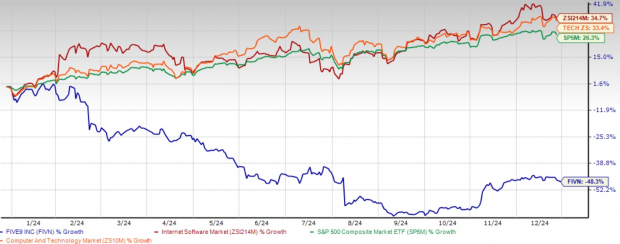

Five9 FIVN has faced a tough year in 2024, with a notable 48.3% drop in its stock price. However, the company’s strong performance metrics and strategic direction point to a possible comeback in 2025, making it a potential opportunity for investors to consider.

Five9: A Bright Spot Amidst Stock Challenges

1-Year Stock Performance Overview

Image Source: Zacks Investment Research

Strong Foundations Despite Market Challenges

In its third-quarter 2024 report, Five9 showcased impressive growth, with total revenues rising 15% from the previous year to reach $264.2 million. The subscription revenues, accounting for almost 80% of total sales, climbed 20%, indicating robust business activity. Profitability metrics also saw positive trends, with an adjusted EBITDA margin of 19.8% and a record quarterly operating cash flow of $41 million, making up 16% of revenues.

The dollar-based retention rate held steady at 108%, indicating strong customer satisfaction and growth within the existing customer base. Furthermore, the growth of enterprise customers generating more than $1 million ARR—up 29% year over year—represents about 56% of subscription revenues, highlighting Five9’s strong hold on the enterprise market.

AI as a Major Growth Driver

Five9 competes with prominent CCaaS providers like Twilio, Talkdesk, RingCentral RNG, and Zoom ZM Contact Center. However, it distinguishes itself with robust AI capabilities and a deep foothold in the enterprise sector.

In the third quarter, AI products made up more than 20% of new enterprise Annual Contract Value (ACV) bookings, with AI-inclusive deals averaging five times larger than non-AI deals over the past four quarters. The recent introduction of Five9 AI Agents and the AI Blueprint Program underscores the company’s commitment to leveraging artificial intelligence to enhance customer experiences.

Investments in AI are crucial as businesses increasingly aim to upgrade their customer experience platforms. The rollout of advanced intelligent virtual agents and generative AI capabilities puts Five9 ahead of shifting market needs.

Building Partnerships and Driving Innovation

Five9 is fortifying its market standing through key partnerships and innovative product launches. The introduction of the industry’s first pre-built bi-directional presence feature for Microsoft MSFT Teams highlights its dedication to improving platform capabilities. With over 500 shared clients globally and an eight-year partnership with Microsoft, FIVN is well-placed to meet the rising demand for integrated customer experience solutions.

Looking Forward: Financial Outlook for 2025

As 2025 approaches, Five9’s management has offered preliminary guidance of approximately $1.13 billion in revenues, which could rise if broader economic conditions improve. Additionally, the company anticipates exceeding the current consensus of $2.52 for non-GAAP EPS, reflecting confidence in profit margin growth.

For the fourth quarter of 2024, Five9 estimates revenues between $267 million and $268 million, alongside a non-GAAP net income per share forecasted to be between 69 cents and 71 cents. This suggests continued upward momentum leading into 2025. The company’s focus on balancing growth with profitability is showcased through improved financial metrics and operational efficiencies.

The Zacks Consensus Estimate indicates a 13.21% year-over-year revenue increase for 2024, predicting total revenues of $1.03 billion. Earnings estimates are projected at $2.37 per share, reflecting a 15.61% year-over-year increase.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Five9’s trailing 12-month price-to-book ratio stands at 5.38, which is above the Zacks Internet – Software industry average of 3.01. This showcases investor confidence in FIVN’s growth potential, even amidst a challenging market environment.

Valuation Insights: FIVN’s P/B TTM Ratio

Image Source: Zacks Investment Research

Making the Case for Investment in 2025

The steep stock decline in 2024 may offer an appealing entry point for investors looking to tap into the growth of AI-driven customer experience solutions. Five9’s outlook for recovery in 2025 is bolstered by several key factors. The expanding Total Addressable Market, driven by the rapid adoption of AI and ongoing digital transformation, opens up significant growth pathways. With a solid recurring revenue model, the company offers high visibility for future performance.

Improving profitability indicators and cash flow generation further support this view, as showcased in the third quarter of 2024. The adjusted EBITDA margin stood at 19.8%, and operating cash flow reached a record $41 million.

Moreover, Five9’s leadership in AI-enhanced customer solutions, with AI products contributing over 20% to new enterprise ACV bookings, positions it to seize market share. Its strategy of targeting high-value enterprise clients is reflected in a 29% year-over-year growth of customers with over $1 million ARR, complemented by valuable partnerships such as that with Microsoft. Given the current stock valuation post-2024 decline, these elements create a compelling opportunity for investors ready to navigate short-term market fluctuations.

Conclusion: Resilience and Future Potential

While 2024 posed significant challenges for Five9, its robust business fundamentals, strategic actions, and favorable positioning signal a strong potential rebound in 2025. The company’s focus on innovative AI solutions, growth within its enterprise customer base, and enhanced profitability metrics offer a solid foundation for sustainable growth.

As digital transformation continues and businesses embrace AI-powered solutions, Five9 seems well-equipped to capitalize on these trends, potentially delivering substantial returns for investors in 2025. Currently, FIVN holds a Zacks Rank #1 (Strong Buy), indicating strong market confidence. To view the complete list of top-ranked stocks, click here.

For Only $1, Access Zacks’ Buys and Sells

We genuinely mean it.

Several years ago, we offered our members 30-day access to all our picks for just $1—no strings attached.

Many have taken advantage of this opportunity, while others hesitated, thinking there might be a catch. The reason is straightforward: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which generated significant gains in 2023.

Want the latest recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Ringcentral, Inc. (RNG): Free Stock Analysis Report

Five9, Inc. (FIVN): Free Stock Analysis Report

Zoom Communications, Inc. (ZM): Free Stock Analysis Report

For the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.