Alphabet’s AI Strategy: Enhancing Client Engagement and Performance

Alphabet GOOGL is harnessing artificial intelligence (AI) to attract new clients, secure larger contracts, and foster deeper engagement with existing customers. The introduction of PaliGemma 2, GOOGL’s latest version of its tunable vision-language model (VLM), marks significant progress in this strategy.

PaliGemma builds on the same research and technology used in the Gemini models developed by GOOGL. Launched in May, PaliGemma was inspired by PaLI-3 and allows for interaction with various visual inputs. The latest version, PaliGemma 2, is capable of reading and generating detailed captions for images, enabling applications such as recognizing chemical formulas, music scores, spatial reasoning, and analyzing chest X-rays.

Existing users will find the upgrade to PaliGemma 2 easy, as it is designed to be a drop-in replacement. The new model comes in various sizes (3B, 10B, 28B parameters) and resolutions (224px, 448px, 896px), showcasing immediate improvements in performance.

Boosting Alphabet’s Search and Cloud Business with AI

Strong demand for Alphabet’s AI and Generative AI (Gen AI) services is fueling growth. The Gemini models now serve over 2 billion users monthly across various platforms. These models, available in four sizes, can run efficiently on a range of devices from servers to smartphones.

GOOGL’s commitment to investing in cutting-edge infrastructure further bolsters its AI initiatives. Remarkably, over 25% of all new code at Google is generated with the help of AI, streamlining operations.

The integration of GenAI into Google Search is proving beneficial. The combination of large language models, multi-search, and visual exploration features is enhancing the quality of search results.

New AI-driven tools like AI Overview, Circle to Search, and advanced features in Lens are significantly enhancing user experiences. Monthly, AI Overview reaches over 1 billion users, demonstrating strong engagement and encouraging monetization through integrated ads.

With Circle to Search now on more than 150 million Android devices, users are leveraging it for shopping, translating text, and exploring new topics. Lens has emerged as the fastest-growing query type due to its effectiveness in aiding product discovery and shopping.

Additionally, Alphabet is enhancing the features of its Pixel devices using AI and Gen AI. The devices are powered by Google Tensor G4 chips, which run the latest Gemini Nano model that can process text, images, audio, and speech simultaneously.

Google Tensor G4 provides users with faster web browsing—20% quicker on average—and improves app launches by 17%.

AI and Gen AI also enhance Pixel’s photography and video features, including Add Me and Plus Magic Editor functionalities. The Pixel Weather app employs AI for more accurate forecasting, while Google Keep assists users in list-making using Gemini’s capabilities. Notably, Pixel’s Call Assist feature screens spam calls and even holds on the line for users, with availability extended to Pixel Watch 3.

Maintaining Competitive Edge in the Cloud Market

In the competitive landscape of cloud infrastructure, Google Cloud has established itself as the third-largest provider, following Amazon’s AMZN cloud division, AWS, and Microsoft MSFT Azure.

Alphabet benefits from a growing demand for its innovative AI infrastructure. GOOGL offers a variety of AI accelerator options, such as multiple classes of NVIDIA NVDA GPUs and custom-built TPUs.

The enterprise AI platform Vertex is witnessing rapid growth as companies increasingly integrate it with Alphabet’s BigQuery to make data-driven decisions. Over the past six months, BigQuery’s machine learning operations have experienced 80% growth due to strong demand.

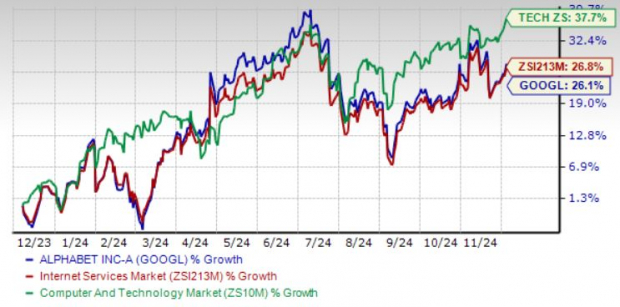

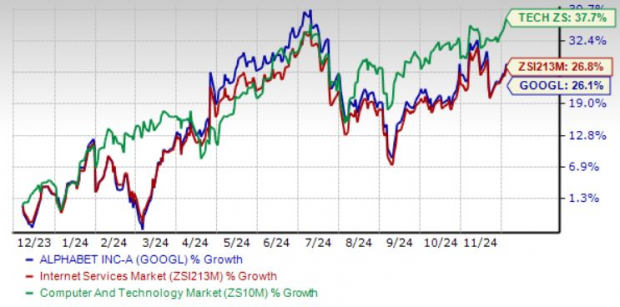

Despite this, tough competition in the cloud and AI sectors has put pressure on Alphabet’s stock performance. GOOGL shares have increased 26.1% in the last year, lagging behind both the Zacks Computer & Technology sector, which saw a 37.7% gain, and the Zacks Internet Services industry, which returned 26.8% during the same period.

GOOGL’s Performance Over the Past Year

Image Source: Zacks Investment Research

Positive Trends in Earnings Estimates for GOOGL

The Zacks Consensus Estimate for Alphabet’s revenues in 2024 is $294.74 billion, indicating a 14.91% increase compared to 2023’s reported figures.

The consensus projection for 2024 earnings is $8.02 per share, reflecting a slight increase over the past month and suggesting a 38.28% growth from the previous year.

Alphabet has consistently exceeded the Zacks Consensus Estimate for earnings in the last four quarters, with an average surprise of 11.84%.

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Stay informed on the latest EPS estimates and surprises on the Zacks Earnings Calendar.

Assessing GOOGL’s Stock Valuation

Currently, the Value Score of C suggests that Alphabet’s stock may be overvalued.

GOOGL is trading at a forward 12-month Price/Sales ratio of 6.44X, compared to the industry average of 6.18X.

F12M Price/Sales Ratio Comparison

Image Source: Zacks Investment Research

GOOGL shares have remained above both the 50-day and 200-day moving averages, indicating a generally positive market trend.

GOOGL Shares: Above 50-Day & 200-Day SMA

Image Source: Zacks Investment Research

Investment Outlook for GOOGL Stock

Alphabet’s expanding GenAI capabilities present a potential growth avenue despite competition in the cloud space and mounting regulatory challenges. Its leading position in the search engine market, along with a strong cloud presence, serve as long-term advantages.

That said, regulatory scrutiny continues to rise. Google is facing accusations of using Android to gain an unfair advantage in promoting its search engine, as well as multiple lawsuits concerning data privacy and competition practices worldwide.

Increased scrutiny and potential government-imposed breakups could significantly impact Alphabet’s future. Additionally, competition from Microsoft and Amazon in the cloud sector poses ongoing challenges.

Alphabet currently holds a Zacks Rank of #3 (Hold), suggesting that investors may want to consider waiting for a more opportune moment to invest in the stock. A complete list of Zacks Rank #1 (Strong Buy) stocks is available.

Discover Top Investments for the Upcoming Month

Recently released: Experts have identified 7 elite stocks from a current list of 220 Zacks Rank #1 Strong Buys, which they believe are “Most Likely for Early Price Pops.”

Since 1988, this full list has consistently outperformed the market, achieving an average gain of +24.1% per year. Consider giving these selected stocks your immediate attention.

See them now >>

Interested in the latest recommendations from Zacks Investment Research? You can now download the report on 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.