Evaluating Alibaba’s Future: Risks and Rewards Ahead of 2025

As Alibaba BABA moves toward 2025, investors must decide whether now is the right time to invest in the company or if they should wait for potentially better opportunities. The stock has experienced a solid 14.3% increase year-to-date, but challenges remain amidst significant investments in AI and the evolving economic landscape in China. Recent advancements in AI technology and cloud computing, along with expected changes in China’s monetary policy, present both potential benefits and risks for investors.

Recent Financial Results and Strategic Focus

Alibaba’s second-quarter fiscal 2025 performance reveals substantial changes, with revenues reaching $33.7 billion, marking a 5% year-over-year increase. The company boasts a strong net cash position of $50.2 billion, but heavy spending on AI infrastructure has resulted in a 70% drop in free cash flow. This strategic choice indicates a focus on long-term growth through technological innovation, particularly in AI and cloud services, although it may affect short-term profitability.

Advancements in AI Technology and Cloud Services

Alibaba’s commitment to technology is clear from its recent AI launch, Wanx 2.1, which scored an impressive 84.7% on the VBench leaderboard. The company’s Cloud Intelligence Group continues to thrive, reporting triple-digit growth in AI-related products for five successive quarters. Furthermore, being recognized as an Emerging Leader across all quadrants in Gartner’s Innovation Guide highlights Alibaba’s strong position in technological advancements.

Growth in International Markets and New Strategies

The AIDC unit has shown promising growth with a 29% increase in international commerce. New monetization tactics, including a 0.6% software service fee and the rising use of the Quanzhantui marketing tool, indicate a stronger revenue outlook. Moreover, the Qwen model series has seen over 40 million downloads and generated 78,000 derivative models, showing a robust ecosystem. Additionally, Model Studio reaching more than 300,000 customers suggests significant penetration in the enterprise AI market.

Key Factors for Investment Decisions

Investors should evaluate various elements before proceeding with investments. The development of advanced AI models like QVQ for visual reasoning and autonomous delivery systems through Cainiao’s GT Pro depicts Alibaba’s focus on future growth. While these commitments are promising, they may exert pressure on profit margins in the near term. Anticipated changes in China’s monetary policy towards a more accommodating stance in 2025 could provide economic support, but geopolitical issues and domestic competition add notable risks.

Stock Performance and Valuation Insights

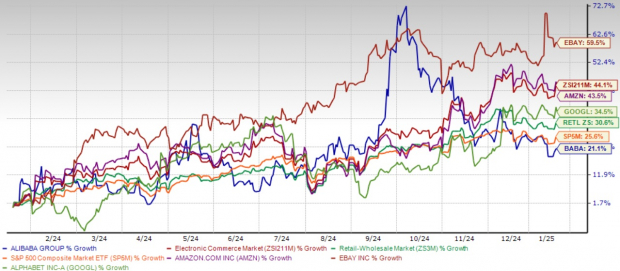

Over the past year, Alibaba’s stock has risen by 21.1%. In comparison, the Zacks Internet-Commerce industry, Zacks Retail-Wholesale sector, and S&P 500 have seen returns of 44.1%, 30.6%, and 25.6%, respectively. Alibaba continues to face scrutiny from major competitors such as Amazon AMZN and eBay EBAY in its e-commerce sector, alongside strong competition in the global cloud market from leaders like Amazon, Microsoft, and Alphabet’s GOOGL Google.

1-Year Performance

Image Source: Zacks Investment Research

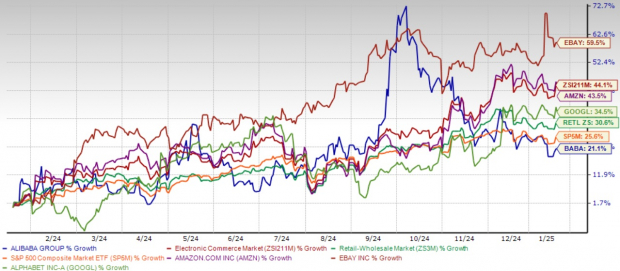

Currently, Alibaba is trading at a forward 12-month Price/Earnings ratio of 8.11X, significantly lower than the industry average of 25.48X and the median of 15.04X. This valuation suggests that BABA’s stock is undervalued compared to its industry counterparts. Its lower-than-median forward P/E ratio indicates a potential entry point for investors, reflecting strong fundamentals. Notably, it has been given a Value Score of A.

BABA’s P/E F12M Ratio Depicts Discounted Valuation

Image Source: Zacks Investment Research

Investment Approach Recommendation

Considering the current market conditions, a cautious investment strategy is advisable. Although Alibaba’s tech innovations and market leadership are commendable, waiting for clearer indicators may yield better entry points in 2025. The company’s ongoing investment phase in AI and its global expansion may continue to affect short-term financial outcomes.

The existing share buyback program, with $22 billion remaining in authorization, offers some safety for investors and demonstrates management’s belief in the company’s long-term prospects. However, investors should closely observe important metrics, such as cloud revenue growth, adoption rates of AI, and success in international expansion before committing significantly.

A gradual investment approach throughout 2025 might be the most practical way to engage in Alibaba’s long-term growth potential while managing the risks associated with short-term volatility. This strategy could enable investors to gain from expected improvements in operational leverage as AI investments progress and monetization strategies take root while allowing flexibility to adapt placements based on market conditions and execution success.

The Zacks Consensus Estimate for fiscal 2025 revenues is projected at $137.85 billion, which would represent a 5.63% year-over-year increase. However, the Zacks Consensus Estimate for earnings per share for fiscal 2025 has been revised downwards by 5.6% over the past month to $8.78, reflecting market uncertainty regarding Alibaba’s growth outlook.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Final Thoughts

While the outlook for Alibaba appears encouraging, especially in the realms of AI and cloud computing, the company’s current transitional stage suggests that patience may offer rewards. Investors should wait for clearer indications of ROI on AI initiatives and evaluate the effects of China’s monetary policy changes before making significant investments. Tracking Alibaba’s performance in cloud computing, AI monetization, and international market growth will be essential for identifying more advantageous investment entries in 2025. BABA currently holds a Zacks Rank of #3 (Hold). To explore Zacks’ top recommendations, click here.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss the chance to learn about our top 10 stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has an impressive track record. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has performed remarkably, gaining +2,112.6%, which is more than quadruple the S&P 500’s +475.6%. Sheraz has sifted through approximately 4,400 companies to identify the best 10 investments for 2025. Be among the first to access these newly announced stocks with significant potential.

See New Top 10 Stocks >>

Interested in the latest recommendations from Zacks Investment Research? Download your report on the 7 Best Stocks for the Next 30 Days now.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.