Quantum Computing: A Groundbreaking Shift for Investors

While artificial intelligence dominated stock market discussions in the past year, 2024 has seen quantum computing steal the spotlight. IonQ (NYSE: IONQ) is at the forefront of this emerging technology, offering potential innovations that seem almost unimaginable.

How Quantum Computing Compares to Traditional Systems

To grasp the significance of quantum computing, consider this: Alphabet, Google’s parent company, recently revealed its quantum chip could perform a calculation in under five minutes—something the fastest supercomputers would take an astonishing 10 septillion years to tackle.

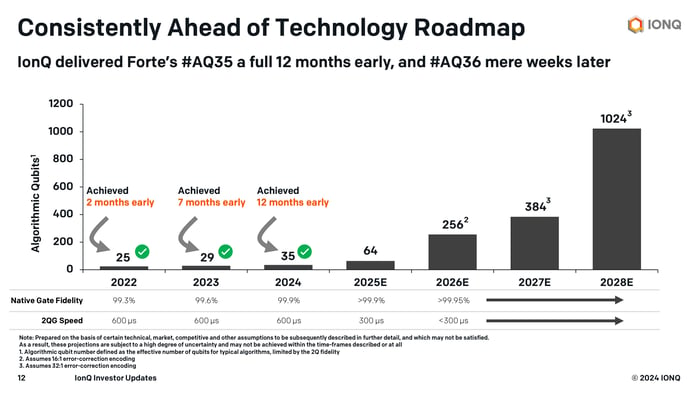

In simple terms, traditional computers rely on binary switches called bits, which can only be 0 or 1 at any given moment. In contrast, quantum computers use qubits that can represent multiple states simultaneously. This capability allows them to process vast amounts of information much more quickly. Currently, IonQ’s Forte quantum computer operates with 36 qubits, and management anticipates surpassing 1,000 qubits by 2028.

Image source: IonQ.

The Future Market: A Multitude of Possibilities

Quantum computing holds tremendous promise, with analysts predicting an addressable market of $65 billion by 2030. The potential applications range from enhancing machine learning capabilities to revolutionizing drug discovery. Many experts believe that as quantum computing matures, it could redefine technology in ways we cannot yet predict.

IonQ: An Early Player in the Quantum Arena

IonQ has only begun its journey. Since 2022, the company has sold access to its Forte computer but generated only $37 million in revenue in the past four quarters. This year, it started shipping its 36-qubit Forte Enterprise computers and plans to introduce Tempo, targeting 64 qubits.

Future revenue estimates show IonQ might grow to $102 million in 2025 and $357 million by 2027. While these numbers indicate impressive growth, they still represent a fraction of IonQ’s current $9 billion market cap. Moreover, the competitive landscape is crowded, with heavyweights like IBM and major cloud providers, including Alphabet, Microsoft, and Amazon, also racing to develop quantum technologies.

Should Investors Consider IonQ Stock?

These points raise critical questions for potential investors. IonQ is undeniably innovative, yet the market carries inherent uncertainties. With its $9 billion valuation, significant risk exists. At an anticipated $357 million in revenue by 2027, IonQ would still have a price-to-sales (P/S) ratio of 25, making it unclear how this stock could perform amidst competitors.

Due to these uncertainties and the stock’s notable rise, recommending IonQ as a purchase at this moment proves challenging. Speculative investors might want to hold off until they see a price reduction, as such stocks can experience volatility, creating better buying opportunities in the near future.

Is Investing $1,000 in IonQ a Smart Move?

Before committing funds to IonQ, consider the following:

The Motley Fool Stock Advisor team recently identified their top ten stock picks for investors, and IonQ does not appear on their list. The chosen stocks are predicted to deliver strong returns in the coming years.

For instance, had you invested $1,000 in Nvidia when it made their list on April 15, 2005, you would have seen that investment grow to $885,388!

The Stock Advisor program equips investors with useful guidance on navigating the market, offering insights on portfolio building and regular stock recommendations. The service has significantly outperformed the S&P 500 since its inception in 2002.

Check out the 10 stocks recommended now »

*Stock Advisor returns as of December 30, 2024

Note: John Mackey, former CEO of Whole Foods Market, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also serves on the board. Justin Pope holds no positions in the discussed stocks. The Motley Fool recommends Alphabet, Amazon, and Microsoft and has positions in them while also recommending International Business Machines.

The views expressed here are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.