“`html

BigBear.ai Holdings, Inc. (BBAI) shares have skyrocketed 281% over the past year but have faced volatility, dropping 6.1% since August. The decline follows disappointing second-quarter results, with revenues of $32.5 million—a decrease of 18% from $39.8 million year-over-year. BigBear.ai reported a net loss of $228.6 million, compared to a loss of $14.4 million in the same quarter last year.

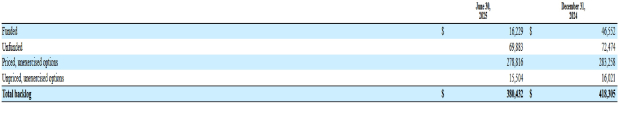

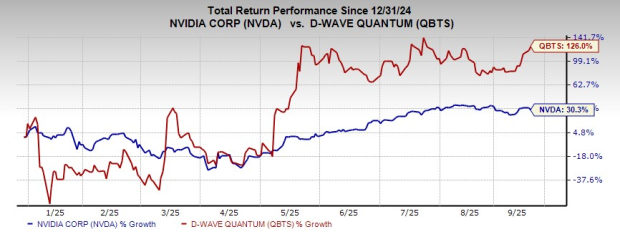

Management now projects 2025 revenues to be between $125 million and $140 million, lowering expectations from a previous estimate of $160 million to $180 million due to postponed government contracts. As of June 30, 2025, BigBear.ai has a backlog of $380 million, but only 4% is funded and authorized. In contrast, Palantir Technologies Inc. (PLTR) reported U.S. business revenue growth of 68% and raised its 2025 revenue forecast to $4.142-$4.150 billion, highlighting significant performance differences between the two companies.

Despite its challenges, BigBear.ai has initiated projects like Enhanced Passenger Processing at Nashville International Airport, which may influence future performance. Currently, BBAI carries a Zacks Rank of #3 (Hold).

“`