MercadoLibre Faces Valuation Concerns Amid Strong Growth

MercadoLibre’s MELI P/E ratio of 40.01X raises questions about its valuation given the industry average of 25.73X. This highlights the need for careful consideration by investors regarding the sustainability of its high valuation despite the company’s strong market presence and growth potential.

Stretched Valuation Reflected in MELI’s P/E Ratio

Image Source: Zacks Investment Research

Strong Performance but Slimming Margins

In the third quarter of 2024, MercadoLibre reported net revenues of $5.3 billion, a 35% increase compared to the previous year, and net income of $397 million, up 11%. Conversely, the operating margin fell sharply to 10.5% from 20% year-over-year, a consequence of heavy investments in infrastructure and business expansion. The company’s commitment to building fulfillment centers, with five new openings in Brazil and one in Mexico, indicates its growth strategy but also points to increasing capital expenses that may affect short-term profitability.

Expanding Credit Operations Introduce Risks

MercadoLibre’s credit portfolio experienced a remarkable year-over-year growth of 77%, reaching $6 billion. The credit card transaction volume surged by 166%. However, this rapid credit business expansion, where credit cards now make up 39% of the total portfolio (up from 25%), has led to heightened loss provisions and a drop in Net Interest Margin After Losses, decreasing from 37% to 24% year-over-year.

Positioned for Growth Amid Rising Competition

The company holds a robust position in Latin American e-commerce, boasting a currency-adjusted Gross Merchandise Volume (GMV) rise of 34% in Brazil and 27% in Mexico. With only 15% e-commerce penetration in Latin America, there remains significant growth potential. Yet, competition is intensifying as e-commerce giant Amazon AMZN pushes to strengthen its foothold in the region, while retail competitor Walmart WMT also gains ground, particularly in Mexico.

Investment Considerations and Outlook

Despite MercadoLibre’s favorable long-term growth outlook, its current P/E ratio of 40.01X signals a potentially stretched valuation. Long-term strategic investments may continue to exert pressure on profit margins in the short run. Moreover, the fast-paced growth of its credit sector raises risk factors in an uncertain economic environment. Though asset quality remains steady with non-performing loans at 7.8%, the rapid increase in credit card issuance and portfolio growth warrants close observation.

The Zacks Consensus Estimate for 2025 anticipates revenues of $25.66 billion, a 24.25% year-over-year increase, and earnings per share at $44.65, a rise of 34.31%. However, earnings estimates have decreased by 0.6% over the last month, suggesting the need for caution.

Image Source: Zacks Investment Research

Stay informed with quarterly reports: Check out the Zacks Earnings Calendar.

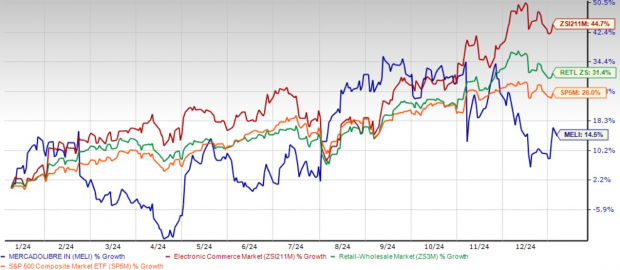

New investors may want to wait for a more favorable entry point, as the stock has seen a 14.5% return over the past year, trailing behind the Zacks Retail-Wholesale sector’s growth of 31.4%. Due to stock price movements and ongoing margin pressures from growth-focused investments, investors might find better buying opportunities in the near future.

1-Year Stock Performance

Image Source: Zacks Investment Research

Conclusion

Considering the elevated valuation, existing margin pressures from investments, and the risks tied to credit expansion, potential investors might find it prudent to seek better entry points in 2025. MercadoLibre continues to showcase strong fundamentals and a commanding market position, yet the current risk-reward dynamics prompt a cautious approach for new buyers.

Current shareholders can maintain their positions in light of the company’s longstanding market leadership and growth prospects. Nevertheless, new investors would be wise to await signs of either a valuation decrease or clearer outcomes from the company’s strategic investments before committing capital.

In the coming months, keeping an eye on important metrics such as credit portfolio health, productivity of fulfillment centers, and margin trends will be essential as investors evaluate potential entry points in 2025. MELI stock currently holds a Zacks Rank #3 (Hold). For a complete list of Zacks #1 Rank (Strong Buy) stocks, click here.

Discover 5 Stocks Poised for Significant Growth

Experts at Zacks have identified these stocks as the top picks with the potential to raise +100% or more in 2024. While performance may vary, past recommendations have experienced remarkable increases of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of these high-potential stocks remain under the radar of Wall Street, creating a unique chance to invest early.

Today, Explore These 5 Potential Winners >>

Want the latest investment insights from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days now for free!

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

To read more, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.