AMD Struggles in a Booming Tech Market: Is Now the Time to Invest?

In a year where tech stocks and artificial intelligence (AI) have drawn a lot of attention, Advanced Micro Devices (NASDAQ: AMD) has notably faltered. As of Monday, AMD’s shares are down 15% year-to-date, placing them close to their 52-week low, despite the company’s long-term outlook.

Is this a prime opportunity to consider purchasing AMD stock?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

What’s Behind AMD’s Poor Stock Performance This Year?

In contrast to its competitor, Nvidia (NASDAQ: NVDA), which has seen tremendous success, AMD has not kept pace. Nvidia is currently one of the world’s top three most valuable companies, valued at $3.2 trillion—over 16 times AMD’s $200 billion market cap.

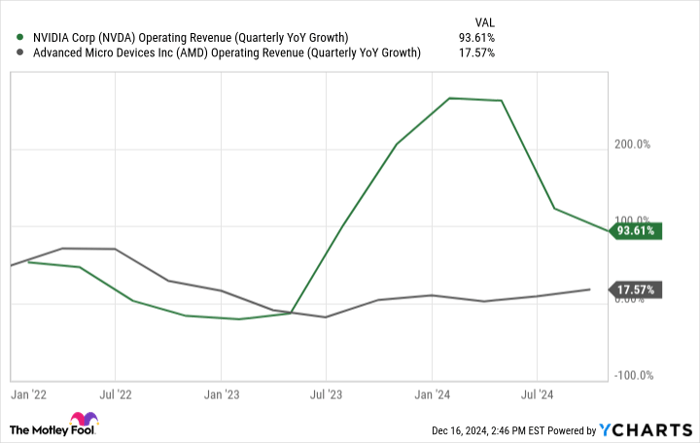

AMD’s stock trades at more than 110 times its trailing earnings. Coupled with this high valuation, AMD’s revenue growth has lagged behind Nvidia’s impressive numbers.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts.

Clearly, this has been a stark contrast between the two companies. While many tech firms are thriving due to increased AI demand, AMD’s performance remains underwhelming. To regain the favor of growth investors, AMD will need a significant catalyst.

While the company claims to be on track for record revenue in 2024 and cites “significant growth” across various segments, investors might find it hard to be impressed against the backdrop of advancements made by other tech companies this year.

On a positive note, AMD expects its growth rate to speed up in the fourth quarter. Management anticipates revenues of about $7.5 billion, a 22% increase from last year.

How a New Chip Could Shape AMD’s Future

AMD is making a concerted effort to capture a share of the AI chip market and could potentially gain ground on Nvidia. Many companies appear to be looking for more affordable chip options or want to diversify their supply chains beyond a single vendor.

AMD recently launched its MI325X chip, claiming it is 30% faster than Nvidia’s H200. If these claims hold true, this could challenge Nvidia’s dominance, driving both revenue growth and potentially boosting AMD’s stock price in 2025.

Is Investing in AMD Stock a Smart Move Right Now?

Despite its lackluster performance in 2024, AMD could prove to be a hidden gem for investors looking to hold shares in the new year. With the anticipated rollout of its new chip and expected growth, conditions might be ripe for a resurgence in stock value in 2025.

Though AMD appears expensive at first glance using trailing metrics, it is showing a forward price-to-earnings ratio of 25 based on analysts’ expectations. This valuation could make it more appealing to long-term investors. Given AMD’s potential in the AI chip sector, overlooking this stock could be a misstep.

A Potential Second Chance for Investors

Ever felt like you missed out on investing in top-performing stocks? It’s not too late to reconsider.

Our expert analysts occasionally issue a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you think your chance to invest has passed, now could be the perfect moment to act before it’s too late. The numbers certainly highlight the potential:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $338,103!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,005!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,679!*

We are currently identifying three exceptional companies for “Double Down” alerts, and this might be your last chance to invest.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.