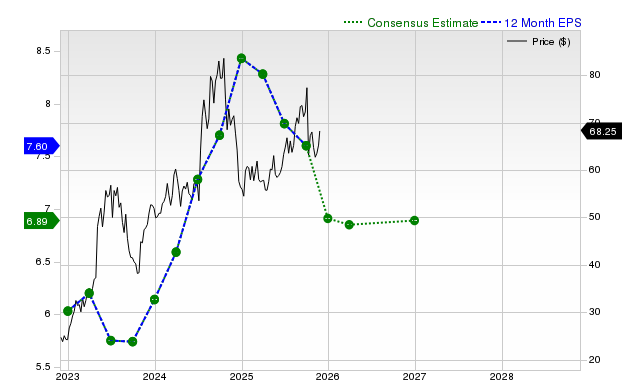

Analysts are currently optimistic about ESS, which holds a Zacks Rank #3 (Hold). In the past two months, the Zacks Consensus Estimate for its 2024 FFO per share has risen to $15.55.

Image Source: Zacks Investment Research

Drivers of Growth for ESS: What Lies Ahead?

Essex Property Trust’s strong presence on the West Coast has allowed the company to capitalize on market growth. This region hosts a number of technology and innovation companies, contributing to job growth and higher household incomes. Additionally, the area has a larger percentage of renters compared to homeowners and favorable demographic trends.

As layoffs in the tech sector slow down and companies encourage employees to return to the office, the demand for rental properties in West Coast markets is expected to grow. High homeownership costs complicate transitions from renting to owning, making rental units a more practical choice for many. These trends suggest a positive outlook for ESS’s revenue and demand.

As of September 30, 2024, Essex Property Trust reported $1.2 billion in liquidity, which includes undrawn credit, cash, and marketable securities. The company’s net debt-to-adjusted EBITDAre ratio stood at 5.5X in the third quarter of 2024.

Over time, ESS has aimed to enhance its unencumbered net operating income (NOI), which reached 93% by the close of the third quarter of 2024. This high level allows easier access to both secured and unsecured debt markets.

Stable dividend payments appeal to investors in REITs. Essex Property has increased its dividend five times in the last five years, exhibiting a five-year annualized growth rate of 4.35%. Given its low payout ratio and strong financial position, investors can expect continued sustainability of these dividend payments.

Potential Risks for Essex Property Trust

However, challenges remain. An increase in apartment unit supply in some of ESS’s markets may lead to heightened competition and erosion of pricing power.

The company’s asset concentration is significant, with 42% of its portfolio NOI coming from Southern California and 38% from Northern California as of September 30, 2024. This makes its financial performance vulnerable to local market fluctuations.

Other Stocks to Watch

Other stocks that may be worth considering include Iron Mountain (IRM) and Welltower (WELL), both holding a Zacks Rank #2 (Buy). You can see the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Iron Mountain’s 2024 FFO per share is currently at $4.49, reflecting an 8.98% year-over-year increase.

In addition, the estimate for Welltower’s 2024 FFO per share stands at $4.26, an increase of 17.03% from the previous year.

Note: All earnings referenced in this report refer to funds from operations (FFO), a common measure to evaluate the performance of REITs.

Five Stocks with High Growth Potential

These stocks have been selected by a Zacks expert as top candidates to double their value in 2024. While not every recommendation will succeed, past selections have seen increases of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of the stocks in this report remain under the radar of Wall Street, presenting an early opportunity for investment.

Discover These 5 Potential Home Runs >>

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Read the original article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.