Analysts Predict Positive Upside for Vanguard’s Mid-Cap ETF

Recent evaluations from ETF Channel highlight the Vanguard S&P Mid-Cap 400 ETF (Symbol: IVOO) and its potential growth. By comparing the ETF’s underlying holdings against analyst targets, a significant upside has been identified.

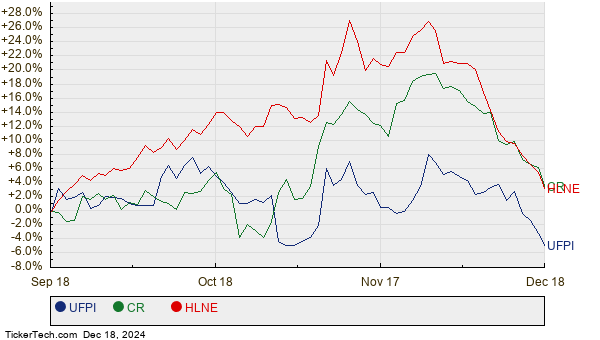

Currently, IVOO trades around $109.76 per unit, while analysts have set an implied target price of $121.76 per unit. This suggests a potential upside of 10.94% if the targets are reached. Among the ETF’s top holdings, three stocks stand out with considerable upside potential: UFP Industries Inc (Symbol: UFPI), Crane Co (Symbol: CR), and Hamilton Lane Inc (Symbol: HLNE). UFP Industries recently traded at $122.04 per share, yet analysts predict a target of $138.75, indicating a 13.69% upside. Similarly, Crane Co’s current price is $159.67, with a target of $179.60 for a 12.48% increase. Hamilton Lane Inc, priced at $163.41, has a target of $183.33, offering a potential 12.19% upside.

Below is the comparative performance chart of UFPI, CR, and HLNE over the past twelve months:

A detailed summary of the current analyst target prices is presented in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Mid-Cap 400 ETF | IVOO | $109.76 | $121.76 | 10.94% |

| UFP Industries Inc | UFPI | $122.04 | $138.75 | 13.69% |

| Crane Co | CR | $159.67 | $179.60 | 12.48% |

| Hamilton Lane Inc | HLNE | $163.41 | $183.33 | 12.19% |

Investors may wonder whether these analyst targets are achievable or perhaps too optimistic. It is crucial to assess whether analysts base their predictions on recent developments or whether they reflect outdated information. High price targets might signal optimism, but they can also lead to downgrades if market conditions shift. Further research will be essential for investors deciding on IVOO and its holdings.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

– GRSVU Historical Stock Prices

– HOOK Insider Buying

– ROLL Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.