“`html

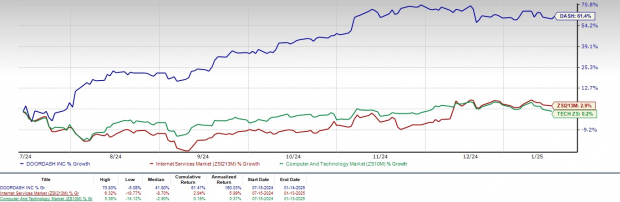

DoorDash’s DASH stock has experienced a remarkable surge of 61% in the past six months. This development far surpasses the Zacks Internet – Services industry, which recorded a modest return of 2.9%, and the broader Zacks Computer & Technology sector, which rose just 0.2%.

In contrast, major competitors like Amazon AMZN and Alphabet have posted gains of 13.4% and 2.5%, respectively, as they expand into the delivery and logistics market.

DASH’s impressive stock performance can be attributed to significant increases in total orders and Marketplace Gross Order Value (GOV), along with improved logistics efficiency and a rise in advertising revenue.

The company is also making strides into new markets, particularly grocery delivery, which enhances its growth potential.

Image Source: Zacks Investment Research

Rising Orders and Strategic Partnerships Driving Growth

DoorDash is benefiting from an expanding customer base, leading to an 18% year-over-year rise in order volume during the third quarter of 2024. The total reached 643 million orders, while Marketplace GOV grew by 19%, amounting to $20 billion.

To capitalize on this momentum, DoorDash has teamed up with Ibotta IBTA, integrating personalized digital promotions and coupons across various categories, including grocery and health. This partnership extends DoorDash’s offerings beyond mere restaurant delivery.

With over 115,000 non-restaurant stores in North America, this collaboration allows for increased savings and greater engagement opportunities for Consumer Packaged Goods brands through AI-driven strategies.

Expanding Groceries and Partnerships Enhance Service

DoorDash’s growing network of partnerships is noteworthy. Collaborations with Ibotta, Walmart WMT’s Canadian branch, and other companies have significantly expanded DoorDash’s reach and service capacity.

The partnership with Walmart Canada enables Canadians to access grocery items from over 300 supercenters via DoorDash’s platform.

Additionally, DoorDash’s collaboration with Lyft provides benefits for both rides and deliveries, allowing DashPass members to enjoy monthly perks without extra fees.

Further strengthening its grocery delivery offerings, DoorDash’s expanded partnership with Wegmans allows deliveries from all Maryland locations, with plans to cover other states soon.

DoorDash has also partnered with Max, offering DashPass Annual Plan members a complimentary subscription, providing a considerable savings opportunity.

Positive Earnings Outlook for DASH

For 2025, the Zacks Consensus Estimate for earnings per share stands at $1.94, unchanged over the past month, indicating a robust year-over-year growth of 646.24%.

In the past four quarters, DASH has managed to exceed the Zacks Consensus Estimate in two instances, while falling short in the others, with an average earnings surprise of 86.19%.

DoorDash, Inc. Price and Consensus

DoorDash, Inc. price-consensus-chart | DoorDash, Inc. Quote

Discover the latest EPS estimates and surprises on the Zacks Earnings Calendar.

The Zacks Consensus Estimate for 2025 revenue is projected at $12.72 billion, reflecting a 19.16% increase from 2024’s anticipated $10.68 billion.

Analyzing Investment Potential for DASH Stock

Despite its growth, DoorDash stock may not be considered a bargain. A Value Score of D suggests an inflated valuation.

Currently, DASH has a Price/Book ratio of 9.24, surpassing the Zacks Internet – Services industry’s average of 6.31.

Price/Book Ratio

Image Source: Zacks Investment Research

Nonetheless, DoorDash’s strong portfolio and an expanding network of partners are pivotal in driving its growth trajectory, justifying its premium valuation. The stock currently has a Zacks Rank #1 (Strong Buy) and a Growth Score of A, presenting an attractive investment opportunity based on Zacks’ proprietary methodology.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions in Federal funds are allocated to revamp and enhance America’s infrastructure. This influx will not only contribute to roads and bridges but also support AI data centers and renewable energy initiatives.

In this context, 5 unexpected stocks poised to benefit from this spending spree will be revealed.

Download your free guide on Profiting from the Trillion-Dollar Infrastructure Boom today.

Looking for the latest stock recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days right now. Click for your complimentary report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ibotta, Inc. (IBTA) : Free Stock Analysis Report

DoorDash, Inc. (DASH) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`