High-Yield Dividend Stocks: Are They Really the Best Choice?

When investors choose dividend-paying stocks, one of the first metrics they analyze is the annual yield. However, is a high yield always the best option for those focused on generating income? Let’s examine the nuances of this investment strategy.

Understanding High-Yield Stocks

At first glance, a stock boasting a high dividend yield appears to be a sound investment for income-oriented investors. This view holds especially true in the short term, but the reality can be more complex.

Dividend yields often fluctuate based on share price movements. When a stock price rises, its yield decreases, and vice versa. Investors must be aware of ‘dividend traps,’ where a seemingly attractive yield results from poor share performance. In these scenarios, the risk to the initial investment increases significantly because negative sentiment has driven down the stock price. It’s important to remember that stocks can decline more than anticipated, trapping investors in a downward trend.

For those seeking steadiness, focusing on companies with a strong history of increasing their payouts may be a wiser strategy. Dividend Aristocrats, which are companies that have raised their dividend payments for at least 25 consecutive years while being part of the S&P 500, are ideal candidates. These firms typically have strong business fundamentals and a proven track record.

Notable members of this elite group include Johnson & Johnson (JNJ), Coca-Cola (KO), and Procter & Gamble (PG).

Below, you will find annual dividend payment data for these leading companies:

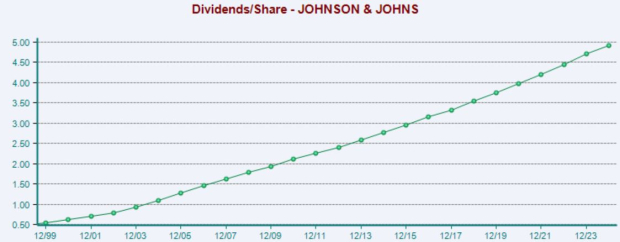

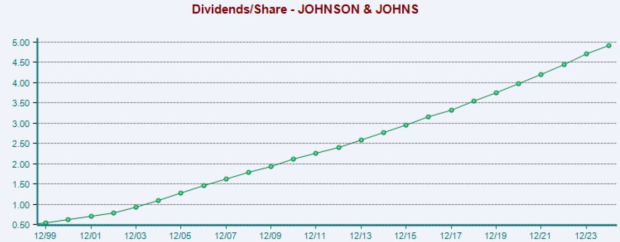

Johnson & Johnson

JNJ shares currently yield 3.0% annually.

Image Source: Zacks Investment Research

Coca-Cola

KO shares currently yield 2.7% annually.

Image Source: Zacks Investment Research

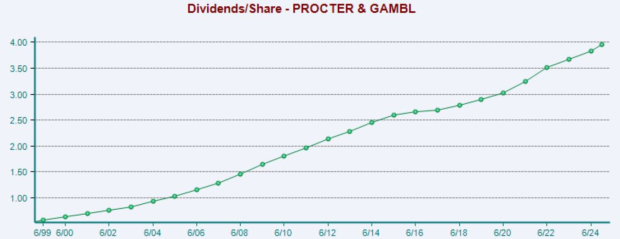

Procter & Gamble

PG shares currently yield 2.3% annually.

Image Source: Zacks Investment Research

Conclusion

Dividends offer several benefits, including a passive income stream and a buffer against losses in other investments. Members of the Dividend Aristocrat group—such as Johnson & Johnson, Coca-Cola, and Procter & Gamble—have consistently increased their payouts over the years, providing a reliable source of income for investors.

5 Stocks with Potential for Significant Gains

Experts at Zacks have selected five stocks they believe could double in value in 2024. Although not all stock picks succeed, past recommendations have seen impressive returns of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of these stocks might not attract much attention on Wall Street right now, offering a perfect opportunity for early investment.

Today, Explore These 5 Potential Home Runs >>

Coca-Cola Company (KO): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Procter & Gamble Company (PG): Free Stock Analysis Report

View the original article published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.