Netflix Surpasses Milestones: What It Means for Investors

Netflix (NASDAQ: NFLX) has recently published its fourth quarter 2024 earnings, exciting the market with over 300 million subscribers and more than $10 billion in quarterly revenue for the first time. As a result, Netflix’s stock has surged nearly 70% over the past year, approaching an all-time high.

In this article, we will analyze Netflix’s impressive earnings report, explore its financial performance, and assess management’s outlook for 2025 to determine whether Netflix stock is a buy, sell, or hold.

Where to invest $1,000 right now? Our analyst team has shared what they believe are the 10 best stocks to buy currently. See the 10 stocks »

Netflix Continues to Lead in Streaming

Netflix confirmed its stronghold in the streaming arena in 2024, ending the year with 301.6 million memberships—an impressive 16% increase from the previous year. The company generated $39 billion in revenue, also up 16% compared to the year prior, while maintaining a steady free cash flow of $6.9 billion, equal to 2023 results.

Although not all competitors provide detailed subscriber numbers, FlixPatrol, which tracks streaming data, indicates that Netflix leads by a wide margin, with Amazon Prime at 200 million subscribers and Disney+ trailing at 123 million subscribers.

NFLX revenue (TTM); data by YCharts, TTM = trailing 12 months.

Netflix has actively used its healthy free cash flow to repurchase shares, thereby increasing the ownership stakes of existing shareholders. The company invested $6 billion in buybacks during 2023 and followed with $6.2 billion in 2024, resulting in nearly a 4% reduction in outstanding shares over the last two years.

Recently, Netflix’s board approved an additional $15 billion for share repurchases, raising the total to $17.1 billion, suggesting that current investors will likely see their stakes grow.

NFLX shares outstanding data by YCharts.

Looking Forward to 2025

For 2025, management predicts full-year net revenue between $43.5 billion and $44.5 billion, reflecting potential growth of 11.5% to 14.1% compared to 2024. The anticipated operating margin for the year is 29%, which marks an improvement of 1.6% from the 2024 operating margin of 27.4%. These optimistic expectations indicate management’s confidence in Netflix’s future.

In addition to its strong financial projections, Netflix is embarking on two intriguing initiatives to watch. The company is enhancing its live-event strategy, recently broadcasting two NFL games that attracted an average viewership of 30 to 31 million. The debut episode of WWE’s Raw on Netflix also drew 5 million viewers.

Netflix will continue to air Christmas Day NFL games for the next two years and has committed to a 10-year, $5 billion deal with WWE, ensuring 52 weeks of programming each year.

“Right now, we believe that the live events business is where we really want to be,” remarked co-CEO Ted Sarandos during the latest earnings call, marking Netflix’s dedication to growth in live entertainment.

Netflix is also leveraging these live broadcasts to boost advertising revenue. By attracting new subscribers, these events create premium ad opportunities, supporting its ad-supported membership tier. This strategy enables Netflix to offer lower-priced options while maintaining revenue levels.

Although the company does not disclose user numbers by tier, it mentioned that 55% of new users opted for the ad-supported subscription when available.

The ad tier plan provides flexibility for Netflix to raise prices overall. The standard ad-free plan will increase by $2.50 from $15.49 to $17.99 per month, while the ad-supported tier will rise by $1 from $6.99 to $7.99 monthly.

Co-CEO Gregory Peters highlighted during the fourth quarter 2024 earnings call that ad revenue doubled from 2023 to 2024, stating: “We love our ads plan because it allows us to offer a lower price point for consumers. That’s more choice and good accessibility that is proving to be popular.”

Assessing Netflix’s Valuation

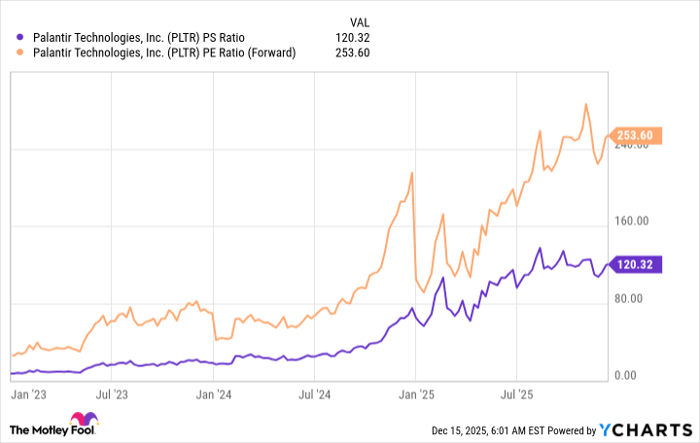

Much of the current enthusiasm surrounding Netflix stems from its impressive market position and effective business strategies. However, investing in any stock without considering its valuation can be risky.

One useful valuation metric is the price to free cash flow ratio, which compares a company’s free cash flow over the past year to its market value. Currently, Netflix trades at 61.7 times free cash flow, reaching a peak for the last year. Even when adjusted for its projected free cash flow of $8 billion in 2025, the stock still trades at 52 times forward free cash flow.

Regardless of the lens through which it is viewed, Netflix’s current valuation is elevated. At this price point, the company must continue delivering stellar growth to justify its valuation.

NFLX price to free cash flow; data by YCharts.

Final Thoughts on Netflix

For long-term investors, Netflix presents a strong hold. The company’s effective management, increasing subscriber count, the untapped potential of its ad-supported tier, and strategic growth into live events lend it a promising outlook. Nevertheless, the current valuation suggests little margin for error.

For those interested in investing, waiting for a stock price decline or starting with dollar-cost averaging could be a wiser approach.

Seize This Second Chance for Investment

Have you ever felt that you missed out on buying successful stocks? Now may be your chance.

Occasionally, our expert analysts recommend stocks they believe are poised for significant growth. If you’re concerned about missing your opportunity to invest, acting now could be beneficial before it’s too late. The statistics are compelling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $311,343!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,694!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $526,758!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not present itself again soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Collin Brantmeyer has positions in Amazon, Netflix, and Walt Disney. The Motley Fool has positions in and recommends Amazon, Netflix, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.